- 20 Marks

Question

Obonku Limited produces Single, Double, and King-size beds for sale to hotels in West Africa. Its manufacturing plant is located in Tema and is currently operating at 100% capacity. Below is the annual output and sales for each product and the associated costs:

| Product | Single bed | Double bed | King Size bed |

|---|---|---|---|

| Units sold | 5,000 units | 3,500 units | 4,000 units |

| Sales (GHS) | 2,500,000 | 2,800,000 | 3,800,000 |

| Costs: | |||

| Material cost | 750,000 | 1,400,000 | 1,520,000 |

| Labour costs | 600,000 | 1,050,000 | 1,200,000 |

| Manufacturing O’head | 200,000 | 650,000 | 300,000 |

| Administrative cost | 200,000 | 100,000 | 200,000 |

| Total cost | 1,750,000 | 3,200,000 | 3,220,000 |

| Profit/Loss | 750,000 | (400,000) | 580,000 |

The Director of Obonku is of the view that the Double bed product line is not doing well and should not be produced any longer. The following additional information has been provided:

- 40% of the labor cost for all bed types are fixed costs.

- 50% of the manufacturing overhead is variable for all products.

- 80% of the administrative cost is fixed.

Alom Hotel Limited, situated in Elmina, has requested 80 units of each bed and is ready to procure them at the current prices. Obonku Ltd can only produce more if they increase production capacity in the short term at an additional cost of GHS 80,000.

Assuming that costs and prices remain the same, you are required to:

a) Advise whether the company should shut down the production of Double beds. (10 marks)

b) Should the company accept the new order assuming Double beds will still be produced? (10 marks)

Answer

a) Calculation of Contribution that Will Be Lost if Double Bed Production Ceases:

| Item | GHS |

|---|---|

| Potential loss of revenue | 2,800,000 |

| Less: | |

| – Material cost savings | 1,400,000 |

| – Variable labor cost savings (60% of 1,050,000) | 630,000 |

| – Variable manufacturing overhead savings (50% of 650,000) | 325,000 |

| – Variable administrative cost savings (20% of 100,000) | 20,000 |

| Total potential savings | 2,375,000 |

| Potential contribution to fixed costs that will be lost | 425,000 |

Conclusion:

A contribution of GHS 425,000 will be lost if Double bed production ceases. This loss in contribution will result in a decline in profit by the same amount since fixed costs will still be incurred. Therefore, the company should continue the production of Double beds.

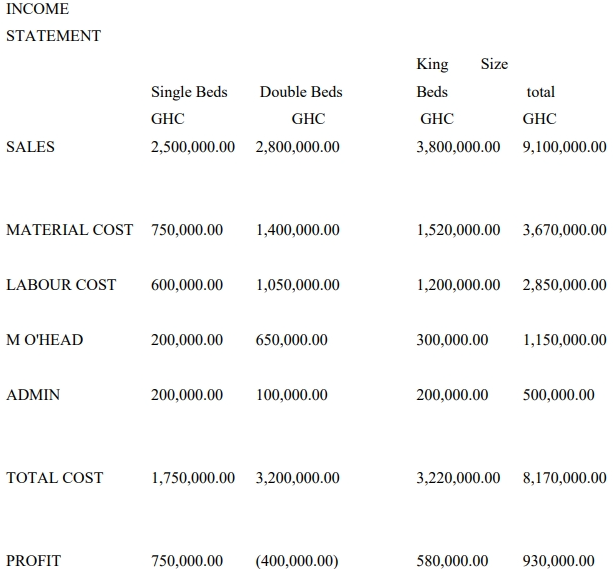

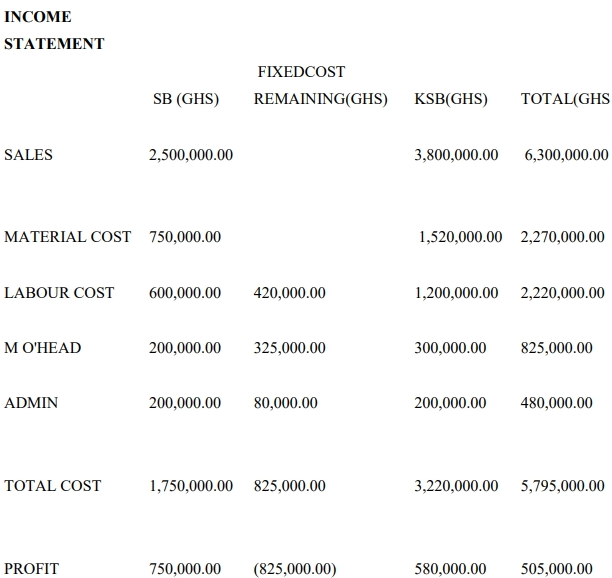

ALTERNATIVELY

In this case profit reduced from GHC 930,000 to GHC 505,000 a reduction of GHC425, 000

b) Income Statement for 80 Units of Each Product:

| Item | Single bed | Double bed | King Size bed | Total |

|---|---|---|---|---|

| Sales (GHS) | 40,000 | 64,000 | 76,000 | 180,000 |

| Material Cost | 12,000 | 32,000 | 30,400 | 74,400 |

| Labor Cost | 5,760 | 14,400 | 14,400 | 34,560 |

| Manufacturing O’head | 1,600 | 7,428.57 | 3,000 | 12,028.57 |

| Administrative Cost | 640 | 457.14 | 800 | 1,897.14 |

| Total Variable Cost | 20,000 | 54,285.71 | 48,600 | 122,885.71 |

| Contribution | 20,000 | 9,714.29 | 27,400 | 57,114.29 |

| Less Incremental Fixed Costs | 80,000 | |||

| Loss on Order | 22,885.71 |

Conclusion:

The order should be rejected because it will result in an incremental loss of GHS 22,885.71 unless Alom Hotel Limited is willing to pay a higher price to cover the additional costs associated with producing the extra units.

- Topic: Decision making techniques, Relevant Cost and Revenue

- Series: NOV 2015

- Uploader: Joseph