- 5 Marks

Question

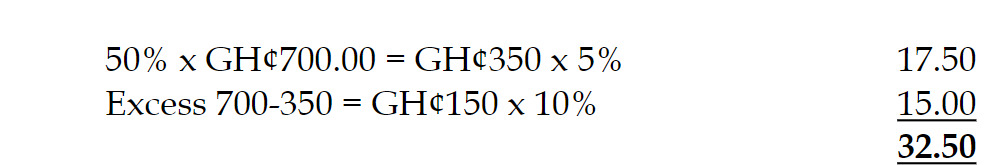

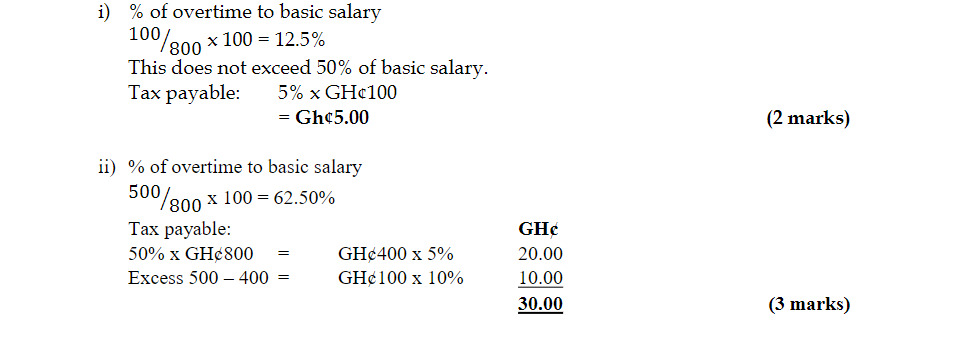

b) Maame Agyeiwaa is a junior staff member of KayDee Ltd. Her monthly basic salary is GH¢800. She was paid an overtime allowance totalling GH¢100 during the month of January 2021. In February 2021, Maame Agyeiwaa was paid overtime allowance totalling GH¢500.

Required:

i) Compute her tax liability on the overtime allowance for the month of January 2021.

(2 marks)

ii) Compute her tax liability on the overtime allowance payments for the month of February 2021.

(3 marks)

Answer

i) Maame Agyeiwaa

- Topic: Income Tax Liabilities, Taxation of Overtime

- Series: APR 2022

- Uploader: Cheoli