i) Before accepting the engagement to review the company’s prospective financial information, there are several matters to be considered. A significant matter is whether it is ethically acceptable to perform the review. The review would constitute a non-assurance service provided to an audited entity, and IESBA’s Code of Ethics for Professional Accountants states that this may create self-interest, self-review, and advocacy threats to independence. In this case, the advocacy threat may be deemed particularly significant as BS Cipax could be perceived as promoting the client’s position to the bank. The review engagement should only be provided if safeguards can be used to reduce the threat to an acceptable level, which may include:

- Having a professional accountant who was not involved with the non-assurance service review the non-assurance work performed or otherwise advise as necessary.

- Discussing ethical issues with those charged with governance of the client.

- Using separate teams to work on the audit and on the review engagement.

As well as ethical matters, ISAE 3400 “The Examination of Prospective Information” requires that certain matters are considered before a review engagement is accepted. The firm must also consider the specific terms of the engagement. For example, the firm will need to clarify whether the bank has requested a review report to be issued, and what exact information will be included in the application to the bank. It is likely that more than just a forecast statement of profit or loss is required, for example, a forecast statement of cash flows and accompanying narrative, including key assumptions, is likely to be required for a lending decision to be made.

ISAE 3400 also requires that consideration should be given to the intended use of the information and whether it is for general or limited distribution. It seems in this case the review engagement and its report will be used solely in connection with raising bank finance, but this should be confirmed before accepting the engagement.

The period covered by the prospective financial information and the key assumptions used should also be considered. ISAE 3400 states that the auditor should not accept an engagement when the assumptions used are clearly unrealistic or when the auditor believes that the prospective financial information will be inappropriate for its intended use. For example, the assumption that the necessary capital expenditure can take place by September 2014 may be overly optimistic.

The firm should also consider whether there are staff available with appropriate skills and experience to perform the review engagement and the deadline by which the work needs to be completed. If the work on the shops is scheduled to be completed by September 2014, presumably the cash will have to be provided very soon, meaning a tight deadline for the review engagement to be performed. (5 marks)

ii) The report by an auditor on an examination of prospective financial information should contain the following:

- Title;

- Addressee;

- Identification of the prospective financial information;

- A reference to the ISAE or relevant national standards or practices applicable to the examination of prospective financial information;

- A statement that management is responsible for the prospective financial information, including the assumptions on which it is based;

- When applicable, a reference to the purpose and/or restricted distribution of the prospective financial information;

- A statement of negative assurance as to whether the assumptions provide a reasonable basis for the prospective financial information;

- An opinion as to whether the prospective financial information is properly prepared on the basis of the assumptions and is presented in accordance with the relevant financial reporting framework;

- Appropriate caveats concerning the achievability of the results indicated by the prospective financial information;

- Date of the report, which should be the date procedures have been completed;

- Auditor’s address; and

- Signature.

Such a report would:

- State whether, based on the examination of the evidence supporting the assumptions, anything has come to the auditor’s attention which causes the auditor to believe that the assumptions do not provide a reasonable basis for the forecast. E.g.:

- Based on our examination of the evidence supporting the assumptions, nothing has come to our attention which causes us to believe that these assumptions do not provide a reasonable basis for the forecast.

- Express an opinion as to whether the prospective financial information is properly prepared on the basis of the assumptions and is presented in accordance with the relevant financial reporting framework. E.g.:

- Further, in our opinion, the forecast is properly prepared on the basis of the assumptions and is presented in accordance with International Financial Reporting Standards (IFRS).

- State that actual results are likely to be different from the prospective financial information since anticipated events frequently do not occur as expected, and the variation could be material. (8 marks)

An injured party must prove ALL of the following three things in order to succeed in a claim for financial loss against an auditor for negligence:

- That the auditor owes a duty of care;

- That the duty of care has been breached;

- That financial loss has been suffered that was caused by the negligence.

bi) Looking at the strict interpretation of the first requirement, the auditor owes a duty of care only to the shareholders as a body and not to Boafo Bank Limited as an outsider. The courts, however, have accepted that if the Auditor, at the time of signing the report, knew that someone other than the shareholders as a body would rely on the report, then the duty of care extends to that person. The facts of this case show that at the time the auditor signed the Audit Report, he was aware that it was Financial Statements going to form the basis for preparing the projected financial information to be used to seek the bank facility from Boafo Bank Limited. This means it is probable that a court will rule that requirement 1 above has been proved. (2 marks)

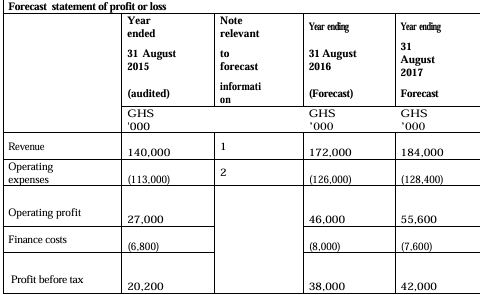

ii) A breach of duty of care must be proved for a negligence claim against the audit firm to be successful. Duty of care generally means that the audit firm must perform the audit work to the required standard and that relevant legal and professional requirements and principles have been followed. For an audit firm, it is important to be able to demonstrate that ISAs have been adhered to. There is no evidence in the facts as given to enable us to reach the conclusion that the duty of care has been breached or not. Looking at the fact that a loss of GHS4.3M was stated as a profit of GHS20.2M, a difference of GHS24.5M, if this error in the Income Statement is confirmed, it is likely to be interpreted by a court to mean that the auditor did not perform the duties expected of him/her with all the skill, care, and caution which a reasonably competent, careful, and cautious auditor would use. What is reasonable skill, care, and caution will depend on the particular circumstances of each case. In this case, however, an error is material by all standards and will be proof that the auditor has acted negligently unless he can prove that the circumstance that caused this material error was beyond his/her control. Requirement 2 appears to be likely to be proved. (2 marks)

iii) Requirement 3 is easy to prove since the loan was given on the basis of the projected financial information based on the audited financial statements, it is likely that a court will not need any serious persuasion to agree with the Bank that its financial loss was caused by the negligence of the auditor. From this discussion, the Auditors must seek an out-of-court settlement to avoid the bad publicity and likely litigation costs since it is probable that they would be found to be professionally liable to the Bank and the Bank is likely to succeed in the court. (1 mark)

Total: 7 marks