- 20 Marks

Question

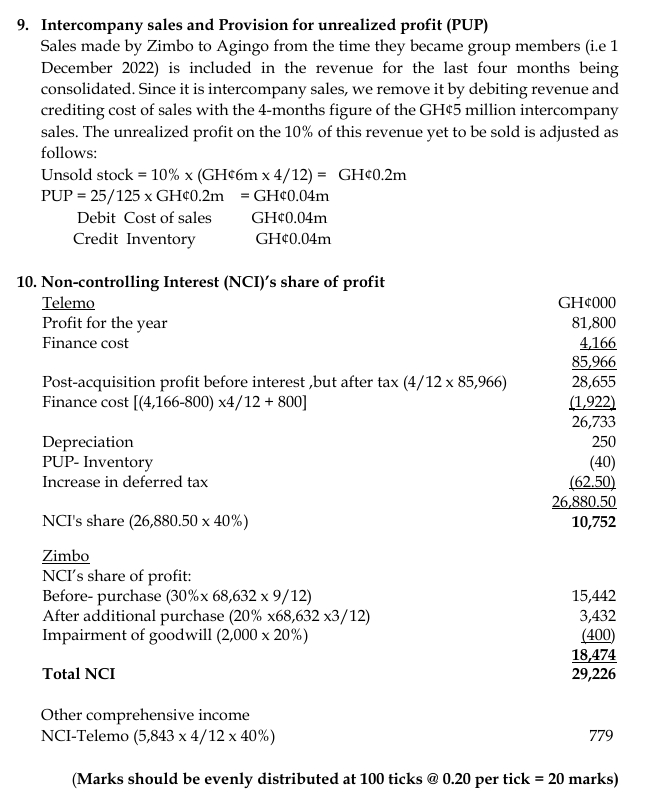

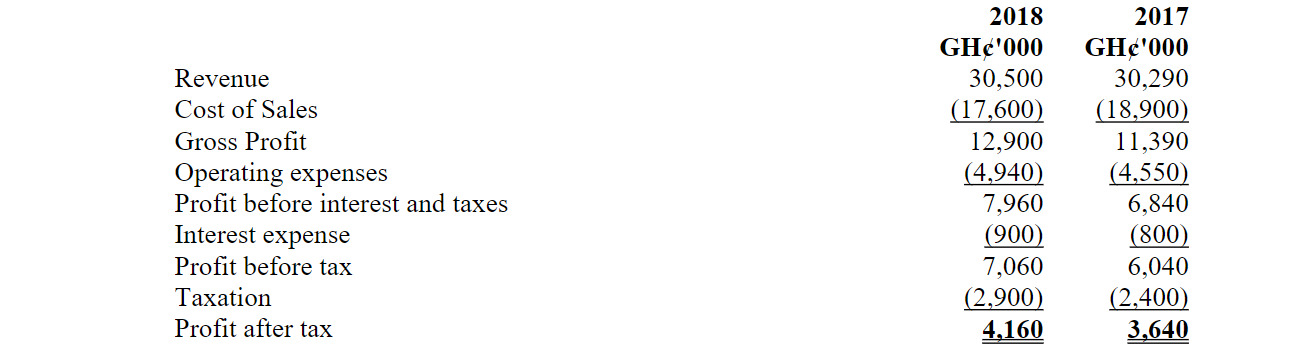

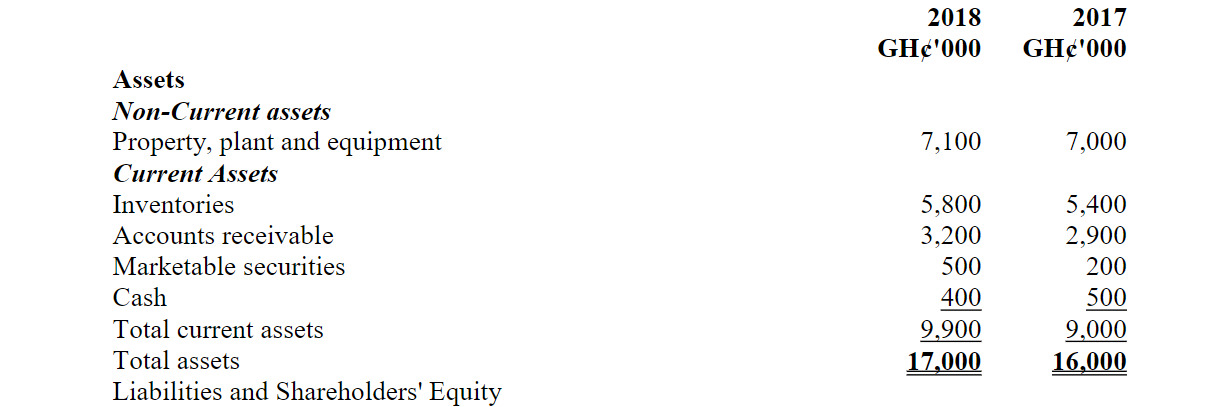

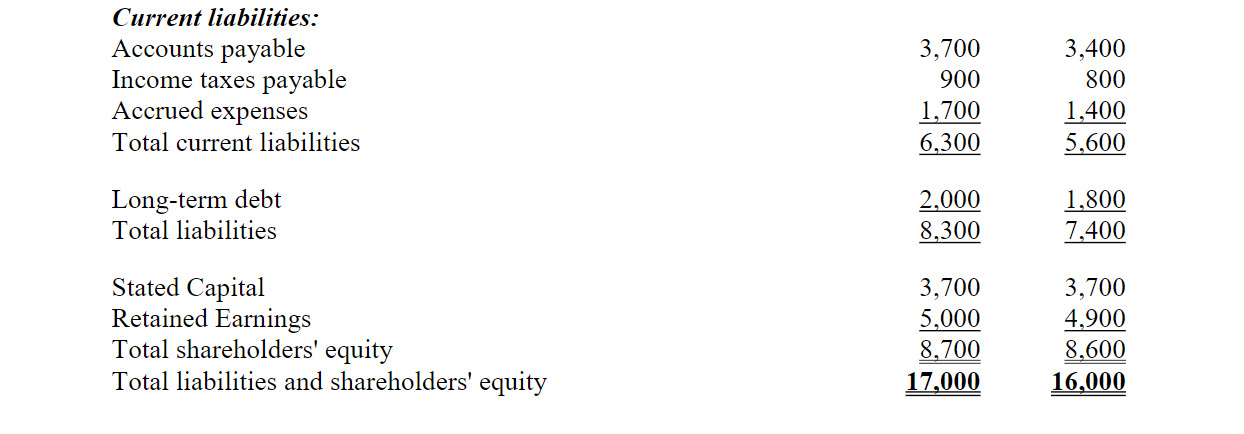

Hukpor Ltd (Hukpor) manufactures a variety of consumer products. The company’s founders have managed the company for thirty years and are now interested in selling the company and retiring. Seekers Ltd is looking into the acquisition of Hukpor and has requested the company’s latest financial statements and selected financial ratios in order to evaluate Hukpor’s financial stability and operating efficiency. The summary of information provided by Hukpor is presented below:

