- 18 Marks

Question

KYC Ltd makes three products: Hand Chew (HC), Yogurt Swallow (YS), and Canned Lick (CL). All three products are sold as a package and so are offered for sale each month to be able to provide a complete market service. The products are fragile, and their quality deteriorates rapidly once they are manufactured. The products are produced on two types of machines and worked on by a single grade of direct labour. Five direct employees are paid GH¢8 per hour for a guaranteed minimum of 160 hours each per month. All of the products are first molded on machine type 1 and then finished and sealed on machine type 2. The machine hour requirements for each of the products are as follows:

| Product | Machine Type 1 (Hours/Unit) | Machine Type 2 (Hours/Unit) |

|---|---|---|

| HC | 1.5 | 1 |

| YS | 4.5 | 2.5 |

| CL | 3 | 2 |

The capacity of the available machines type 1 and 2 are 600 hours and 500 hours per month respectively. Details of the selling prices, unit costs, and monthly demand for the three products are as follows:

| Product | HC (GH¢/Unit) | YS (GH¢/Unit) | CL (GH¢/Unit) |

|---|---|---|---|

| Selling price | 91 | 174 | 140 |

| Component cost | 22 | 19 | 16 |

| Other direct material cost | 23 | 11 | 14 |

| Direct labour cost at GH¢8 per hour | 6 | 48 | 36 |

| Overheads | 24 | 62 | 52 |

| Profit | 16 | 34 | 22 |

Maximum monthly demand (units):

- HC: 120

- YS: 70

- CL: 60

Although KYC Ltd uses marginal costing and contribution analysis as the basis for its decision-making activities, profits are reported in the monthly management accounts using the absorption costing basis. Finished goods (inventories) are valued in the monthly management accounts at full absorption cost.

Required:

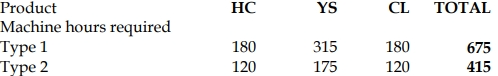

i) Calculate the machine utilization rate per month for each machine and explain which of the machines is the bottleneck/limiting factor. (4 marks)

ii) Using the current system of marginal costing and contribution analysis, calculate the profit-maximizing monthly output of the three products. (5 marks)

iii) Explain why throughput accounting might provide more relevant information in KYC’s circumstances. (4 marks)

iv) Using a throughput approach, calculate the throughput-maximizing monthly output of the three products. (5 marks)

Answer

i

𝐸𝑂𝑄 =![]()

Relevant costs:

Holding costs =![]()

Ordering costs =![]()

ii)

Total cost with discount; purchase cost 8,000 @ 171= 1,368,000.

Ordering cost 8000÷8000 ×270= 270

Holding cost 8000÷2×24 = 96,000

The decision should be reject offer.

Machine type 1 has the highest utilisation rate and the rate is above 100%. Therefore

machine type 1 is the bottleneck/limiting factor.

Allocation of machine type 1 hours according to this ranking:

Product HC 120 units using 180 hours

Product CL 60 units using 180 hours

360 hours used

Product YS (240/4.5) 53 units using 240 hours

600 hours used

iii) Relevance of Throughput Accounting:

- Throughput accounting focuses on maximizing the contribution per unit of the bottleneck resource (machine type 1 in this case), which is crucial for KYC Ltd because their products are perishable and need to be sold quickly. Labor costs, typically considered variable in marginal costing, are seen as fixed in throughput accounting, making this approach more suitable for KYC Ltd.

iv) Throughput-Maximizing Monthly Output:

| Product | HC | YS | CL |

|---|---|---|---|

| Throughput per unit (GH¢) | 46 | 144 | 110 |

| Machine type 1 hours/unit | 1.5 | 4.5 | 3.0 |

| Throughput per hour (GH¢) | 30.67 | 32.00 | 36.76 |

| Ranking (priority) | 3 | 2 | 1 |

- Allocation of Machine Type 1 Hours:

| Product | Units Produced | Machine Hours Used |

|---|---|---|

| CL | 60 | 180 |

| YS | 70 | 315 |

| HC | 70 | 105 |

- Topic: Relevant Cost and Revenue

- Series: NOV 2018

- Uploader: Joseph