- 10 Marks

Question

Firm A and Firm B are both subsidiary companies of Groupe Trojan Electronics. The directors of Groupe Trojan Electronics are reviewing the capital structure of the two subsidiary companies. You have been engaged to advise the directors on the appropriate capital structure for the subsidiaries.

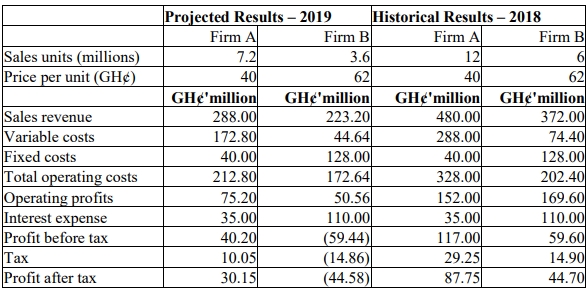

You have obtained extracts from the financial results of the two companies for the past financial year and projection of the annual results for the current year, which is in its first quarter.

Required:

i) Compute the degree of operating leverage for each of the two companies. Based on the degree of operating leverage you obtain, advise the directors on the relative level of business risk associated with the two subsidiaries and the implication of that for capital structure design. (5 marks)

ii) Compute the degree of financial leverage for each of the two companies. Based on the degree of financial leverage you obtain, advise the directors on the relative level of financial risk associated with the two subsidiaries and the implication of that for capital structure design. (5 marks)

Answer

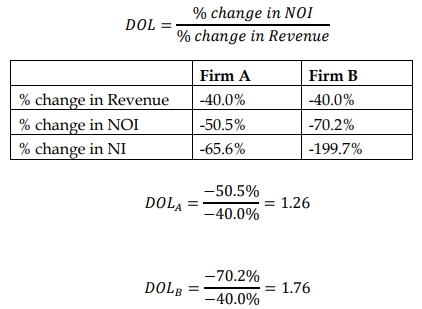

i) The degree of operating leverage (DOL)

The DOL of Firm A is 1.26, and that of Firm B is 1.76:

Implication:

The DOL assesses the volatility in operating profit due to changes in revenue. Firm B, with a higher DOL, presents a higher business risk to Groupe Trojan than Firm A. The implication for the capital structure decision is that Firm A, which has a lower DOL, could sustain higher debt in its capital structure than Firm B.

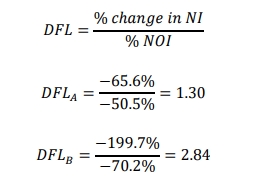

ii) The degree of financial leverage (DFL)

The DFL of Firm A is 1.3 and Firm B is 2.84:

Implication:

The DFL indicates the level of financial risk. Firm B, with a higher DFL, presents a higher financial risk to Groupe Trojan than Firm A. The implication for the capital structure decision is that Firm A, with a lower DFL, could sustain higher debt in its capital structure than Firm B.

- Tags: Business risk, Capital structure, Financial leverage, Financial risk, Operating leverage

- Level: Level 2

- Uploader: Theophilus