- 5 Marks

Question

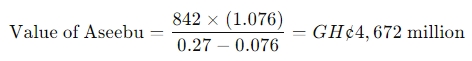

Ape has 2,500 shares outstanding at GH¢10 per share. Bee has 1,250 shares outstanding at GH¢5 per share. Ape estimates that the value of synergistic benefit from acquiring Bee is GH¢500. Bee has indicated that it would accept a cash purchase offer of GH¢6.50 per share.

Required:

Identify whether Ape should proceed with the merger

Answer

Since the net loss from the acquisition is GH¢1,375, Ape should not proceed with the merger as it results in a financial loss despite the synergy benefits.

- Tags: Acquisition, Cash Purchase, Corporate Strategy, Mergers, Share Valuation, Synergy

- Level: Level 3

- Topic: Valuation of acquisitions and mergers

- Series: MAY 2019

- Uploader: Theophilus

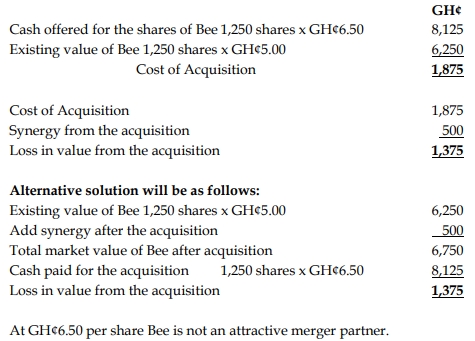

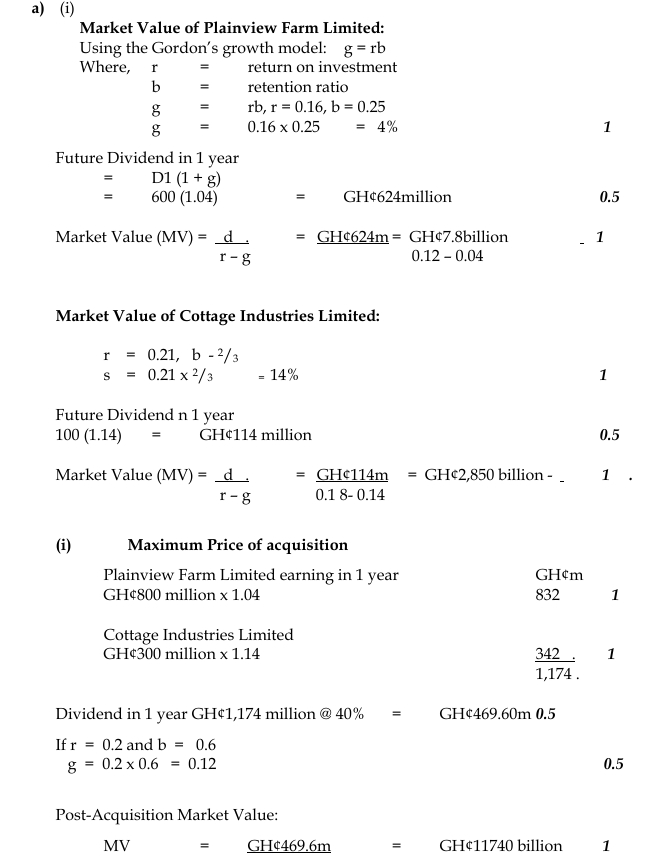

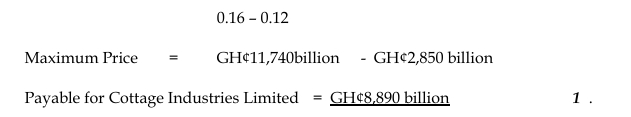

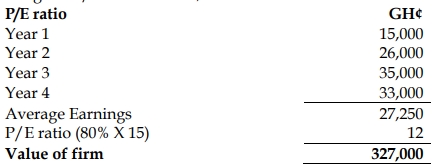

(1 mark for each line up to 5, 1 mark each for the growth rate and 2 marks for cost of equity = 8 marks)

(1 mark for each line up to 5, 1 mark each for the growth rate and 2 marks for cost of equity = 8 marks) =

=