- 4 Marks

Question

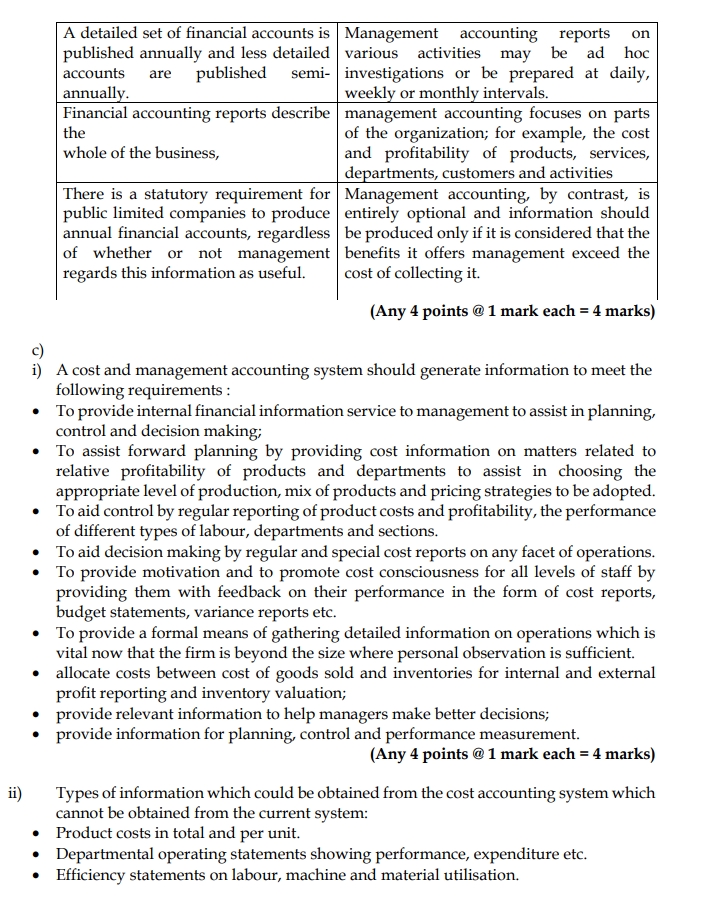

Explain TWO limitations of management information in providing guidance for

managerial decision-making.

Answer

- Failure to Meet the Requirements of Good Information

If the information supplied to managers is deficient or inaccurate, it may lead to poor decision-making. Inadequate or irrelevant data can result in decisions that are not based on a comprehensive understanding of the situation, potentially causing adverse outcomes. - The Problem of Relevant Costs and Revenues

Not all information from accounting systems is relevant for decision-making. Effective decisions depend on considering only future costs and benefits that will be affected by the decision. Factors such as sunk costs (previously incurred costs) and non-incremental costs (unchanged fixed costs) should be excluded from decision-making processes.

- Topic: Other Aspects of Performance Measurement

- Series: MAY 2018

- Uploader: Joseph