- 20 Marks

Question

ABC Ltd is considering five projects for the coming financial year. Four of the projects have undergone financial appraisal (see the table below).

| Project | Lifespan | Initial investment (GH¢) | NPV (GH¢) | IRR |

|---|---|---|---|---|

| PA201 | Indefinite | (50,000) | 85,200 | 11.5% |

| PA202 | Indefinite | (75,000) | 98,500 | 12.3% |

| PA203 | Indefinite | (48,000) | 65,950 | 10.2% |

| PA204 | Indefinite | (85,000) | 95,400 | 11.4% |

| PA205 | Indefinite | (150,000) | Yet to be appraised | Yet to be appraised |

Project PA205 entails an immediate capital investment of GH¢150,000 and will produce the following annual net cash flows in real terms:

| Year | 1 | 2 | 3 | 4 | 5 | Every year after year 5 |

|---|---|---|---|---|---|---|

| Cash flow (GH¢) | 5,000 | 10,500 | 25,000 | 28,000 | 30,000 | 30,000 |

Expected general rate of inflation is 15% and the company’s money required rate of return is 25%.

Required:

a) Appraise Project PA205 using the NPV criteria. (4 marks)

b) Assess the sensitivity of Project PA205 to the discount rate. (4 marks)

c) Suppose in the coming financial year, only GH¢200,000 of finance will be available for investments but the capital constraint will ease afterwards. Advise the company on which project(s) to implement in the coming year if the projects are –

i) Independent and divisible (3 marks)

ii) Independent and indivisible (3 marks)

d) When management rejects projects with positive net present value because of capital constraints, they lose opportunities to enhance the value of shareholders. Suggest three practical ways of dealing with capital rationing so as not to discard projects with positive net present value. (6 marks)

Answer

a) NPV Computation:

NPV can be computed by discounting the real cash flows with the company’s real rate of return. Discounting the project real cash flows with the real rate of return produces an NPV of GHS152,666:

| End of Year | NCF | Discount Factor @ 8.7% | PV |

|---|---|---|---|

| 0 | (150,000) | 1 | (150,000) |

| 1 | 5,000 | 0.92 | 4,600 |

| 2 | 10,500 | 0.846 | 8,883 |

| 3 | 25,000 | 0.779 | 19,475 |

| 4 | 28,000 | 0.716 | 20,048 |

| 5 | 30,000 | 0.659 | 19,770 |

| 6 and every year thereafter | 30,000 | 7.575 | 227,250 |

NPV = 150,026

Comment: Since the NPV of the project is positive, the value of the firm will increase when the project is implemented. The project should therefore be accepted for implementation.

Workings:

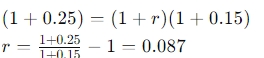

1.) Discount rate:

The real rate of return is estimated using the Fisher’s equation as under:

(1+i)=(1+r)(1+h)

Nominal rate, i = 25%

Inflation rate, h = 15%

Therefore, the real rate of return is 8.7%

2.) Discount factor for equal cash flows occurring every year from year 6 to infinity

The equal annual cash flow of GHS30,000 from year 6 to infinity is first discounted as a perpetuity to obtain the terminal value at end of year 5:

Terminal value of constant CF from 6 to infinity =![]()

The terminal value is then discounted as a single amount to obtain the PV at time zero:

PV of constant CF from 6 to infinity =![]()

The aggregate discount factor is therefore 7.575:

Aggregate discount factor =![]()

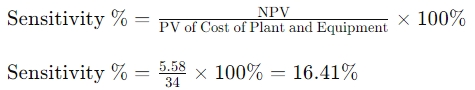

b) Sensitivity Analysis:

The sensitivity of the project’s NPV to the discount rate can be estimated as the percentage change in the discount rate needed to reduce NPV to zero.

Sensitivity percentage =![]()

Sensitivity percentage =![]()

That is, the discount rate will have to increase by 72.4% for the NPV to reduce to zero. The high percentage increase required in the discount rate for the NPV to drop to zero implies Project PA205 is less sensitive to variation in the discount rate.

