- 15 Marks

Question

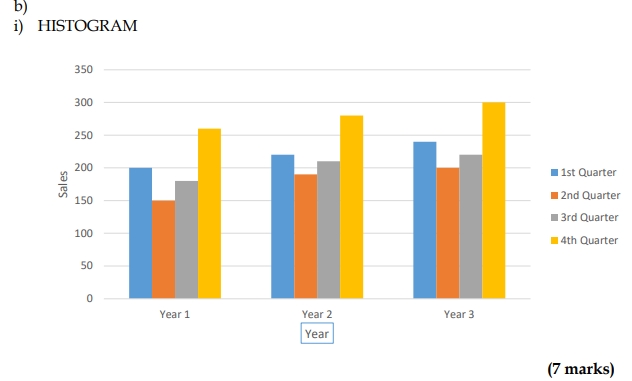

BomBo, a market researcher at a major African Automobile Company (African Moon), classified households by car ownership. The relative frequencies of households for each category of ownership are shown below:

| Number of Cars Per Household | Relative Frequencies |

|---|---|

| 0 | 0.10 |

| 1 | 0.30 |

| 2 | 0.40 |

| 3 | 0.12 |

| 4 | 0.06 |

| 5 | 0.02 |

Required:

(i) Calculate the expected value of the random variable. (4 marks)

(ii) Calculate the standard deviation of the random variable. (4 marks)

(iii) Draw a Relative Percentage Histogram for the data. (4 marks)

(iv) Using (i)-(iii), comment on the distribution of the data. (3 marks)

Answer

(i) Expected Value (E(X)):

The expected value is calculated as follows:

E (X) =![]()

E (X) = (0×0.10) + (1×0.30) + (2×0.40) + (3×0.12) + (4×0.06) + (5×0.02)

E (X) = 0 + 0.30 + 0.80 + 0.36 + 0.24 + 0.10 = 1.80

Thus, the expected value of the number of cars per household is 1.80.

(ii) Standard Deviation (σ):

First, calculate the variance:

Var (X) = ![]()

![]()

![]()

Var (X) = 0.324+0.192+0.016+0.173+0.290+0.205=1.20

Now, calculate the standard deviation: ![]()

Thus, the standard deviation is 1.095.

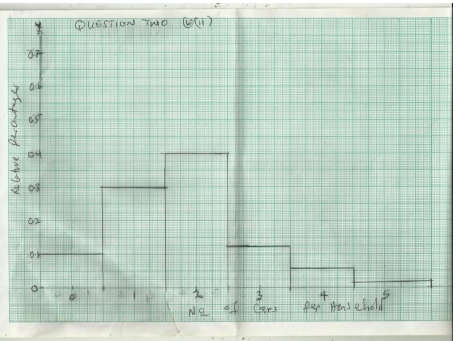

iii)

Relative Percentage Histogram:

(iv) Comments on the Distribution:

The distribution of car ownership is positively skewed, as the expected value (1.80) is closer to the lower end of the range, and most households own 1 or 2 cars. The data shows that only a small percentage of households own more than 3 cars, contributing to the positive skewness.

- Tags: Expected Value, Frequency Distribution, Histogram, Standard Deviation

- Level: Level 1

- Topic: Measures of Central Tendency

- Series: NOV 2018

- Uploader: Joseph