- 15 Marks

Question

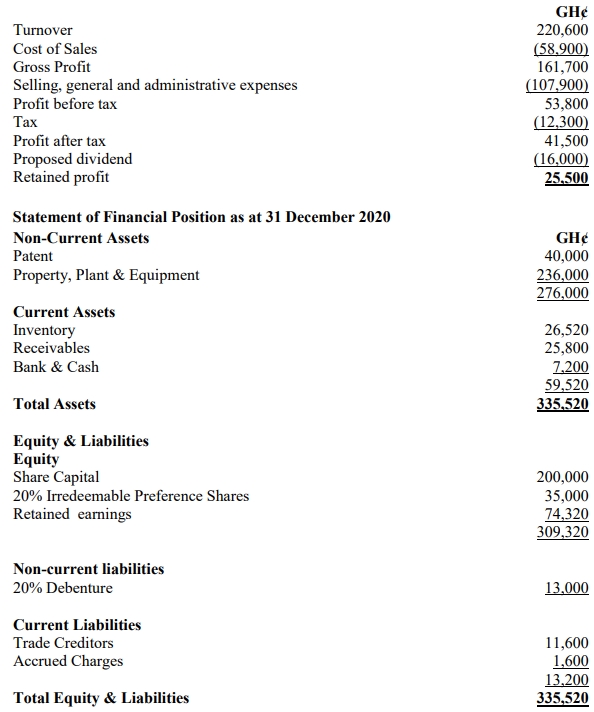

Aboto Ltd is a private company in the printing industry. It was established by the Aboto family some twenty years ago with Mrs. Aboto as the Managing Director. The business has grown in size over the years, and the directors are now considering listing the company on the Ghana Stock Exchange. The financial statements of the company for the year 2020 are given below:

Additional Information:

- The Share Capital of Aboto Ltd consists of ordinary share capital of no par value issued at GH¢100 per share.

- An independent valuer estimated the fair value of the Property, Plant & Equipment at GH¢500,000. Valuation charges of 2% have not been accrued for in the above accounts.

- The inventory includes obsolete items worth GH¢5,000 being held despite persistent advice by the auditors to have them written off.

- Receivables include an amount of GH¢12,000 resulting from the bankruptcy of a major customer. Aboto Ltd is not likely to realize any amount from this, but the directors have refused to make any provision.

- The patents represent a right to sell a special product. This product is expected to generate cash flows of GH¢2,000 per annum indefinitely.

- The discounted present value of future cash payments in respect of the debentures is GH¢20,000.

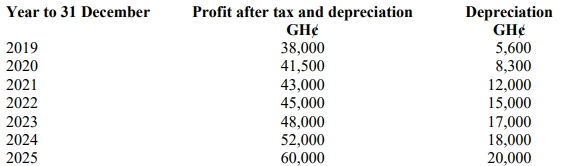

- Profits after tax of Aboto Ltd over the past four years were as follows:

Year Profits (GH¢) 2019 38,000 2018 36,000 2017 32,000 2016 30,000 - A corporate plan prepared by the directors of Aboto Ltd in 2018 included the following positions:

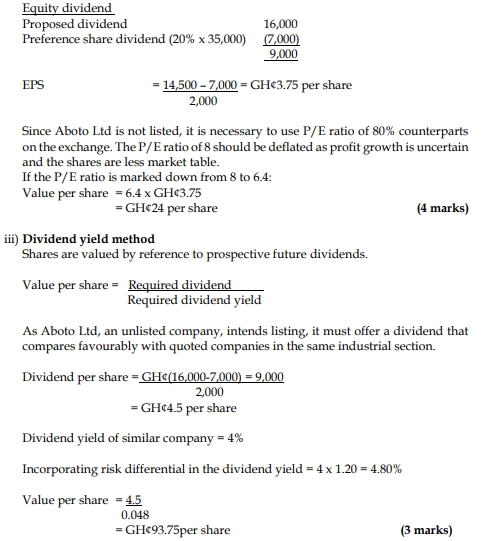

- The price-earnings ratio and a dividend yield of quoted companies in the same industry Aboto Ltd operates are 8 and 4%, respectively.

- The net assets of Aboto Ltd as at 31 December 2019 were GH¢251,100.

- The cost of capital of Aboto Ltd is 20%.

- Investing in unlisted securities is about 20% more risky than investing in listed securities.

Required:

Determine the value to be placed on each share of Aboto Ltd using the following methods of valuation:

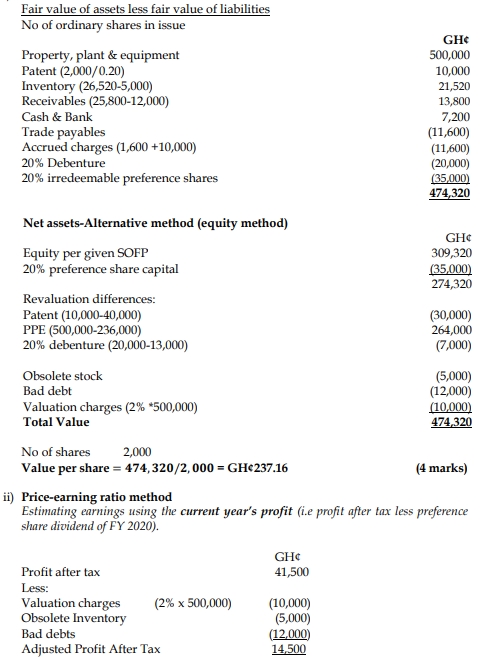

i) Net assets (4 marks)

ii) Price-earnings ratio (4 marks)

iii) Dividend yield (3 marks)

iv) Discounted cash flow (4 marks)

Answer

i) Net Assets Valuation:

The net asset method values a company’s shares based on the difference between the fair value of its assets and liabilities.

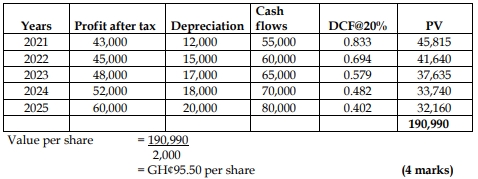

iv) Discounted Cash Flow (DCF) Method:

The DCF method values shares by calculating the present value of future cash flows using a discount rate of 20% (cost of capital).

- Topic: Business valuations

- Series: NOV 2021

- Uploader: Theophilus