- 8 Marks

Question

Scenario:

Papana Ltd, a resident company in Ghana, has cash flow challenges after a major customer ceased business dealings. Dawadawa Ltd, another resident company, negotiated with Papana Ltd and acquired 52% of its underlying ownership. As part of this arrangement, Dawadawa Ltd secured a loan facility of GH¢100 million for Papana Ltd at an interest rate of 4% above the average rate of 25%. The total interest paid in 2021 was GH¢2 million. Dawadawa Ltd is exempt from tax on all its income.

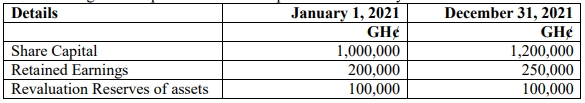

The capital structure of Papana Ltd for the 2021 year of assessment is as follows:

Required:

i) Compute the tax implications of the above arrangement.

ii) What constitutes an exempt person?

Answer

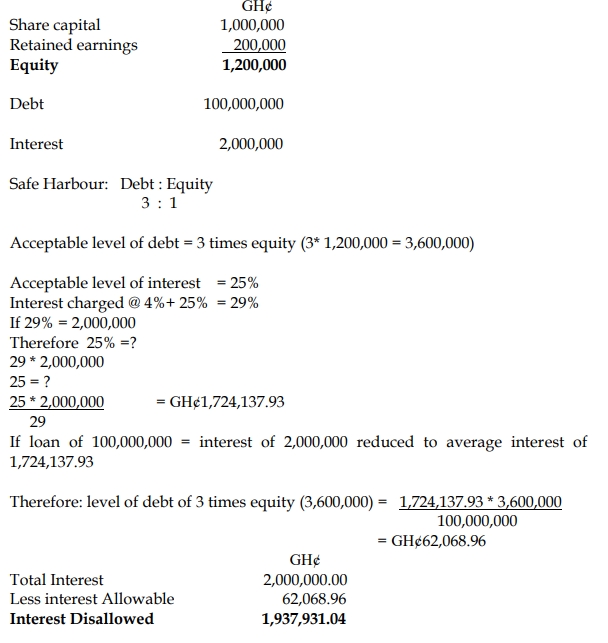

i) Computation of Tax Implications:

The thin capitalization rule in Ghana limits the amount of interest that can be deducted for tax purposes based on a company’s debt-to-equity ratio, which should not exceed 3:1 for tax purposes. Any excess interest is disallowed.

ii) What Constitutes an Exempt Person?

An exempt person refers to an individual or entity whose income is not subject to tax under specific provisions of the tax laws. In the context of corporate taxation, an exempt person may be:

- Government Institutions or Agencies: Government entities that are exempt by statute from paying taxes on their income.

- Charitable Organizations: Non-profit organizations that engage in charitable activities, which are often exempt from tax on income derived from their operations.

- Diplomatic Missions and International Organizations: Diplomats and international organizations that enjoy exemptions from tax under treaties or international agreements.

- Exempt Entities by Statute: Companies or individuals exempt from tax under specific legislative provisions, such as entities operating under certain investment promotion laws (e.g., free zone enterprises).

In this case, Dawadawa Ltd is classified as an exempt person because it is exempt from tax on all its income, as mentioned in the scenario.

- Tags: Corporate Tax, Exempt persons, Interest Deduction, Thin Capitalization

- Level: Level 3

- Topic: Tax planning

- Series: DEC 2023

- Uploader: Theophilus