- 8 Marks

Question

Lawaaba Guo is a Ghanaian born in Nigeria and has lived all his life there. He got an opportunity to relocate to Ghana and took up an appointment as a lecturer in one of the prestigious universities within the first three months of his arrival in Ghana in 2018.

He took up employment with ABB Ltd as a procurement officer. The following relates to his employment details for 2020 year of assessment:

- Salary: GH¢200,000

- Commission from employers: GH¢10,000

- Interest on savings from a Bank in Ghana (Gross): GH¢1,000

His investment income and other returns received from Nigeria are as follows:

- Dividend of US$ 12,000 net of tax. Tax of US$ 1,000 was paid.

- Rental Income of USD 6,000 gross with tax at the rate of 10%.

- On-line consultancy fee USD 20,000 net of tax. Tax of USD1,500 was paid.

Additional information:

- He is married.

- Children (2): both schooling in Nigeria.

- Contributes to Social Security at 5.5%.

- Exchange Rate USD1 = GH¢5.2.

Required:

Determine the following:

i) Chargeable Income

ii) Tax Payable

iii) Amount of foreign credit relief granted

Answer

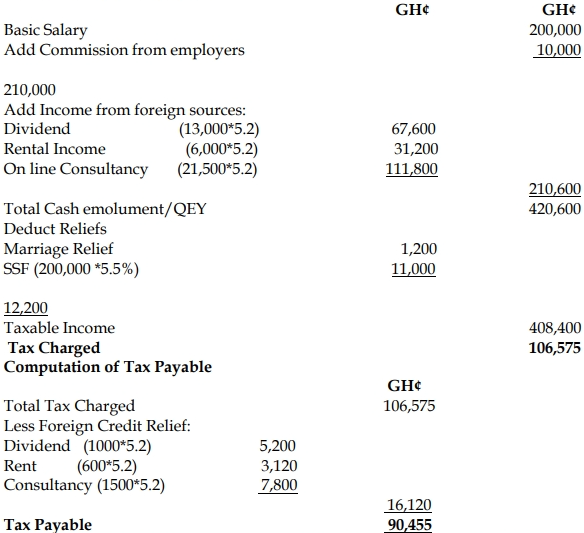

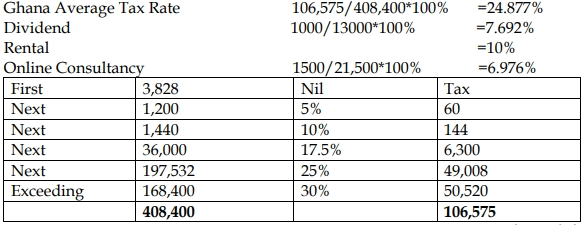

Computation of tax payable

Y/A 2020

Basis Period: 1/1/20 – 31/12/20

- Tags: Foreign income, Foreign Tax Credit, Resident Income, Tax computation

- Level: Level 3

- Topic: International taxation

- Series: APR 2022

- Uploader: Joseph