- 6 Marks

Question

Yelbateng Ltd is a Korean company and has a subsidiary in Ghana, by the name Yelbateng Ghana Ltd.

The parent company in 2008 gave a loan facility to the subsidiary to support its operations. However, interest on the loan from 2009 to 2019 came to $8,000,000 after applying a thin capitalisation rule in taxation. As a result, the total amount was accrued by Yelbateng Ghana Ltd, as the company did not have money to pay the interest as agreed in the loan contract.

The total amount of the loan was $20 million. In the year 2020, the Board took a decision to relief the subsidiary of the loan obligation, meaning the loan with its interest was not going to be repaid by the subsidiary.

Required:

You have been invited as a final level candidate to advise the company on the tax implication of this arrangement. (6 marks)

Answer

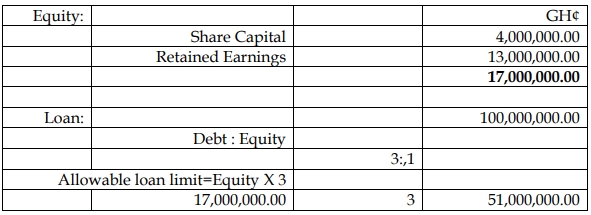

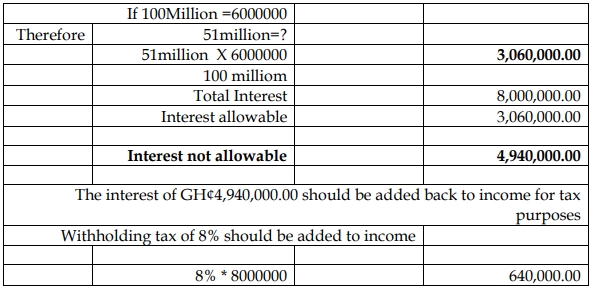

The loan from the parent company to a subsidiary shall be subject to the thin capitalisation rule. The interest on the loan is tax deductible provided it is within the thin capitalisation rule.

With the accumulated interest of $8,000,000 and a loan amount of $20 million forgiven by the parent company, both become income in the books of Yelbateng Ghana limited and therefore taxable.

Tax implication

The withholding tax on the amount of interest on the loan shall be deducted and paid to the Ghana Revenue Authority in line with the tax provision.

Additionally, the amount of $800,000 forgiven and the loan of $20 million shall be treated as income in the company’s books for tax purposes.

- Topic: Business income - Corporate income tax, International taxation

- Series: NOV 2021

- Uploader: Joseph