- 20 Marks

Question

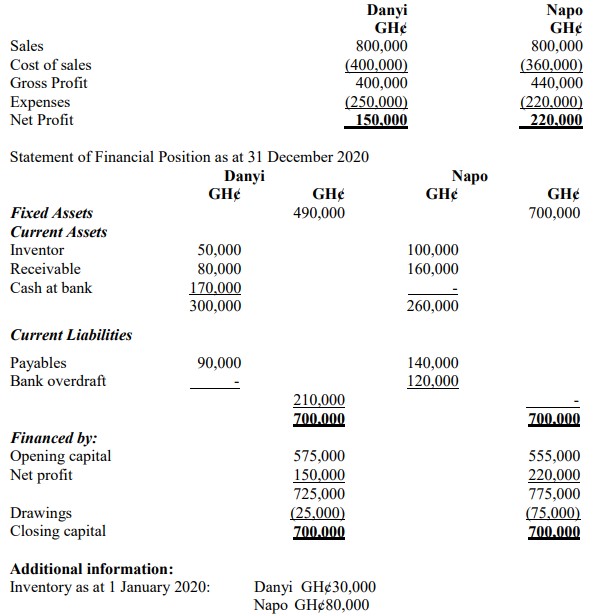

The following summary information relates to two businesses, Danyi and Napo. Both businesses traded in the same market sector for the year ended 31 December 2020.

Statement of Profit or Loss Accounts for the year ended 31 December 2020:

Required:

a) Calculate the following ratios for Danyi and Napo:

i) Gross profit margin

ii) Net profit margin

iii) Return on capital employed (ROCE)

iv) Current ratio

v) Liquid (acid test) ratio

vi) Inventory turnover

(6 marks)

b) Use the ratios calculated in a) to assess:

i) The liquidity of both businesses

ii) The profitability of both businesses

(8 marks)

c) Advise management of both Danyi and Napo on the actions they should now take to improve liquidity and profitability.

(6 marks)

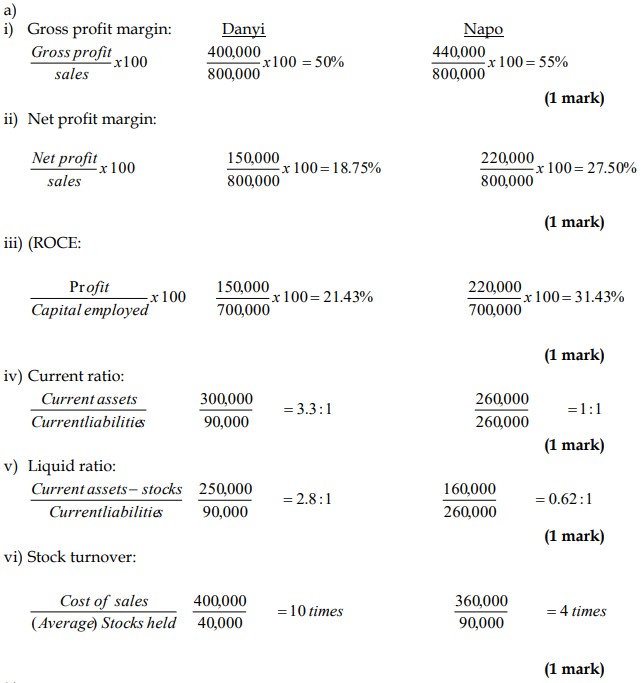

Answer

b)

Assessment of Liquidity and Profitability

i) Liquidity:

- Danyi:

Danyi has a strong liquidity position with a current ratio of 3.33:1 and a liquid ratio of 2.78:1. This suggests that Danyi has sufficient liquid assets to cover its current liabilities and is in a good position to meet short-term obligations. - Napo:

Napo’s liquidity is much weaker, with a current ratio of 1.00:1 and a liquid ratio of 0.62:1. This indicates that Napo may struggle to cover its current liabilities, especially when inventory is excluded from liquid assets.

ii) Profitability:

- Danyi:

Danyi has a gross profit margin of 50.00% and a net profit margin of 18.75%. The ROCE of 21.43% suggests that Danyi is generating a decent return on the capital employed, though it is lower than Napo’s. - Napo:

Napo demonstrates higher profitability with a gross profit margin of 55.00% and a net profit margin of 27.50%. The ROCE of 31.43% indicates that Napo is using its capital more efficiently to generate profits compared to Danyi.

(8 marks)

c)

Advice to Management

- For Danyi:

- Improve Inventory Management: Danyi should consider reducing its inventory levels to further improve its liquidity and increase the efficiency of its operations.

- Enhance Profit Margins: Danyi may need to focus on increasing its net profit margin by either reducing operating expenses or improving sales pricing strategies.

- Invest Surplus Cash: Given Danyi’s strong liquidity, the management should consider investing surplus cash in revenue-generating opportunities to enhance profitability.

- For Napo:

- Strengthen Liquidity: Napo should prioritize improving its liquidity by tightening credit control, collecting receivables more efficiently, and reducing reliance on bank overdrafts.

- Review Cost Structure: Napo should carefully review its cost structure to ensure that operating expenses do not erode profitability, particularly focusing on cost control measures.

- Optimize Working Capital: Napo should work towards optimizing its working capital by reducing inventory levels and improving cash flow management.

- Uploader: Theophilus