- 6 Marks

Question

b) Kundugu Ltd (Kundugu) is a manufacturing company located in the Savannah Region. The reporting date of Kundugu is 31 December, and the company reports under International Financial Reporting Standards (IFRSs). Kundugu intends to expand its production to take advantage of emerging economic activities in the new region.

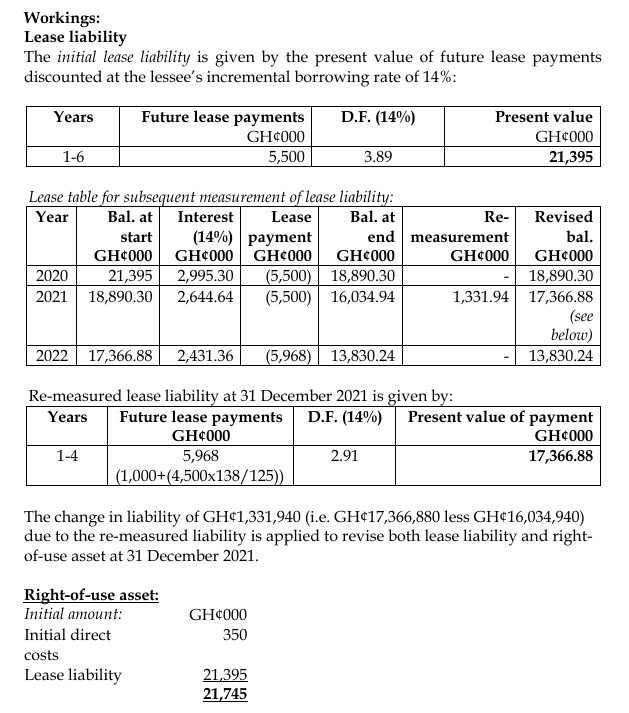

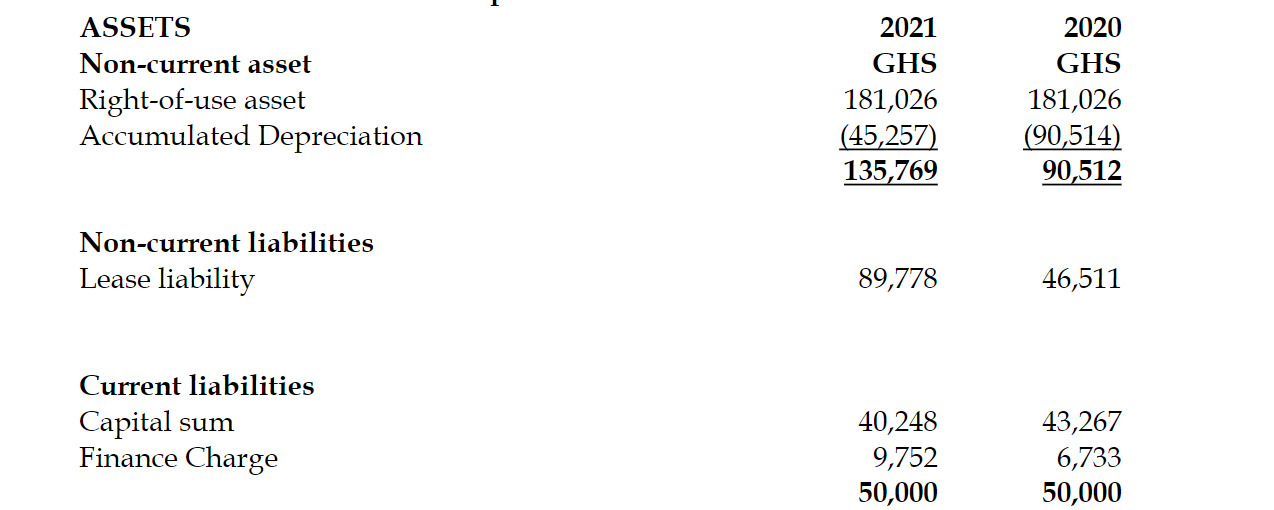

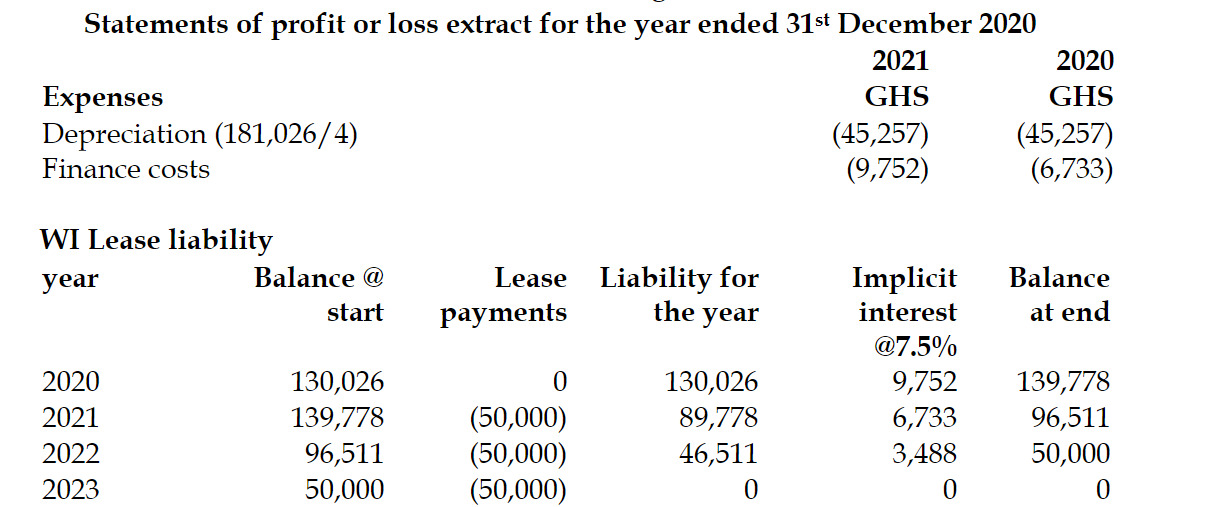

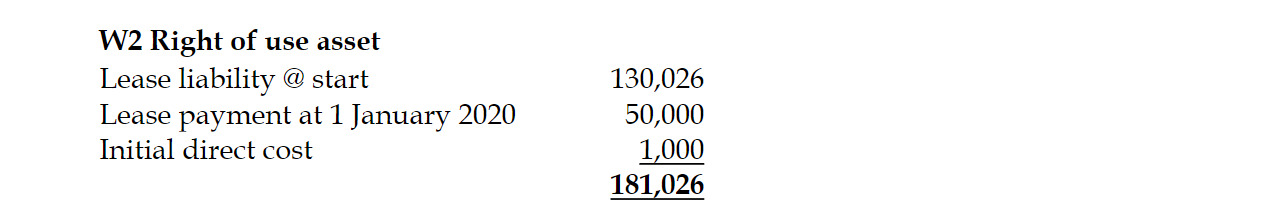

On 1 January 2020, the company entered into a lease agreement for production equipment with a useful economic life of 8 years. The lease term is for four years, and Kundugu agrees to pay annual rent of GH¢50,000 commencing on 1 January 2020 and annually thereafter. The interest rate implicit in the lease is 7.5%, and the lessee’s incremental borrowing rate is 10%. The present value of lease payments not yet paid on 1 January 2020 is GH¢130,026. Kundugu paid legal fees of GH¢1,000 to set up the lease.

Required:

Prepare extracts for the Statement of Financial Position and Statement of Profit or Loss for 2020 and 2021, showing how Kundugu should account for this transaction. (6 marks)

Answer

Kundugu Ltd

Statements of financial position extract as at 31st

December 2020

Kundugu Ltd

Annual depreciation = GHS181,026 ÷ 4 years GHS 45,257

Initial recognition of right-of-use asset 1 mark Initial recognition of lease liability 0.5 marks

Lease schedule 1.5 mark

SOFP (Extract) 2 marks

SOPL (Extract) 1 mark

- Topic: Financial Reporting Standards and Their Applications

- Series: APR 2022

- Uploader: Cheoli