- 20 Marks

Question

a) A company owns a number of properties which are rented to tenants. The following information is available for the year ended 30 June 2021:

| Date | Rent in advance (GHȼ) | Rent in arrears (GHȼ) |

|---|---|---|

| 30 June 2020 | 140,500 | 5,200 |

| 30 June 2021 | 148,200 | 9,200 |

Cash received from tenants for the year ended 30 June 2021 was GHȼ820,400. All rent in arrears was subsequently received.

Required:

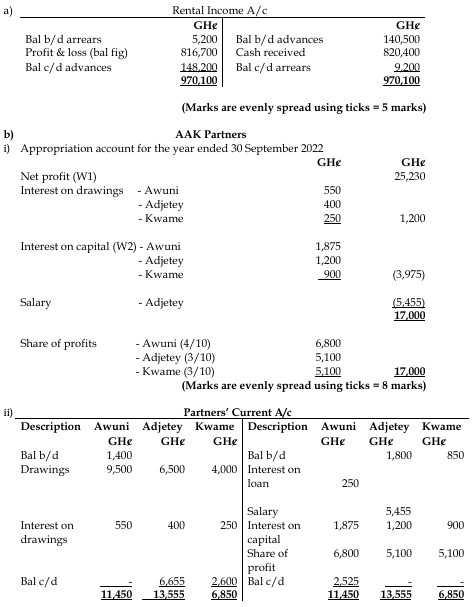

Prepare the ledger account for rental income showing the transfer to the Statement of Profit and Loss, for the year ended 30 June 2021. (5 marks)

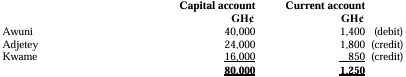

b) Awuni, Adjetey, and Kwame are in partnership, running an evening school, and sharing residual profits and losses in the ratio 4:3:3 respectively. At 1 October 2021 their capital and current account balances were:

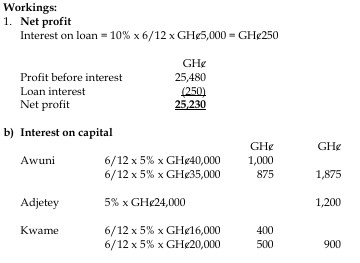

By formal agreement, the partners are entitled to receive interest at 5% on capital. In addition, Adjetey is paid an annual salary of GHȼ5,455 for his part in running the business.

On 1 April 2022, by mutual agreement, Kwame increased his capital by paying a further GHȼ4,000 into the partnership bank account. Awuni reduced his capital by GHȼ5,000, but kept this in the partnership as a loan bearing interest at 10% per annum. Interest on the loans, by agreement, is credited to Awuni’s current account.

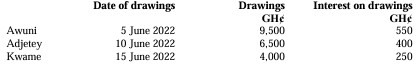

The partners are allowed to take out drawings at any time during the year, but they have agreed to charge interest on such drawings. The date of taking out the drawings, the amount drawn out by each partner, and the interest payable, were as follows during the year to 30 September 2022:

Required:

i) Prepare the profit and loss appropriation account for the year ended 30 September 2022. (8 marks)

ii) Prepare the partners’ current accounts for the year ended 30 September 2022. (7 marks)

Answer

- Topic: Preparation of Partnership accounts

- Series: JULY 2023

- Uploader: Theophilus