- 20 Marks

Question

Olongon Plc (Olongon) and Kwatrikwa Plc (Kwatrikwa) are competitors listed on the Ghana Stock Exchange. Due to poor managerial decisions, Kwatrikwa’s earning power has been uncertain in recent years, making shareholders contemplate selling the business. However, the management of Kwatrikwa has used various defensive tactics to block any takeover they perceive to be hostile. In the just-ended Annual General Meeting (AGM), Kwatrikwa’s shareholders resolved to sell the company. Shareholders of Olongon have expressed interest in acquiring Kwatrikwa and have suggested to the board to put a proposal together for consideration in the next extraordinary meeting. Olongon’s board has gathered the information below to guide the drafting of the proposal:

| Company | Olongon | Kwatrikwa |

|---|---|---|

| Earnings per share (GH¢) | 0.50 | 0.50 |

| Retention ratio | 0.60 | 0.40 |

| Price per share (GH¢) | 10.00 | 5.00 |

| Number of shares | 25,000 | 25,000 |

Required:

a) Assuming the acquisition will be financed with shares, how many shares of Olongon should be exchanged for all the shares of Kwatrikwa based on market value?

(4 marks)

b) Assuming the share price of the combined business after the acquisition is the same as the share price of Olongon, calculate the market value, earnings per share, and the Price/Earnings ratio of the combined business.

(6 marks)

c) Calculate the cost of the acquisition if Olongon pays GH¢130,000 in cash for Kwatrikwa.

(2 marks)

d) Explain FOUR (4) defensive tactics the management of Kwatrikwa can employ to prevent Olongon from acquiring the company.

(8 marks)

Answer

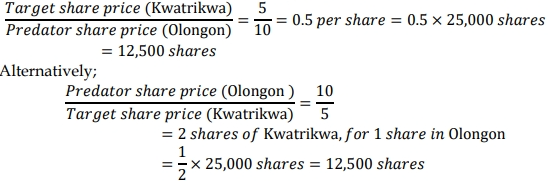

a) Shares of Olongon that should be exchanged for all the share of Kwatrikwa

b) Value of the combined business using the following:

- 𝑀𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒 = 𝑇𝑜𝑡𝑎𝑙 𝑠ℎ𝑎𝑟𝑒𝑠 𝑜𝑓 𝑐𝑜𝑚𝑏𝑖𝑛𝑒𝑑 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 × 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝑀𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒 = (25,000 + 12,500) × 10 = 𝑮𝑯𝑺𝟑𝟕𝟓, 𝟎𝟎𝟎

𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑜𝑓 𝑐𝑜𝑚𝑏𝑖𝑛𝑒𝑑 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 = (0.5 × 25,000) + (0.5 × 25,000) = 𝐺𝐻𝑆25,000

c) Cost of the acquisition if Olongon pays GH¢130,000 in cash for Kwatrikwa.

Cost of Acquisition = Cash paid – Value of Target (Kwatrikwa)

Cost of Acquisition = 130,000 – 125,000 = GH¢5,000

The acquisition is good for Kwatrikwa’s shareholders, they can gain GH¢5,000 for

free.

d) Defensive tactics the management of Kwatrikwa can employ to prevent Olongon

from acquiring the company.

- Staggered board: The board is classified into three equal groups. Only one group

is elected each year. Therefore, the bidder cannot gain control of the target

immediately. - Supermajority: A high percentage of shares, typically 80%, is needed to approve

a merger. - Fair price: Mergers are restricted unless a fair price (determined by formula or

appraisal) is paid. - Restricted voting: Shareholders who acquire more than a specified proportion of

the target have no voting rights unless approved by the target’s board. - Waiting period: Unwelcome acquirers must wait for a specified number of years

before they can complete the merger. - Poison pill: Existing shareholders are issued rights that, if there is a significant

purchase of shares by a bidder, can be used to purchase additional stock in the

company at a bargain price. - Poison put: Existing bondholders can demand repayment if there is a change of

control as a result of a hostile takeover. - Litigation: Target files suit against bidder for violating antitrust or securities laws.

- Asset restructuring: Target buys assets that bidder does not want or that will

create an antitrust problem. - Liability restructuring: Target issues shares to a friendly third party, increases the

number of shareholders, or repurchases shares from existing shareholders at a

premium. - Crown jewels: Crown jewels are options under which a favored party can buy a

key part of the target at a price that may be less than its market value. - Golden parachutes: Golden parachutes are additional compensations to the

target’s top management in the case of termination of its employment following a

successful hostile acquisition.

- Tags: Defensive Tactics, Earnings Per Share, Market Value, Share Exchange

- Level: Level 2

- Topic: Mergers and acquisitions

- Series: MAR 2024

- Uploader: Joseph