- 20 Marks

Question

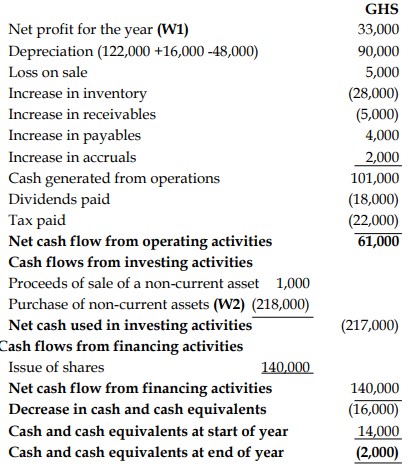

Financial data extracted from the books of Kandor Enterprises Limited for the year ended 31 December 2014 are shown below:

| Details | N’000 |

|---|---|

| Revenue | 6,990 |

| Decrease in receivables | 177 |

| Cost of sales | 5,128 |

| Increase in inventories | 1,483 |

| Increase in payables | 613 |

| Selling and distribution expenses | 300 |

| Administrative expenses | 343 |

| Loss on disposal of non-current assets | 6 |

| Depreciation charges for the year | 62 |

| Ordinary shares issued for cash | 400 |

| Purchase of property, plant, and equipment | 113 |

| Income tax paid | 198 |

| Proceeds from disposal of non-current assets | 3 |

| Repayment of loan notes | 10 |

| Dividend paid | 86 |

| Interest paid on loan notes | 191 |

| Cash and cash equivalent at the beginning of the year | (409) |

Required:

Prepare the Statement of Cash Flows for the year ended 31 December 2014 using the direct method, showing:

a. Net cash flow from operating activities (5 Marks)

b. Net cash flow from investing activities (5 Marks)

c. Net cash flow from financing activities (5 Marks)

d. Cash and cash equivalents at the end of the year (5 Marks)

Show all workings.

