- 6 Marks

Question

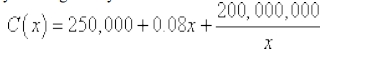

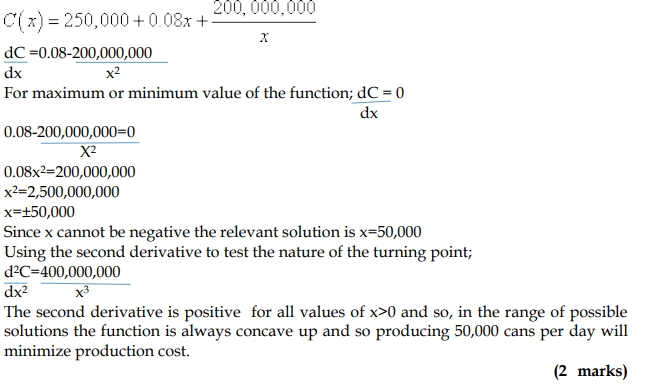

If, after expanding its facilities, the company is capable of producing 60,000 cans in a day and the total daily cost is given by:

Required:

How many cans per day should they produce in order to minimize production costs?

Answer

To minimize production costs, we need to find the value of xx that minimizes the cost function. This is done by taking the first derivative of the cost function and setting it equal to zero.

- Tags: Derivatives, Minimization, Optimization, Production Costs

- Level: Level 1

- Series: NOV 2017

- Uploader: Theophilus