- 20 Marks

Question

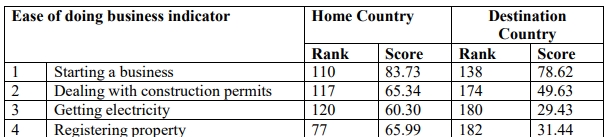

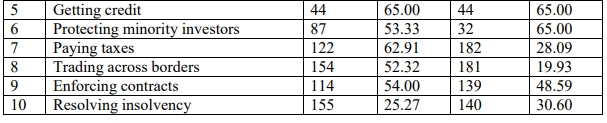

The directors of One-Village are considering another irrigation project in a country in Sub-Saharan Africa. The World Bank’s Doing Business Report for 2017 ranked the destination country 140th out of 190 countries on the ease of doing business. Below is the ease of doing business statistics for the destination country and One-Village’s home country as reported in the Doing Business 2017 report.

Required:

Advise the directors on four risks or issues One-Village should consider when deciding on whether to implement the proposed irrigation project in the destination country, and suggest how the risks or issues may be mitigated or resolved.

(8 marks for risks and mitigation)

Answer

Identified Risks and Issues:

- Dealing with Construction Permits:

- The destination country ranks 174th for dealing with construction permits with a score of 49.63, compared to One-Village’s home country at rank 117 with a score of 65.34. This indicates potential delays or additional bureaucratic hurdles in obtaining permits for the irrigation project.

- Mitigation: One-Village should engage local legal and regulatory experts early in the process to navigate the bureaucratic requirements efficiently and ensure all paperwork and procedures are completed in a timely manner.

- Getting Electricity:

- The destination country ranks 180th with a low score of 29.43 for getting electricity, compared to One-Village’s home country’s rank of 120 (60.30 score). This suggests significant challenges in accessing reliable electricity, which could hinder the operation of irrigation equipment.

- Mitigation: One-Village could consider alternative energy sources, such as solar or wind power, to reduce reliance on the national grid. Additionally, partnerships with local authorities or infrastructure providers could be explored to secure priority access to electricity.

- Paying Taxes:

- The destination country ranks very low (182nd) with a score of 28.09 in terms of paying taxes, compared to One-Village’s home country rank of 122 (62.91 score). This implies potential issues with tax compliance, high tax rates, or complex tax procedures in the destination country.

- Mitigation: One-Village should hire tax consultants familiar with the local tax regime to ensure compliance and explore tax incentives or exemptions for agricultural projects, which may be available in the destination country.

- Trading Across Borders:

- With a rank of 181 and a low score of 19.93 in trading across borders, compared to One-Village’s home country rank of 154 (52.32 score), this indicates potential difficulties in importing necessary materials or exporting agricultural products due to inefficient border controls, customs delays, or restrictive trade policies.

- Mitigation: One-Village should engage in advance planning for supply chain management, including identifying reliable local suppliers or negotiating favorable terms with customs brokers. Understanding and planning for potential delays in shipping and customs clearance is essential.

Overall Discussion:

The rankings and scores highlight potential risks related to bureaucracy, infrastructure, tax compliance, and cross-border trade in the destination country. One-Village should carefully assess the project feasibility in light of these risks and develop comprehensive risk management strategies, including forming local partnerships, conducting due diligence on regulatory requirements, and exploring alternative solutions to infrastructure challenges. Engaging local experts and leveraging government incentives could also help mitigate the identified risks.

- Topic: Economic environment for multinational organisations

- Series: NOV 2018

- Uploader: Theophilus