- 8 Marks

Question

Oheneba Limited is considering the acquisition of a concession in the Brong Ahafo region to enable it to start a quarry business. The average industry beta is 1.6 with an equity-to-debt ratio of 2:1.

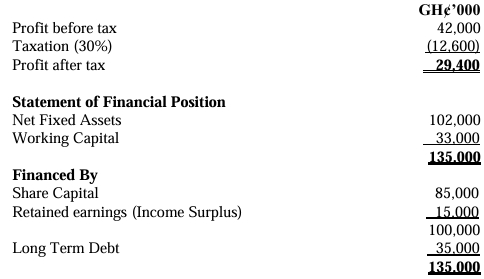

The following information was extracted from the books of Oheneba Limited:

Income Statement

You are also informed that the long-term debt of the company is considered risk-free with a gross redemption yield of 10% and the beta coefficient of the company’s equity is 1.2, while the average return on the stock market is 15%.

Required:

i) Determine the cost of capital to apply for the appraisal of the quarry if Oheneba Limited will maintain its capital structure after the implementation of the quarry project. (5 marks)

ii) Determine the cost of capital to apply if the company will change its capital structure to 20% debt and 80% equity. (3 marks)

Answer

i) Cost of capital for the quarry if the company maintains its current capital structure:

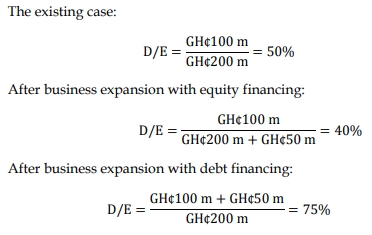

The current capital structure of Oheneba Limited consists of GH¢100,000 in equity and GH¢35,000 in debt, so the debt-to-equity ratio is 0.35 (35/100).

We are given:

- Industry beta: 1.6

- Equity-to-debt ratio: 2:1

- Tax rate: 30%

- Long-term debt yield: 10% (risk-free)

- Average return on the stock market: 15%

- Company’s equity beta: 1.2

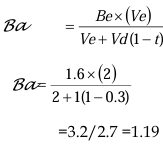

Ungearing the beta:

We first need to ungear the beta using the formula:

Next, we need to gear the beta for Oheneba Limited’s capital structure using the same formula:

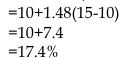

ow, we can calculate the cost of equity (KeKeKe) using the Capital Asset Pricing Model (CAPM):

Ke=Rf+Be⋅(Rm−Rf)

Where:

- Rf=10%Rf = 10% (risk-free rate)

- Rm=15%Rm = 15% (market return)

Thus, the cost of capital for Oheneba Limited if it maintains its current capital structure is 14.7%.

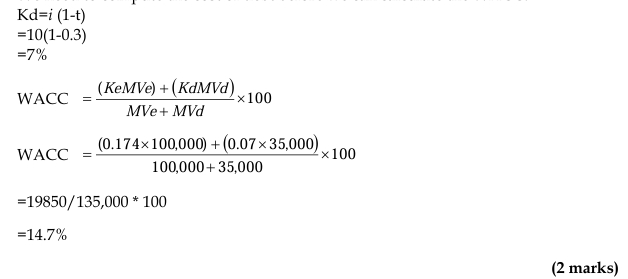

ii) Cost of capital for the quarry if the company changes its capital structure to 20% debt and 80% equity:

We already know the asset beta (Ba=1.19Ba = 1.19Ba=1.19).

Now we need to regear the beta for the new capital structure (20% debt and 80% equity):

- Tags: Beta, Cost of Capital, Debt-to-Equity Ratio, Quarry project, Risk-free rate, WACC

- Level: Level 3

- Topic: Sources of finance and cost of capital

- Series: MAY 2017

- Uploader: Dotse