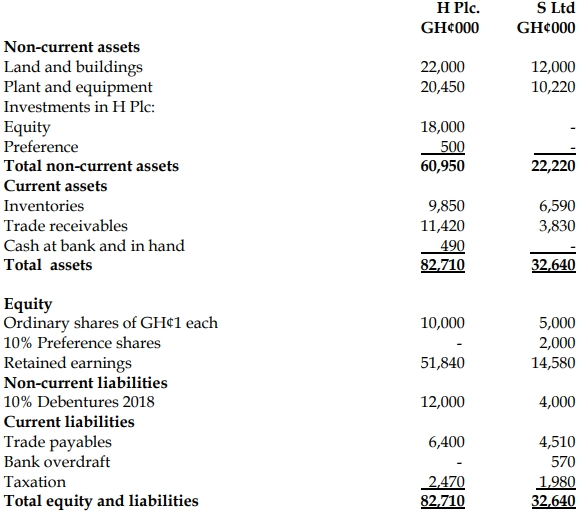

Statements of Financial Position as at 31 December

Selected Financial Ratios of Hukpor Ltd for 2017

Current ratio 1.61:1

Acid-test ratio 0.64:1

Inventory turnover 3.17 times

Times interest earned 8.55 times

Debt-to-equity ratio 86%

Required:

a) Calculate ratios for the years 2018 for Hukpor in comparison with ratios for 2017. (5 marks)

b) For each of the ratios computed for 2018, analyse Hukpor’s performance for 2018 based

on the results of the ratio computed, in comparison with the results for 2017. (10 marks) c) Explain FIVE (5) limitations of accounting ratios. (5 marks)

(Total: 20 marks)

