- 20 Marks

Question

a) A company is preparing its annual budget and it is estimating the number of units of Product W that would be sold in each quarter of year 2. Past experience has shown that the trend for sales of the product is represented by the following relationship:

y = a + bx where: y = quantity of sales units in the quarter a = 15,000 b = 3,000 x = the quarter number where 1 = quarter 1 of year 1

Actual sales of Product W in year 1 were affected by seasonal variations and were as follows:

| Quarter | Actual Sales Units |

|---|---|

| 1 | 20,250 |

| 2 | 19,425 |

| 3 | 25,200 |

| 4 | 24,300 |

Required: Calculate the expected unit sales of Product W for each quarter of year 2, after adjusting for seasonal variations using the multiplicative model. (6 marks)

b) The records of direct labour hours and total factory overhead cost of Cooper Limited over the first six months of its operations are given below:

| Month | Direct Labour Hours | Total Factory Overheads (GH¢000) |

|---|---|---|

| September | 50,000 | 14,800 |

| October | 80,000 | 17,000 |

| November | 120,000 | 23,800 |

| December | 40,000 | 11,900 |

| January | 100,000 | 22,100 |

| February | 60,000 | 16,150 |

Management is interested in distinguishing between the fixed and variable portions of the overheads.

Required: Using the least square regression method, estimate the variable cost per direct labour hour and the total fixed cost per month. (9 marks)

c) State and explain the methods used in setting: i) Direct Material Cost Standard. (2.5 marks) ii) Direct Labour Cost Standard. (2.5 marks)

Answer

a)

| Quarter | Trend Sales Units | Actual Sales Units | Variation |

|---|---|---|---|

| 1 | 18,000 | 20,250 | +12.5% |

| 2 | 21,000 | 19,425 | -7.5% |

| 3 | 24,000 | 25,200 | +5.0% |

| 4 | 27,000 | 24,300 | -10.0% |

Forecast sales:

- Year 2 Quarter 1 = 15,000 + (3,000 x 5) = 30,000 + 12.5% = 33,750 units

- Year 2 Quarter 2 = 15,000 + (3,000 x 6) = 33,000 – 7.5% = 30,525 units

- Year 2 Quarter 3 = 15,000 + (3,000 x 7) = 36,000 + 5.0% = 37,800 units

- Year 2 Quarter 4 = 15,000 + (3,000 x 8) = 39,000 – 10.0% = 35,100 units

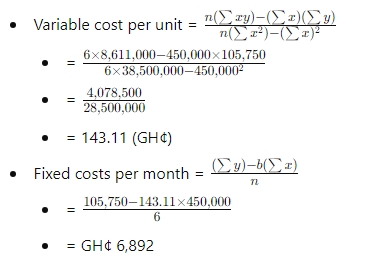

b)

| Direct Labour Hours (x) | Total Overheads (y) | xy | x² |

|---|---|---|---|

| 50,000 | 14,800 | 740,000 | 2,500,000 |

| 80,000 | 17,000 | 1,360,000 | 6,400,000 |

| 120,000 | 23,800 | 2,856,000 | 14,400,000 |

| 40,000 | 11,900 | 476,000 | 1,600,000 |

| 100,000 | 22,100 | 2,210,000 | 10,000,000 |

| 60,000 | 16,150 | 969,000 | 3,600,000 |

| Total | 450,000 | 8,611,000 | 38,500,000 |

c) i) Direct Material Cost Standard:

- Quality Standard: Specifications for the material’s quality.

- Quantity Standard: Amount of material required per unit.

- Price Standard: Cost of the material per unit.

ii) Direct Labour Cost Standard:

- Standard Wage Rate: Rate of pay per hour for workers.

- Standard Labour Time: Amount of time required to complete a unit.

- Efficiency Standard: Expected efficiency level of workers.

- Uploader: Joseph