- 20 Marks

Question

Notes:

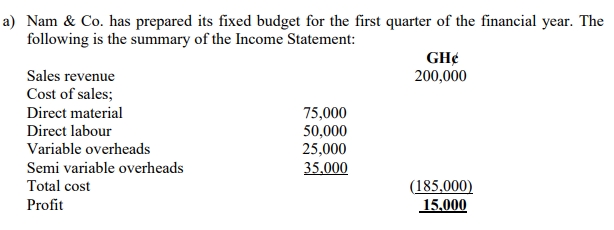

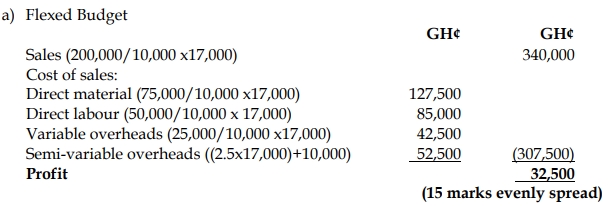

i) The fixed cost in the semi-variable cost is GH¢10,000.

ii) The budgeted units were 10,000, but actual units for the quarter were 17,000.

Required:

Prepare a Flexed Budget for the first quarter. (15 marks)

b) In the budget preparation process, the Budget Manual is an important element. This is because it guides everyone in the budget preparation value chain.

Required:

Identify FIVE (5) rules and instructions that a Budget Manual will set out. (5 marks)

Answer

b) Budget manual may set out the following:

- Key objectives

- Planning procedures

- Instructions about budget details

- Responsibilities for preparation of functional budgets

- Approval process

- Key budget factors (Any 5 points @ 1 mark each = 5 marks)

- Tags: Budget Manual Rules, Flexed Budget

- Level: Level 1

- Uploader: Joseph