- 7 Marks

Question

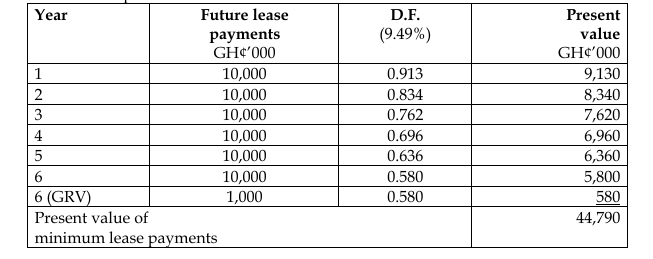

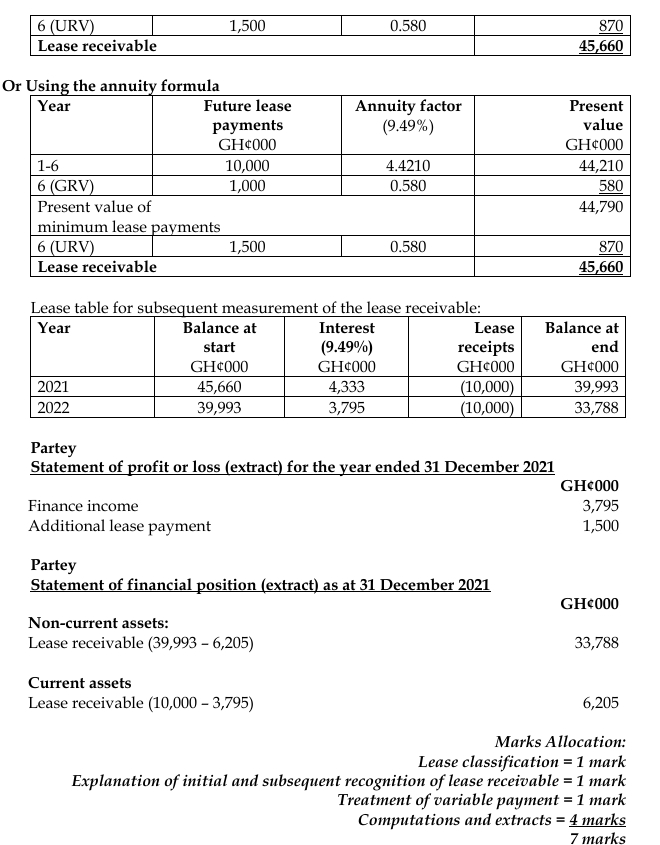

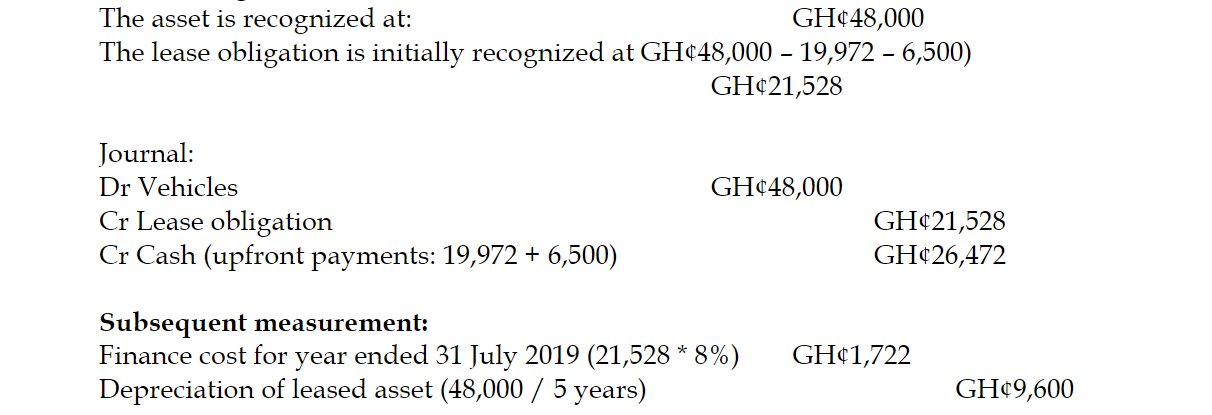

On 1 August 2018, Asawase Ltd entered into an agreement to acquire a motor vehicle. The terms of the agreement were that the vehicle would be leased for five years from the date of inception, subject to a deposit of GH¢19,972 and five annual payments of GH¢6,500 in advance, commencing on 1 August 2018. The fair value of the vehicle and the present value of the lease payments were GH¢48,000 at inception. The interest rate implicit in the lease is 8%.

Required:

In accordance with IFRS 16: Leases, show with appropriate calculations, the accounting entries required to record the transaction in the financial statements for the year ended 31 July 2019. (7 marks)