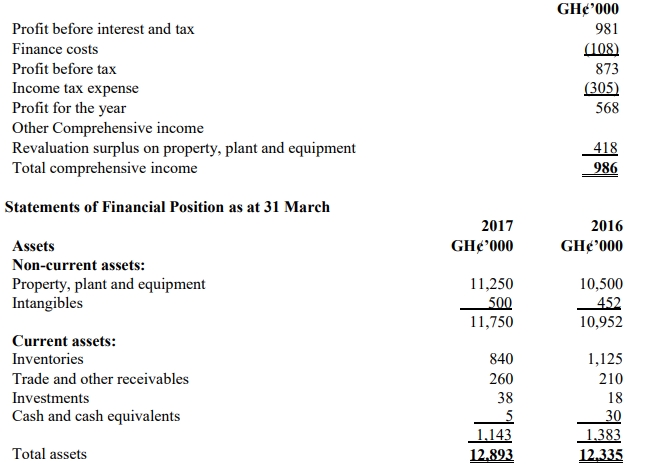

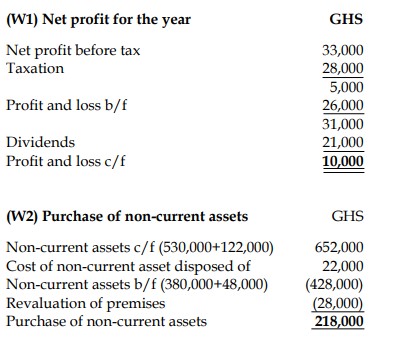

Answer

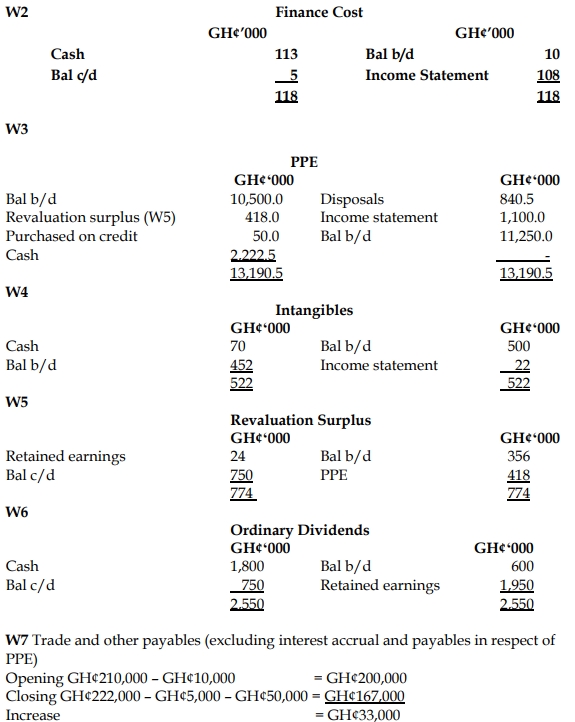

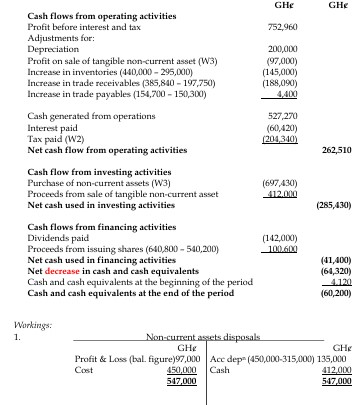

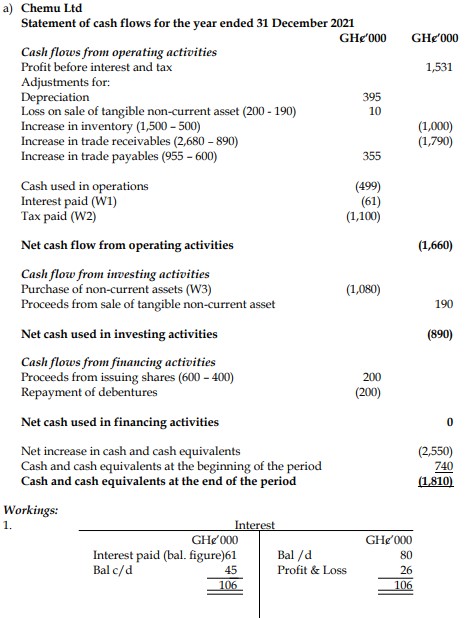

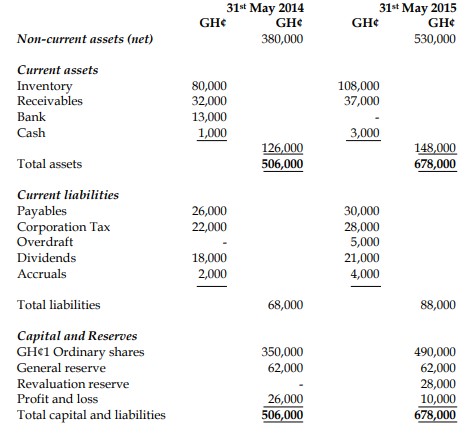

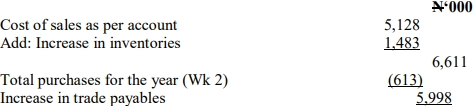

KANDOR ENTERPRISES LIMITED

STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2014

![]()

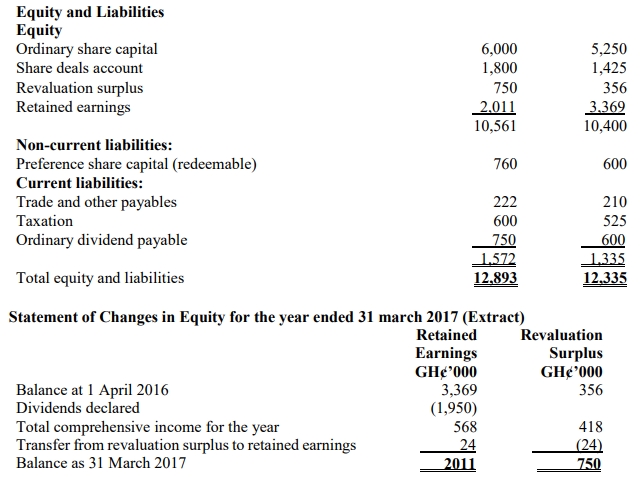

KANDOR ENTERPRISES LIMITED

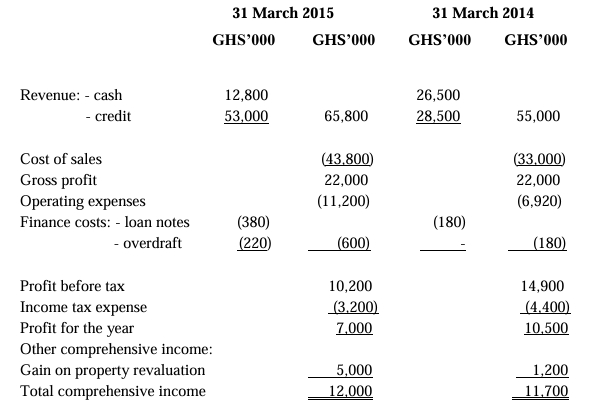

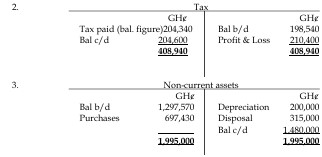

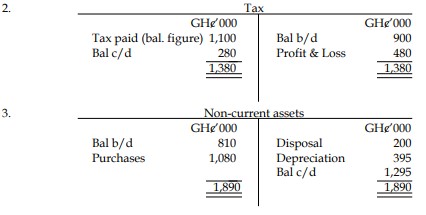

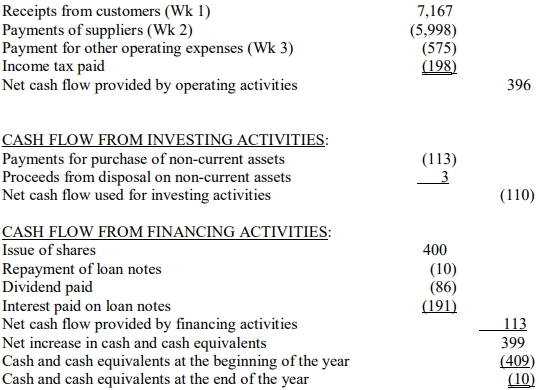

WORKING NOTES

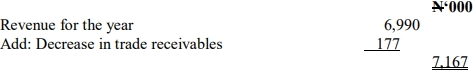

Wk 1: Determination of total receipts from customer

Wk 2: Determination of payment to suppliers

Wk 3: Cash paid for other expenses

![]()

- Topic: Financial Statements Preparation

- Series: MAY 2015

- Uploader: Joseph