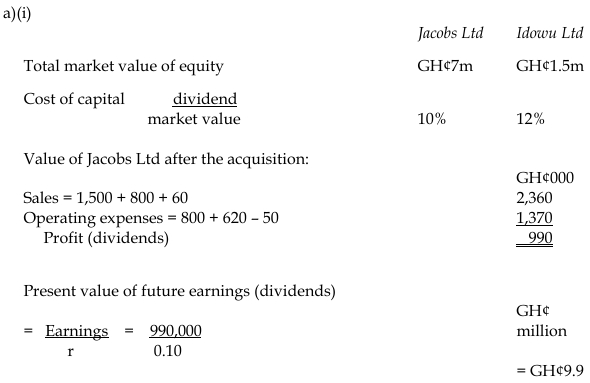

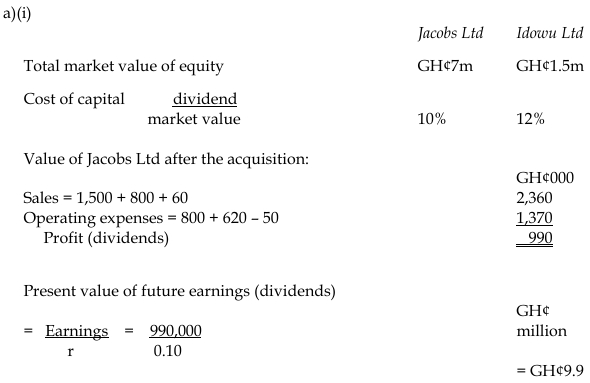

The sale of the unused machinery would generate GH¢100,000, so the total value after the acquisition is:

TotalValue=GH¢9,900,000+GH¢100,000=GH¢10,000,000Total Value = GH¢9,900,000 + GH¢100,000 = GH¢10,000,000TotalValue=GH¢9,900,000+GH¢100,000=GH¢10,000,000

Step 5: Calculate the maximum price

The maximum price Jacobs Ltd should pay is the difference between the value after the acquisition and its current value before the acquisition.

- Current value of Jacobs Ltd: 2,000,000 shares × GH¢3.50 per share = GH¢7,000,000

- Maximum price for Idowu Co Ltd: GH¢10,000,000 – GH¢7,000,000 = GH¢3,000,000

ii) Minimum price Idowu Co Ltd shareholders should accept

The minimum price that the ordinary shareholders in Idowu Co Ltd should accept is the current market value of their shares.

- Market value of Idowu Co Ltd: 1,000,000 shares × GH¢1.50 per share = GH¢1,500,000

Thus, the minimum price the ordinary shareholders in Idowu Co Ltd should accept is GH¢1,500,000.

(Total: 10 marks)

b)

The agreed takeover price for Idowu Co Ltd was GH¢1,500,000, based on the minimum acceptable price for Idowu’s shareholders as calculated in part 3(a)(ii).

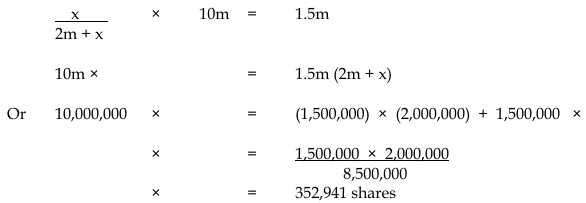

We need to determine how the entire benefit from the acquisition will accrue to the shareholders of Jacobs Ltd using a share exchange mechanism.

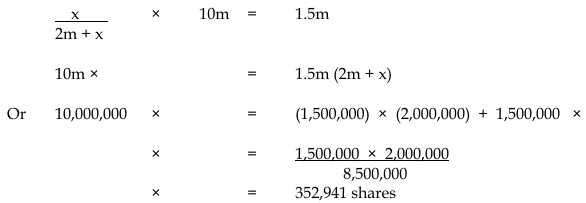

Step 1: Determine the number of shares to be issued in exchange

Let x represent the number of new shares to be issued to Idowu Co Ltd’s shareholders. The total number of shares in issue after the acquisition will be 2,000,000+x shares (since Jacobs Ltd originally has 2,000,000 issued shares).

The total value of Jacobs Ltd after the acquisition is GH¢10,000,000 (as calculated in 3(a)(i)).

For the benefit of the acquisition to accrue fully to Jacobs Ltd’s shareholders, the value of the shares issued to Idowu Co Ltd’s shareholders should equal the agreed takeover price of GH¢1,500,000. This gives us the following equation:

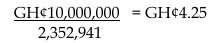

The market value per share after the acquisition will be:

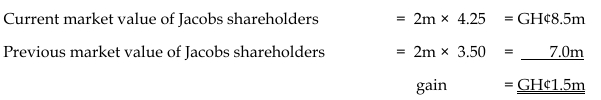

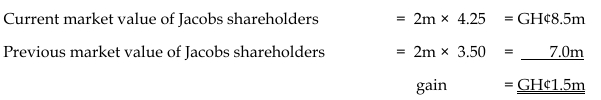

Before the acquisition, the market value of Jacobs Ltd’s shares was GH¢3.50 per share. After the acquisition, the value of each share increases to GH¢4.25, representing a gain of GH¢0.75 per share.

For Jacobs Ltd’s original 2,000,000 shares:

2,000,000×0.75=GH¢1,500,000

Thus, the shareholders of Jacobs Ltd will receive the entire benefit from the acquisition, which is GH¢1,500,000, the same as the agreed takeover price.