- 10 Marks

Question

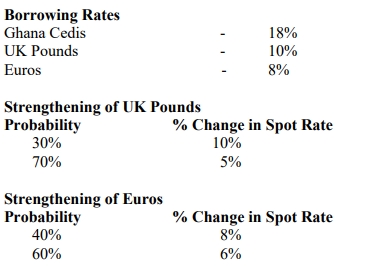

The Ghana Cocoa Board (GCB) is contemplating borrowing one-year funds in anticipation of the coming cocoa season, which starts in September/October 2017. GCB can borrow from the local financial market in Ghana or borrow a portfolio of funds made up of UK pounds and Euros. The information below is the borrowing rates and the probabilities of expected strengthening of the international currencies vis-à-vis the cedi.

Required:

Determine whether GCB should borrow from the local financial market or borrow a portfolio of funds made up of UK pounds and Euros.

Answer

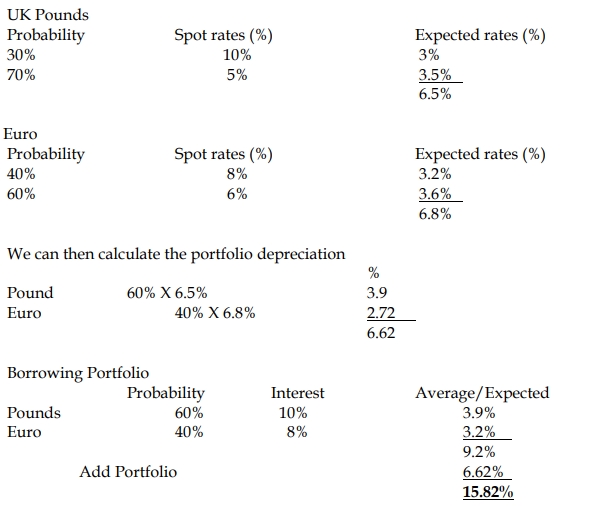

To determine the best borrowing option, we need to compare the effective borrowing rates from both options. First, we calculate the expected strengthening rates for both the UK pounds and Euros.

Since the portfolio borrowing rate of 6.62% is significantly lower than the local borrowing rate of 18%, GCB should borrow the portfolio of funds made up of UK pounds and Euros.

Conclusion:

GCB should opt for borrowing the portfolio of UK pounds and Euros due to the lower effective borrowing rate compared to the local borrowing rate in Ghana Cedis.

- Tags: Borrowing Rates, Currency Exchange, Financial management, Interest rates, Money market

- Level: Level 3

- Topic: The role of the treasury function in multinationals

- Series: NOV 2018

- Uploader: Theophilus