- 20 Marks

Question

a) AD Ventures imports tomato paste from Italy for sale in Ghana. AD Ventures typically buys the tomato paste on an open account and pays the euro invoice value two months after receipt of goods. AD Ventures has suffered heavy exchange rate losses of late due to the continuous depreciation of the Ghanaian cedi against the euro. AD Ventures will receive a consignment of tomato paste on 15th May 2016. The value of this consignment is EUR540,000, which must be settled in two months’ time (settlement deadline being 15th July 2016).

The current spot exchange rate for the euro is GH¢4.7110/EUR. Financial pundits forecast that the Ghanaian cedi will depreciate against the euro in the coming months. The owner-manager of AD Venture, Akua Donkor, is worried about the probable foreign exchange loss her business may suffer when the invoice value is settled in two months’ time.

Akua Donkor has heard of the possibility of hedging AD Ventures’ currency exposure with a forward contract or futures contract but does not know what these contracts are. She has asked you to advise her on what to do to hedge against the underlying exposure relating to the EUR540,000 tomato paste consignment.

You would like to recommend a futures market hedge to Akua Donkor. You searched the derivatives market; and you found a futures contract on the euro that matures in August 2016. Other relevant details of the contract follow:

- Contract size: EUR100,000

- Futures contract price: GH¢4.8112/EUR

Required:

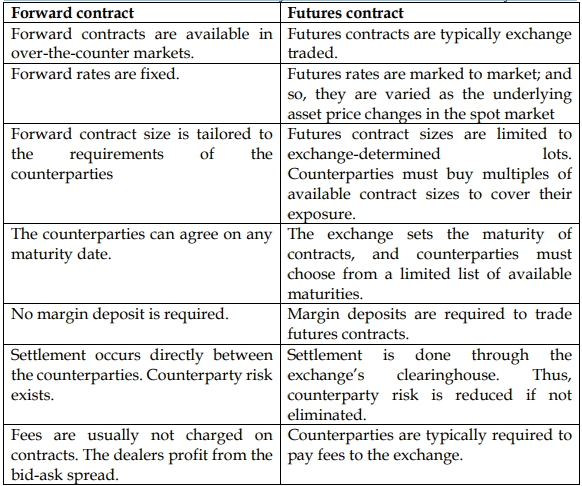

i) Explain to Akua Donkor FOUR differences between a forward contract and a futures contract. (4 marks)

ii) Currency risk exposure may be transaction risk, economic risk, or translation risk. Which of the three kinds of currency risk exposure is AD Ventures facing in relation to the EUR540,000 tomato paste consignment? Explain why. (4 marks)

iii) Explain to Akua Donkor THREE disadvantages of hedging the euro exposure with a futures hedge. (6 marks)

b) It has been observed that interest rates on debt securities or loans differ for different maturities. For the week ending 28th August 2015, the annual interest rate on the 1-year Government of Ghana note was 22.5% whereas the annual interest rate on the 2-year note was 23%.

Required:

With THREE reasons, explain why interest rates on debt securities and loans are different for different maturity periods. (6 marks)

Answer

a) Currency Risk and Hedging

i) Differences Between Forward and Futures Contracts

- Trading Platform:

- Forward Contracts: Traded over-the-counter (OTC) between two parties and tailored to specific needs.

- Futures Contracts: Traded on organized exchanges with standardized contract terms.

- Contract Size:

- Forward Contracts: Tailored to the specific needs of the parties involved, allowing for flexible contract sizes.

- Futures Contracts: Standardized contract sizes (e.g., EUR100,000), not tailored to individual needs.

- Settlement/Close-Out Dates:

- Forward Contracts: Settled on the agreed-upon date, which is fixed.

- Futures Contracts: Settlement can occur before the maturity date through an opposite transaction (close-out), with flexible dates.

- Collateral Requirements:

- Forward Contracts: Typically, no collateral is required.

- Futures Contracts: Require margin deposits as collateral to ensure performance.

- Dealer/mediators

margin:

- Forward Contracts: The exchange profits from

fees paid by contracting

parties - Futures Contracts: The dealer benefits from

the bid-ask spread

ii) Type of Currency Risk Exposure

AD Ventures is facing transaction risk in relation to the EUR540,000 tomato paste consignment. Transaction risk arises when a company has fixed contractual cash flows in a foreign currency, such as the obligation to pay EUR540,000 in two months. The risk is that the exchange rate might move unfavorably between the contract date and the settlement date, leading to potential exchange rate losses.

iii) Disadvantages of Hedging with Futures Contracts

- Contract Size Inflexibility: Futures contracts have standardized sizes (e.g., EUR100,000), which may not match the exact exposure amount. This could result in either over-hedging or under-hedging.

- Maturity Mismatch: The futures contract matures in August 2016, while AD Ventures’ exposure occurs in July 2016. This mismatch in timing can lead to basis risk, where the futures price and the spot price of the currency do not move perfectly in tandem.

- Margin Requirements: Futures contracts require margin deposits to be maintained, which ties up capital that could otherwise be used in the business. Additionally, margin calls may occur if the market moves unfavorably, requiring additional funds to be deposited.

b) Differences in Interest Rates Across Different Maturity Periods

- Liquidity Preference Theory: Investors prefer liquidity and demand a higher interest rate for longer maturities because they are giving up liquidity for a longer period. This typically results in an upward-sloping yield curve, where longer-term securities have higher interest rates than shorter-term ones.

- Expectations Theory: Interest rates for different maturities reflect market expectations of future interest rates. If future interest rates are expected to rise, longer-term interest rates will be higher than shorter-term rates, leading to an upward-sloping yield curve.

- Market Segmentation Theory: The yield curve reflects the supply and demand conditions in different segments of the market. For example, if there is high demand for short-term securities and limited supply, short-term rates may be higher. Conversely, if there is a higher demand for long-term securities, long-term rates may rise relative to short-term rates.

- Government policy: Government may influence level of interest rate in the

economy through its monetary policy. A policy with the effect of keeping interest

rates relatively high may force short-term interest rates higher than long-term rates.

For instance, as the Government of Ghana borrows more through the 182-day

Treasury bill than the 1-year note, the annualised interest rate on the 182-day bill is

higher than the annual rate on 1-year note as of August 28, 2015.

- Tags: Currency risk, Forward Contracts, Futures Contracts, Hedging, Interest Rate

- Level: Level 2

- Uploader: Joseph