- 5 Marks

Question

The cost of iron rods supplied by Akinto Steel Works Ltd to Oputu Construction Ltd is worth GH¢300,000 (inclusive of National Health Insurance Levy, Ghana Education Trust Fund Levy, COVID-19 Health Recovery Levy, and Value Added Tax).

Required:

Determine the Withholding Tax payable in respect of the contract for supplies. (5 marks)

Answer

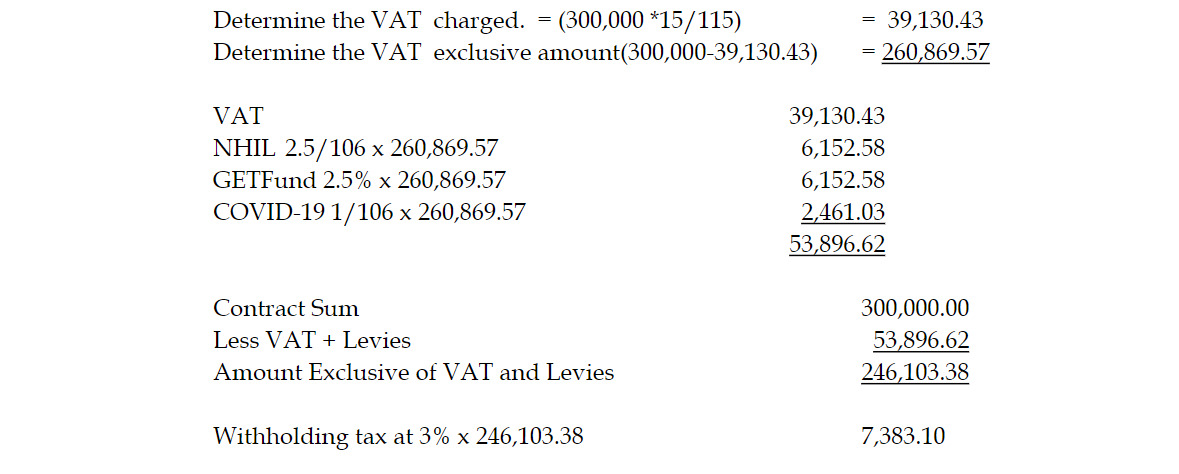

b) Determination of Withholding Tax payable in respect of the contract for supplies

Determine the VAT charged. = (300,000 *15/115) = 39,130.43

Determine the VAT exclusive amount(300,000-39,130.43) = 260,869.57

Note: Candidates who computed withholding VAT instead of 3% withholding for goods were also marked correct.

(5 marks)

- Topic: Withholding Tax Administration

- Series: NOV 2023

- Uploader: Cheoli