- 15 Marks

Question

The details of unit cost of products X, Y, and Z have been provided below:

| Product | X | Y | Z |

|---|---|---|---|

| Demand (units) | 1,200 | 2,800 | 3,000 |

| GH¢ | GH¢ | GH¢ | GH¢ |

| Direct Material | 70 | 55 | 40 |

| Direct Labour | 65 | 60 | 38 |

| Variable Overheads | 11 | 8 | 7 |

| Fixed Overhead | 32 | 24 | 20 |

Additional information:

- The fixed overheads were absorbed at the rate of GH¢8 per machine hour.

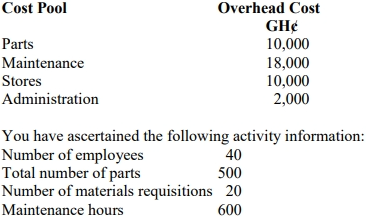

- The budgeted fixed overheads of GH¢165,600 can be analysed into the following cost pools with their respective percentages for apportionment:

Cost Pool Percentages (%) Batch 20 Machinery 45 Customer service 25 Deliveries 10 - The following also relates to the activities of the company:

| Product | X | Y | Z |

|---|---|---|---|

| Units in a batch | 120 | 140 | 200 |

| Quantities per delivery | 100 | 280 | 250 |

| Number of customers | 50 | 180 | 220 |

Required:

i) Calculate the activity rates per batch, machine hour, customer service, and delivery.

(12 marks)

ii) Calculate the total cost of a unit of product X.

(3 marks)

Answer

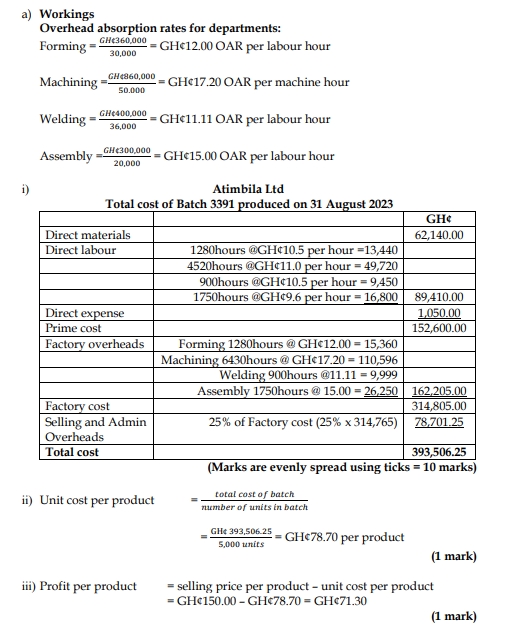

a) Workings:

Apportionment of Overheads (GH¢165,600):

| Cost Pool | Percentage (%) | Overhead (GH¢) |

|---|---|---|

| Batch | 20 | 33,120 |

| Machinery | 45 | 74,520 |

| Customer Service | 25 | 41,400 |

| Deliveries | 10 | 16,560 |

Machine hours:

- X = 1,200 units × 4 hours = 4,800

- Y = 2,800 units × 3 hours = 8,400

- Z = 3,000 units × 2.5 hours = 7,500

Total = 20,700

Number of batches:

- X = 1,200 ÷ 120 = 10

- Y = 2,800 ÷ 140 = 20

- Z = 3,000 ÷ 200 = 15

Total = 45

Number of deliveries:

- X = 1,200 ÷ 100 = 12

- Y = 2,800 ÷ 280 = 10

- Z = 3,000 ÷ 250 = 12

Total = 34

Number of customers:

- Total = 450

Statement showing calculation of activity rates:

| Activity Base | Overhead (GH¢) | Number of Activities | Rate (GH¢) |

|---|---|---|---|

| Machine related | 74,520 | 20,700 hours | 3.6 per hour |

| Batch related | 33,120 | 45 batches | 736 per batch |

| Delivery related | 16,560 | 34 deliveries | 487 per delivery |

| Customer Service | 41,400 | 450 customers | 92 per customer |

(12 marks)

ii) Cost per unit of Product X (1,200 units):

| Description | GH¢ |

|---|---|

| Prime cost GH¢146 × 1,200 | 175,200 |

| Overheads: | |

| Machine-related (4,800 × 3.6) | 17,280 |

| Batch-related (10 × 736) | 7,360 |

| Delivery-related (12 × 487) | 5,844 |

| Customer service (50 × 92) | 4,600 |

| Total | 210,284 |

Cost per unit = 210,284 ÷ 1,200 = GH¢175.24

(3 marks)

- Topic: Activity-based costing

- Series: AUG 2022

- Uploader: Joseph