- 5 Marks

Question

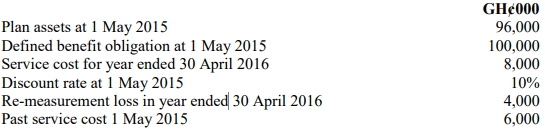

The following information relates to the pension scheme of Patience Pass All Limited for the year ended 30 April 2016:

The pension costs have not been accounted for in the total comprehensive income as the Accountant of the company is not qualified yet and lacks sufficient knowledge on the provisions of IAS 19 Employee Benefits.

Required:

Demonstrate how the above transaction would be accounted for under the provisions of IAS 19 Employee Benefits, including relevant extracts to the financial statements for the year ended 30 April 2016.

Answer

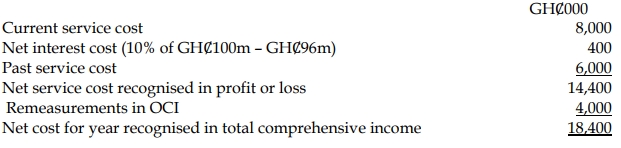

Under IAS 19 Employee Benefits, the pension costs for a defined benefit plan are recognized in the statement of profit or loss and other comprehensive income. The key components are the service cost, net interest cost, past service cost, and re-measurements.

Pension cost to be recognized in profit or loss:

Financial statement extracts:

Statement of profit or loss GHȻ000

Net service cost recognised in profit or loss (14,400)

OCI

Remeasurements in OCI (4,000)

- Tags: Defined Benefit, Interest Cost, Pension Scheme, Service Cost

- Level: Level 3

- Topic: IAS 19: Employee Benefits

- Series: NOV 2016

- Uploader: Theophilus