Answer

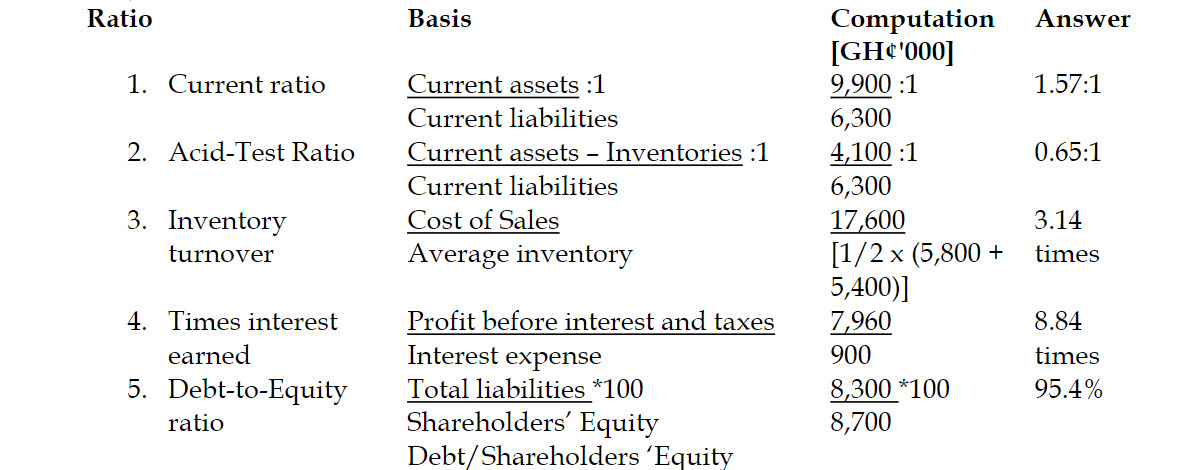

a) Calculation of ratios for 2018:

(1 mark each for correct computation of ratios x 5 ratios = 5 marks)

