- 10 Marks

Question

UTFM Ltd is experiencing financial difficulties, and management is prepared to undertake a buyout. UTFM Ltd is considering selling the business for GH¢50 million. After an analysis, management concluded that the company requires a capital injection of GH¢30 million. A Venture Capitalist has agreed to raise the required funds, providing GH¢8 million at 10% interest and GH¢7 million in equity. Management will provide the remaining funding as equity.

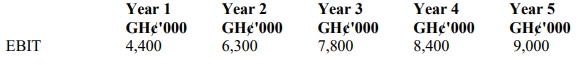

Forecasted Earnings Before Interest and Tax (EBIT) for the next 5 years are as follows:

Corporation tax is charged at 25%, and dividends are expected to be no more than 10% of profits for the first five years. Management forecasts that the value of equity capital is likely to increase by approximately 15% per annum for the next 5 years.

Required:

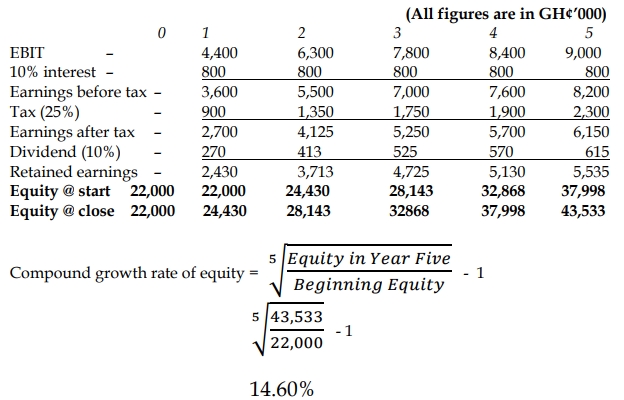

On the basis of the above forecasts, determine whether management’s estimate that the value of equity will increase by 15% per annum is a viable one.

Answer

Conclusion:

The actual growth rate of equity is 14.60% per annum, which is slightly below the management’s target of 15%. Therefore, while the growth is close, the estimate of 15% per annum growth is not fully viable based on the given forecast.

- Tags: Buyout, EBIT, Equity Valuation, Growth Estimation, Venture Capital

- Level: Level 3

- Topic: Business reorganisation

- Series: MAY 2018

- Uploader: Theophilus