MEMO

TO: Tax Manager

FROM: Tax Intern

DATE: 7th July 2019

SUBJECT: Tax Implication on Thin Capitalization Rules

INTRODUCTION

Following your request for me to provide the tax implication on the thin capitalization, I furnish as follows:

ISSUES

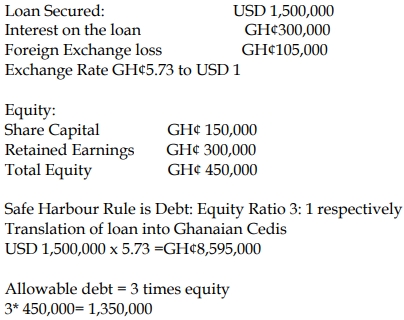

Kelkadadi Ltd is a subsidiary of Danlerigu and any loan that is granted shall be subject to Thin capitalization rule which states that the debt secured should not be more than 3 times the equity of the entity.

In this particular situation, the debt exceeds the three times. Consequently, the interest paid or payable that exceeds the 3:1 ratio shall be added to income and taxed and also the foreign exchange loss paid or payable.

Additionally, the total interest paid or payable attracts a withholding tax at the rate of 8%.

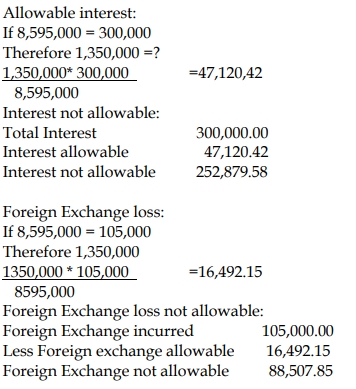

Summary of Interest

Total Interest: GH¢90,124.00

Interest Allowable: GH¢14,922.45

Interest to be disallowed (difference): GH¢75,201.55

From W2 as attached, total interest of GH¢90,124.00 shall attract interest at 8% which is (90,124.00 * 8%)=GH¢7,209.92

Interest of GH¢75,201.55 shall be disallowed, meaning it should not be an allowable deduction out of GH¢90,124 with GH¢14,922.45 allowable.

Summary of Foreign Exchange Loss

Total Foreign Exchange: GH¢147,000.00

Foreign Exchange Allowable: GH¢24,339.81

Foreign Exchange unallowable: GH¢122,660.19

From W3 as per the schedule attached, the total foreign exchange loss of GH¢147,000 only GH¢24,339.81 shall be allowable with GH¢122,660.19 not allowable for tax purposes.

CONCLUSION

In conclusion, the attached schedule will aid your comprehension of the issues as stated above.

Thank you.

Yours faithfully,