Answer

c) Workings

Initial recognition & measurement:

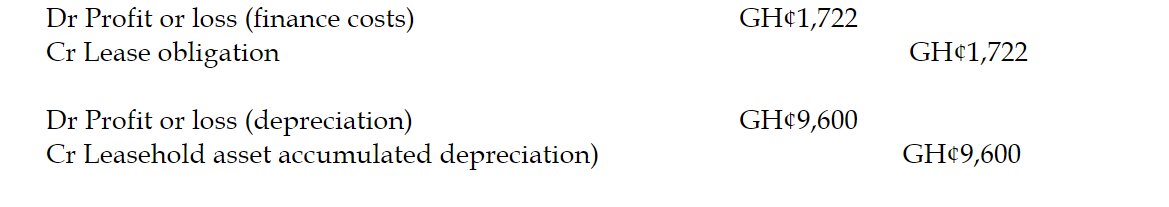

Journal:

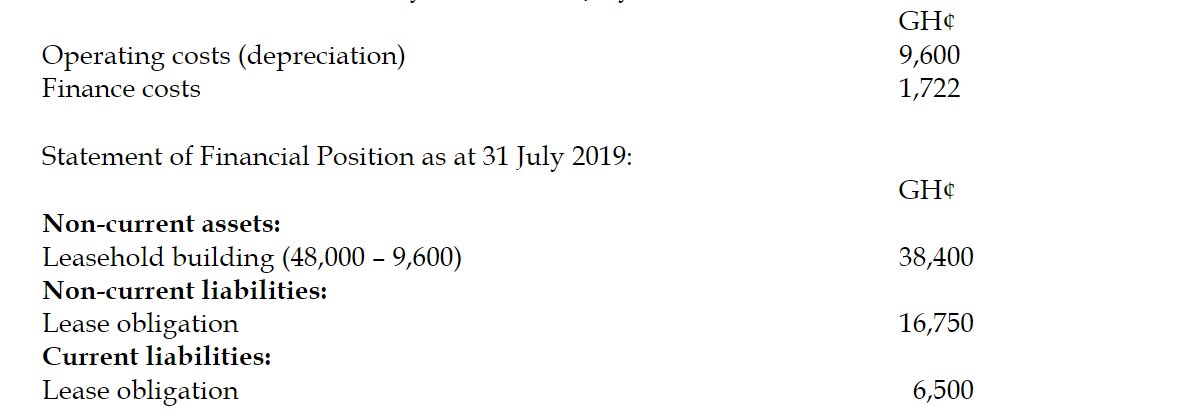

Closing balance on lease obligation (21,528 + 1,722) GH¢23,250

Presented as current liability (full payment as it is in advance, due 1 August 2019) GH¢6,500

Presented as non-current liability GH¢16,750

Extracts from financial statements for year ended 31 July 2019:

Statement of Profit or Loss for year ended 31 July 2019:

Correct entries in the Workings Schedule – 4 marks 6 correct entries in the financial statements extract – 3 marks

- Series: NOV 2019

- Uploader: Cheoli