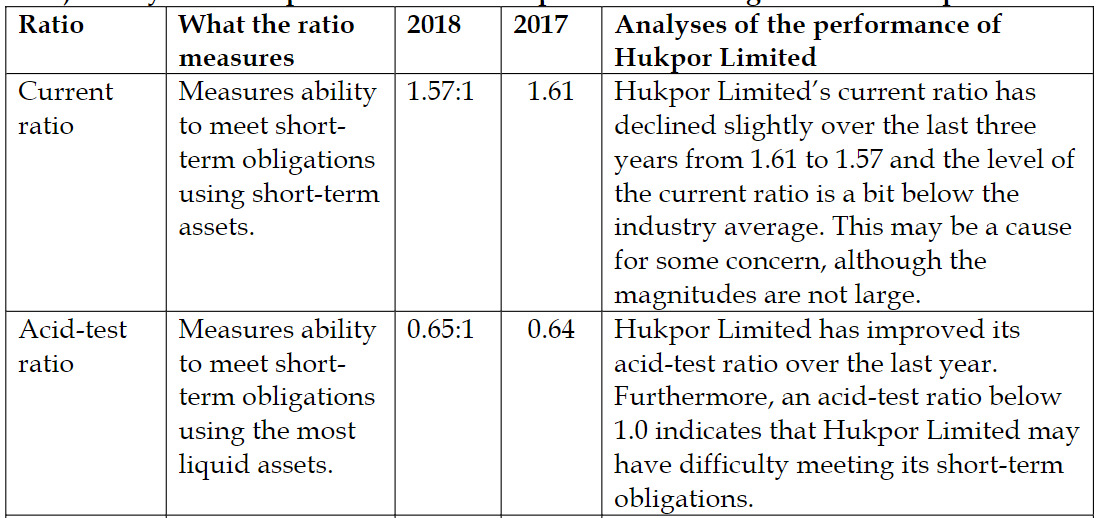

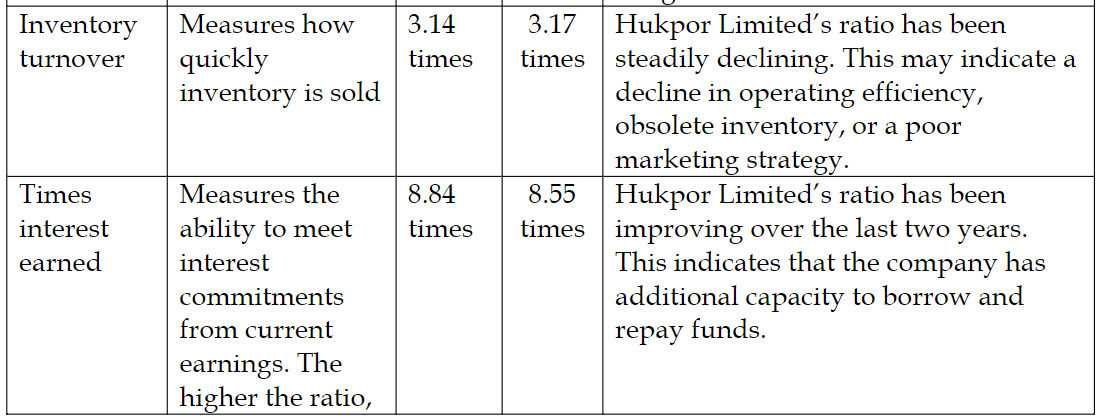

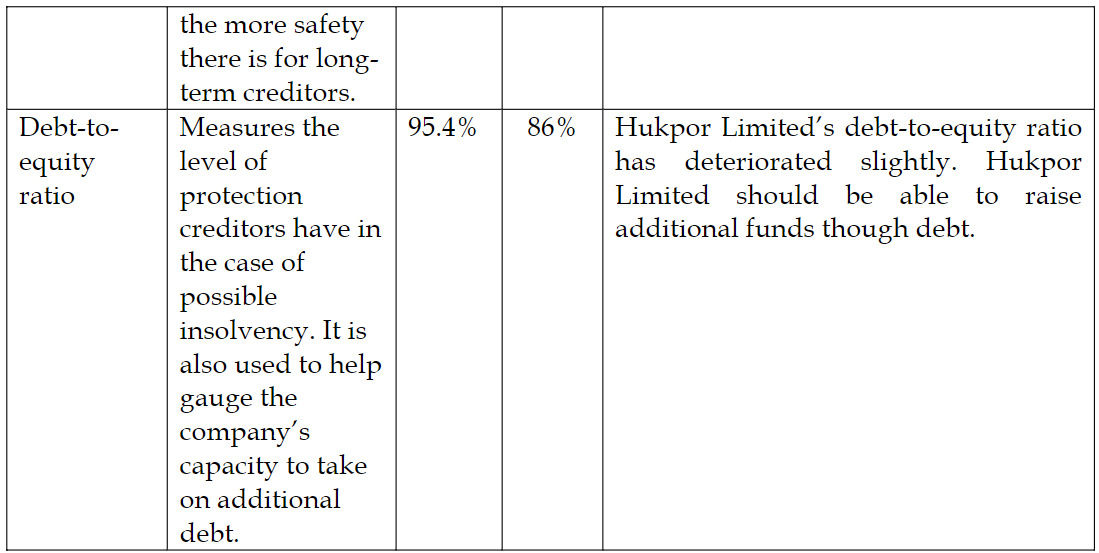

b) Analyses of the performance of Hukpor Limited using the ratios computed:

(2 marks each for analysis of performance x 5 ratios = 10 marks)

c) Limitations of Ratio Analysis

- Although ratios are useful as a starting point in financial analysis, they are not an end in themselves. Ratios can be used as indicators of what to pursue in a more detailed analysis.

- Different companies often use different accounting methods (e.g. FIFO versus LIFO inventory valuation) and this can have an impact on the financial ratios that does not reflect real differences in the operations and financial health of the companies.

- Making comparisons across industries can be difficult. Companies in different industries tend to have different financial ratios.

- Since the ratios are based on accounting statements, they measure what has happened in the past and not necessarily what will happen in the future.

- Business conditions: You need to place ratio analysis in the context of the general business environment. For example, 60 days of sales outstanding for receivables might be considered poor in a period of rapidly growing sales,but might be excellent during an economic contraction when customers are in severe financial condition and unable to pay their bills.

- Interpretation: It can be quite difficult to ascertain the reason for the results of a ratio. For example, a current ratio of 2:1 might appear to be excellent, until you realize that the company just sold a large amount of its stock to bolster its cash position. A more detailed analysis might reveal that the current ratio will only temporarily be at that level,and will probably decline in the near future.

- Company strategy: It can be dangerous to conduct a ratio analysis comparison between two firms that are pursuing different strategies. For example, one company may be following a low-cost strategy, and so is willing to accept a lower gross margin in exchange for more market share. Conversely, a company in the same industry is focusing on a high customer service strategy where its prices are higher and gross margins are higher, but it will never attain the revenue levels of the first company.

(1 mark for each limitation well explained x 5 limitations = 5 marks)

- Topic: Financial Reporting Standards and Their Applications

- Series: NOV 2019

- Uploader: Cheoli