- 8 Marks

Question

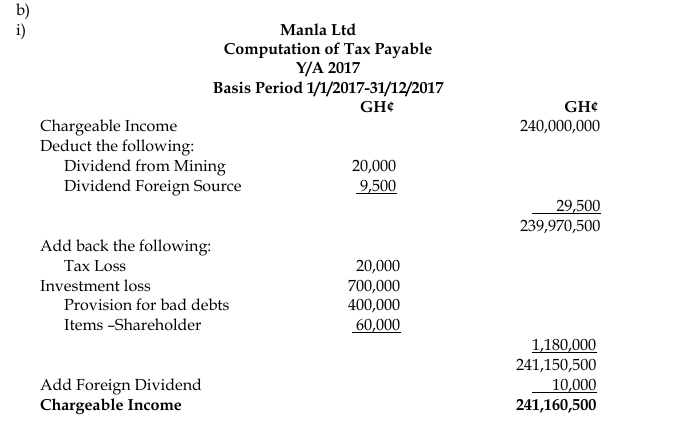

Manla Ltd, since its incorporation, has been providing Mining Support Services (MSS) in line with its mandate, and the following is relevant to its operations for the 2017 year of assessment:

| Details | GH¢ |

|---|---|

| Chargeable income | 240,000,000 |

| Loss from investment deducted in arriving at the chargeable income | 700,000 |

| Dividend (gross) received from A Ltd (a mining company) where Manla Ltd has 26% voting power | 20,000 |

| Provision for bad debts written off | 400,000 |

| Tax loss from 2014 deducted | 20,000 |

| Net dividend received from a US-based company after 5% withholding tax | 9,500 |

| Items worth GH¢ 60,000 granted to a powerful shareholder were adjusted in arriving at chargeable income | 60,000 |

(Note: Manla Ltd has a basis period from January to December.)

Required:

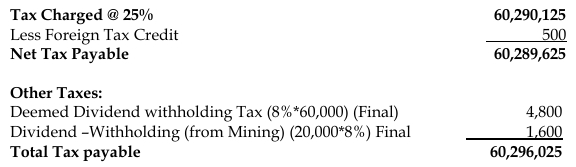

i) Compute the taxes payable by Manla Ltd. (6 marks)

ii) Comment on the treatment of the investment loss of GH¢700,000. (2 marks)

Answer

ii) Treatment of Investment Loss (GH¢ 700,000):

- The investment loss of GH¢ 700,000 should not have been deducted when determining the business’s chargeable income. According to Section 17 of the Income Tax Act, losses from investments are not deductible from business income but may be carried forward to offset future investment gains. The loss should be carried forward and deducted from future investment income only.

- Tags: chargeable income, Dividend tax, Mining Support Services, Tax computation, Tax Losses

- Level: Level 3

- Topic: Business income - Corporate income tax

- Series: NOV 2018

- Uploader: Dotse