- 6 Marks

Question

Lord Pakro was seconded to Ghana from the Crops Scientists Institute in USA as a Crop Scientist to Crop Research Institute in Ghana, for a period of 5 months, starting from 1 August, 2018. He was based at Nyankpala (Northern part of Ghana), one of the farming sites of the Crop Research Institute.

His conditions of service were as follows:

GH¢

Salary: 6,000 per month

Expatriate allowance: 2,000 per month

Risk allowance: 1,000 per month

He was provided with a furnished bungalow and a Toyota Pick-up vehicle with driver and fuel for both official and private activities.

In addition to the above, the parent company agreed to meet his commitment at home during his six-month stay in Ghana at $1,200 per month. The average exchange rate has been $1=GH¢5.00.

Required:

Determine Lord Pakro’s chargeable income and tax liability, if any, during his stay in the country. Produce the related notes guiding your determination.

(6 marks)

Answer

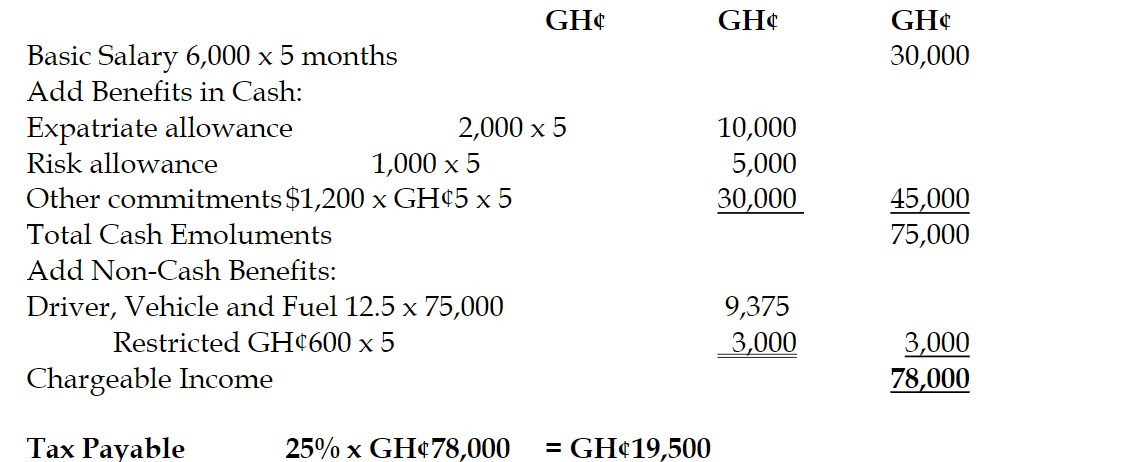

Computation of Chargeable Income for Assessment Year 2019

Related Notes:

- The basic salary and allowances (expatriate and risk) are added to the total cash emoluments.

- Non-cash benefits such as the use of a vehicle, driver, and fuel for both official and personal use are calculated as a percentage of the total cash emoluments.

- The foreign commitment paid in dollars is converted to cedis and added to the income.

(6 marks evenly spread using ticks)

- Tags: chargeable income, Expatriates, Income Tax Computation, Non-Residents

- Level: Level 2

- Topic: Income Tax Liabilities

- Uploader: Cheoli