- 14 Marks

Question

You are the newly employed Finance Director of Gala Gold Mining Ltd (GGML), a fast

growing Ghanaian mining company. The ordinary shares of GGML are listed on the Ghana

Stock Exchange. The company issued two million fresh shares in an Initial Public Offer (IPO)

to meet the minimum public shareholding requirement of the Exchange. In the prospectus

accompanying the IPO, the company proposed a stable earnings pay-out ratio of 20%.

It has been one year since the listing of GGML’s ordinary shares. At the first post-listing annual

general meeting, which was held last week, the directors recommended that the company

retains the entire profit earned in its first year as a public company to help finance profitable

mining opportunities in the Western part of Ghana. This 100% earnings retention proposal was

rejected by the shareholders, and the directors have promised to reconsider the issue and

recommend some dividends.

The directors would be meeting in the coming month to discuss the matter with the hope of

developing a sustainable dividend policy for the next three years. You are expected to make a

presentation on the company’s dividend capacity at the meeting.

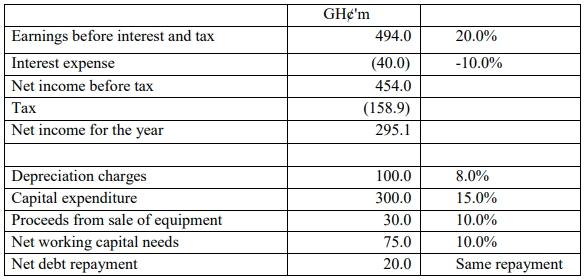

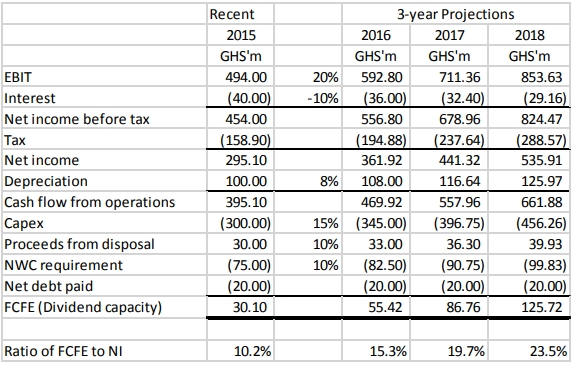

You have gathered relevant extracts from the financial results of the past financial year (i.e.

financial year ending June 2015) and expected annual changes in the values over the next three

years (i.e. financial years ending June 2016, 2017 and 2018) presented in the Table below :

The company’s tax rate is expected to remain at 35%.

Required:

i) Advise the directors on THREE factors they should consider in developing an appropriate

dividend policy for GGML. (6 marks)

ii) Calculate the maximum dividends GGML can pay for the past financial year, and estimate

its dividend capacity for the next three years. Recommend an appropriate dividend payout ratio for the coming three financial years.

Answer

i) Three factors to consider when developing dividend policy:

- Legal requirements: Dividends must be paid from distributable earnings as stipulated in the Companies Code. GGML must ensure it complies with all legal requirements.

- Investment opportunities: GGML is a fast-growing company with high capital needs. Retaining earnings to finance profitable projects is crucial for future growth.

- Alternative sources of finance: The availability of external financing affects how much GGML can afford to distribute as dividends. Limited access to external finance means more earnings need to be retained.

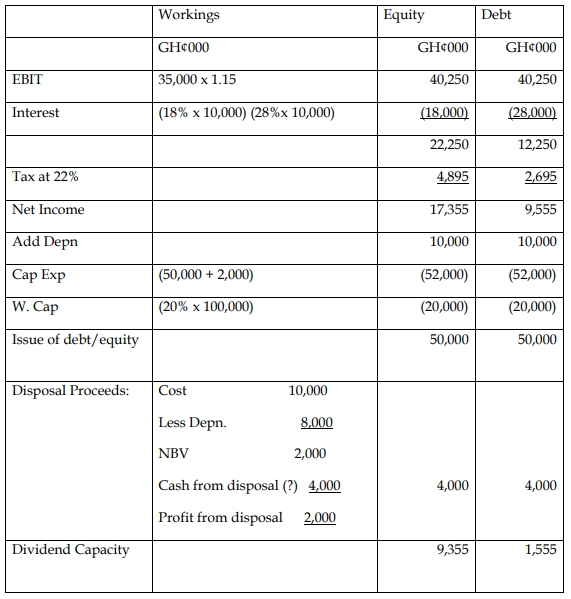

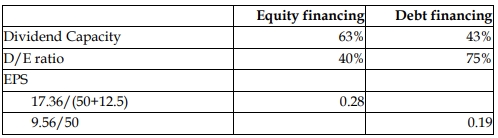

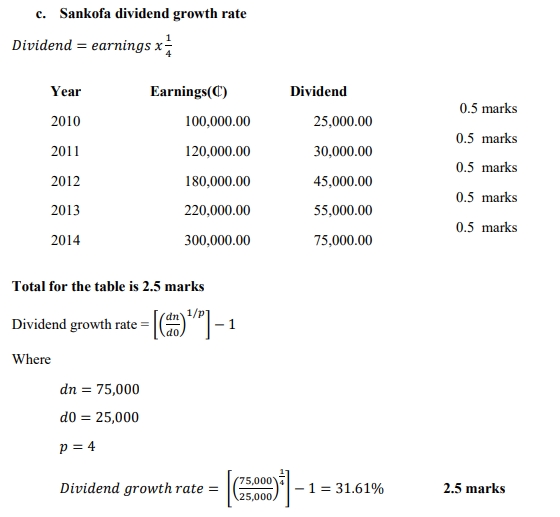

ii) Calculation of maximum dividends and dividend capacity for GGML:

- Maximum dividend for 2015: GH¢30.1m, representing 10.2% of net income.

- Recommendations for the next three years: Based on the FCFE projections, GGML can afford to pay dividends of GH¢55.42m in 2016, GH¢86.76m in 2017, and GH¢125.72m in 2018.

- Recommended payout ratio: To maintain consistency, a minimum payout ratio of 15% or an average of 20% can be recommended over the three years.

- Topic: Dividend policy in multinationals and transfer pricing

- Series: NOV 2016

- Uploader: Joseph