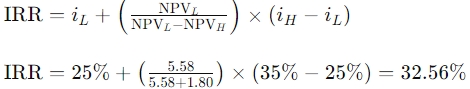

IRR Calculation:

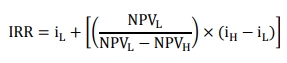

The IRR is calculated by trial and error as under:

Setting iL = 15% and iH = 17%, NPVL and NPVH are computed as under:

| End of Year | NCF | DF (15%) | PV @15% | DF (17%) | PV @17% |

|---|---|---|---|---|---|

| 0 | (150,000) | 1.000 | (150,000) | 1.000 | (150,000) |

| 1 | 5,000 | 0.870 | 4,350 | 0.855 | 4,275 |

| 2 | 10,500 | 0.756 | 7,938 | 0.731 | 7,676 |

| 3 | 25,000 | 0.658 | 16,450 | 0.624 | 15,600 |

| 4 | 28,000 | 0.572 | 16,016 | 0.534 | 14,952 |

| 5 | 30,000 | 0.497 | 14,910 | 0.456 | 13,680 |

| 6 and every year thereafter | 30,000 | 6.667 x 0.497 | 99,405 | 5.882 x 0.456 | 80,466 |

NPV @ 15% = 9,069

NPV @ 17% = (13,351)

The IRR of the project is 15.8%:

![]()

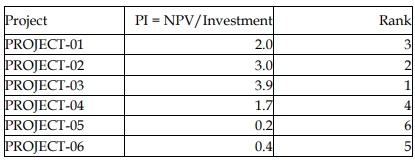

c) Project Selection Under Single Period Capital Rationing

i) If projects are independent and divisible

When a firm faces capital rationing for a single period and projects are independent and divisible, funds may be allocated to projects based on the profitability index rankings.

| Project | Investment | NPV | PI = NPV/Investment | Rank |

|---|---|---|---|---|

| PA201 | 50,000 | 85,200 | 1.70 | 1 |

| PA202 | 75,000 | 98,500 | 1.31 | 3 |

| PA203 | 48,000 | 65,950 | 1.37 | 2 |

| PA204 | 85,000 | 95,400 | 1.12 | 4 |

| PA205 | 150,000 | 150,026 | 1.00 | 5 |

Fund Allocation:

Fund allocation to projects based on PI rankings and respective NPV follow:

| Project | Investment Required | Fund Allocation | NPV |

|---|---|---|---|

| PA201 | 50,000 | 50,000 | 85,200 |

| PA203 | 48,000 | 48,000 | 65,950 |

| PA202 | 75,000 | 75,000 | 98,500 |

| PA204 (balance) | 85,000 | 27,000 | 30,299* |

| PA205 | 150,000 | – | – |

| 200,000 | 279,949 |

That is, the company should invest fully in projects PA201, PA203, and PA202; 31.76% in PA204 (27,000/85,000); and nothing in PA205 which is at the bottom of the ranking. The optimum aggregate NPV is GHS279,949.

Workings:

- NPV from PA204 is its NPV multiplied by the proportion of the investment requirement the company will allocate funds to (i.e. GHS95,400 x 31.76%).

ii) If projects are independent and indivisible

Here we consider a combination of the projects and select the combination that will produce the highest combined NPV. Any unused funds may be invested externally (e.g., in securities).

| Combination of Projects | Combined Investment Requirement | Unused Funds | Combined NPV |

|---|---|---|---|

| PA201, PA202, and PA203 | 173,000 | 27,000 | 249,650 |

| PA201, PA203, and PA204 | 183,000 | 17,000 | 246,550 |

| PA201 and PA205 | 200,000 | 0 | 235,226 |

| PA203 and PA205 | 198,000 | 2,000 | 215,976 |

The company should invest in projects PA201, PA202, and PA203 to earn the highest combined NPV of GHS249,650. The unused funds of GHS27,000 should be invested externally.

d) Practical Ways to Address Capital Constraints:

Practical ways of dealing with capital constraints so as not to lose opportunities to further increase the value of the company include the following:

- Seek joint venture partners to share the project’s investment requirement.

- Use licensing or franchising arrangements to produce and sell the product, earning royalties while avoiding financing of the investment requirements.

- Contract out parts of the project to subcontractors who would finance the project in advance.

- Seek alternative financing such as venture capital and asset securitization.

- Seek grants or aid from the government or organizations if the project aligns with their objectives.

- Tags: Capital Rationing, Discounted Cash Flow, IRR, NPV

- Level: Level 2

- Topic: Capital rationing, Discounted cash flow

- Series: MAY 2016

- Uploader: Joseph