- 20 Marks

Question

Alokome Plc is a company that produces and sells one product “Iga”. Information relating to the operations of Alokome Plc for the first two months of 2023 is as follows:

i) Iga sells for GH₵500 per unit.

ii) There were no inventories of Iga at the end of December 2022.

iii) Other relevant information is as follows:

| Cost Element | GH₵ |

|---|---|

| Direct material and wages | 220 |

| Variable production overhead | 30 |

Budgeted and actual costs per month:

| Cost Element | GH₵ |

|---|---|

| Fixed production overhead | 990,000 |

| Fixed selling and administrative expenses | 400,000 |

| Variable selling expenses | 12.5% of sales |

Normal capacity: 110,000 units per month

Number of units produced and sold:

| Month | Sales (units) | Production (units) |

|---|---|---|

| January | 128,000 | 140,000 |

| February | 110,000 | 102,000 |

Required:

Using the information above, prepare in a columnar form profit statements for January and February 2023 using:

a) Marginal costing (10 marks)

b) Absorption costing (10 marks)

Answer

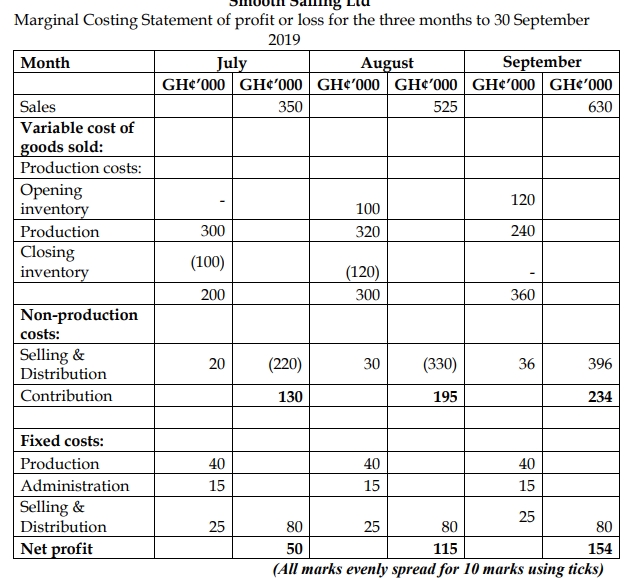

a) Alokome Plc – Profit Statement for January and February 2023 (Marginal Costing)

| January (GH₵’000) | February (GH₵’000) | |

|---|---|---|

| Sales revenue | 64,000 | 55,000 |

| Less: Variable cost of sales: | ||

| Beginning inventory | – | 3,000 |

| Production cost | 35,000 | 25,500 |

| Ending inventory | (3,000) | (1,000) |

| Variable cost of production | 32,000 | 27,500 |

| Variable selling expenses | 8,000 | 6,875 |

| Variable cost of sales | (40,000) | (34,375) |

| Contribution | 24,000 | 20,625 |

| Less: Fixed costs | ||

| Fixed production overhead | (990) | (990) |

| Fixed selling and admin. expenses | (400) | (400) |

| Profit | 22,610 | 19,235 |

| (Marks are evenly spread using ticks = 10 marks) |

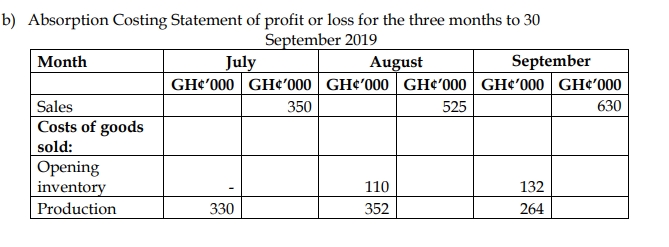

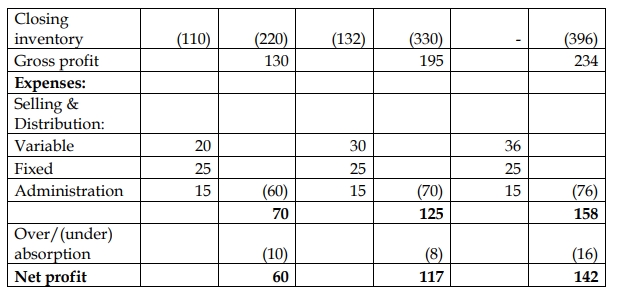

b) Alokome Plc – Profit Statement for January and February 2023 (Absorption Costing)

| January (GH₵’000) | February (GH₵’000) | |

|---|---|---|

| Sales revenue | 64,000 | 55,000 |

| Less: Full cost of sales: | ||

| Beginning inventory | – | 3,108 |

| Production cost | 36,260 | 26,418 |

| Ending inventory | (3,108) | (1,036) |

| Full cost of production | 33,152 | 28,490 |

| Gross profit (Notional) | 30,848 | 26,510 |

| Adjustment for under/over absorption of fixed prodn o/head | 270 | (72) |

| Gross profit (Actual) | 31,118 | 26,438 |

| Less: Selling and administrative expenses: | ||

| Variable selling expenses | (8,000) | (6,875) |

| Fixed selling and admin. expenses | (400) | (400) |

| Profit | 22,718 | 19,163 |

| (Marks are evenly spread using ticks = 10 marks) |

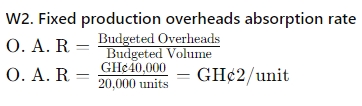

Workings:

| Calculation | GH₵ |

|---|---|

| Variable production cost per unit | |

| Direct material and wages | 220 |

| Variable production overhead | 30 |

| Total | 250 |

| Calculation | GH₵ |

|---|---|

| Fixed production overhead per unit | 9 |

| Full production cost per unit | |

| Direct material and wages | 220 |

| Variable production overhead | 30 |

| Fixed production overhead per unit | 9 |

| Total | 259 |

- Tags: Absorption Costing, Marginal Costing, Over/Under Absorption, Profit Statement

- Level: Level 1

- Topic: Marginal Costing and Absorption Costing

- Series: NOV 2023

- Uploader: Joseph