- 5 Marks

Question

Madam Okailey Armah, a prominent market queen and Philanthropist, was nominated Asafouakye of Namoale Traditional Area in Accra in January 2018. At her out-dooring in August 2018 as Naa Okailey Tsofatse II, she sat in state and received homage and gifts from her people, friends, and business associates. The following were the quantifiable gifts she received:

GH¢

Market Queens Association 1,000

Commercial Bank (Pick-Up) 5,000

Namoale Traditional Council 500

Father-in-Law 500

Anonymous admirer

1,000

A week after her out-dooring,

she made the following donations:

Osu Children’s Home Pick-Up Vehicle

GH¢

Children’s Hospital (Accra) 1,000

Weija Leprosarium 500

Children’s Ward Korle Bu (Assorted Biscuits) 200

Thanksgiving Offering (Freeman Memorial Church, Bukom) 200

Determine any tax payable and briefly comment on the relevant tax implications.

(5 marks)

Answer

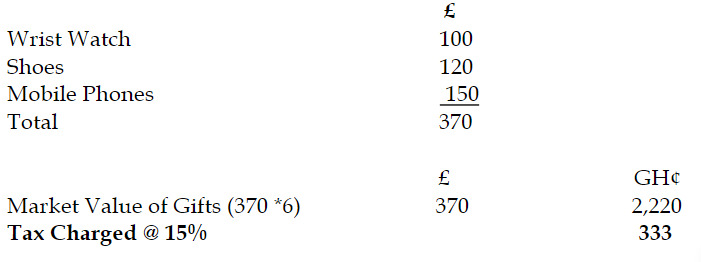

Tax Payable on Gifts Received by Madam Okailey Armah:

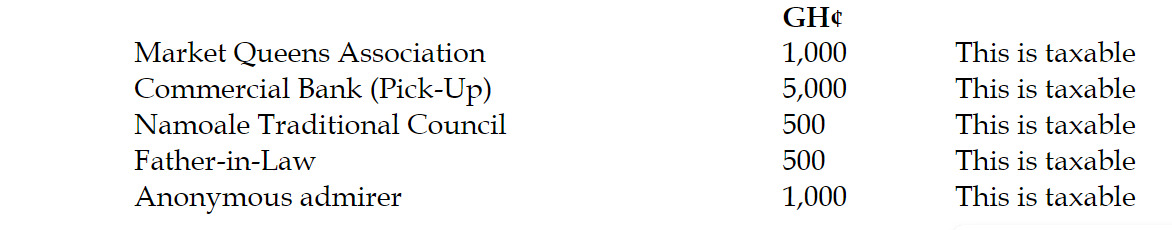

Donor Gift Taxable

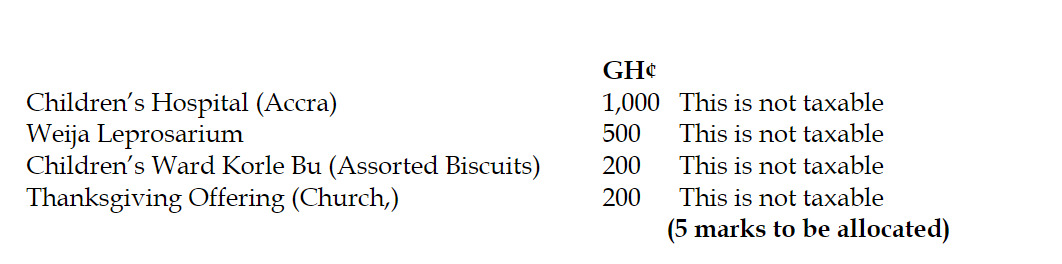

The donations made by Madam Okailey do not attract any tax liability for the recipients.

Recipient Donation Tax Implication

(5 marks)

- Tags: Gift tax, Gifts, Philanthropy, Taxation

- Level: Level 2

- Series: NOV 2019

- Uploader: Cheoli