- 7 Marks

Question

Kingsly Atakora is a postpaid customer of MTN Ghana Ltd. He received his July 2022 billing from MTN Ghana Ltd amounting to GH¢3,121 inclusive of all taxes and levies. He is worried about the amount charged for his telephone usage for the month and wants to know the tax composition in the charge.

Required:

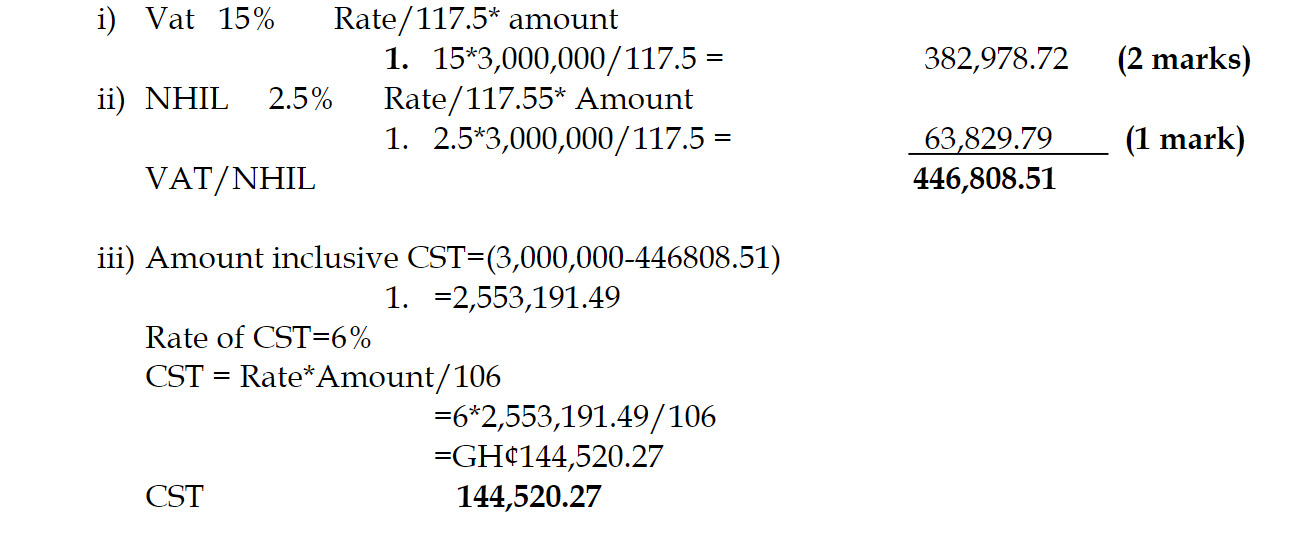

Compute the amounts of the following taxes included in the bill for July 2022:

i) VAT

ii) National Health Insurance Levy (NHIL)

iii) Ghana Education Trust Fund Levy (GETL)

iv) Covid-19 Levy

v) Communication Service Tax (CST)

Answer

| Description | Formula | Amount (GH¢) |

|---|---|---|

| i) VAT | GH¢3,121 × 1/9 | 346.78 |

| ii) NHIL | (GH¢3,121 – 346.78) × 2.5/111 | 62.48 |

| iii) GETFUND Levy | (GH¢3,121 – 346.78) × 2.5/111 | 62.48 |

| iv) Covid-19 Levy | (GH¢3,121 – 346.78) × 1/111 | 25.00 |

| v) Communication Service Tax (CST) | (GH¢3,121 – 346.78) × 1/111 | 124.96 |

Total VAT, Levies & CST: GH¢621.70

- Tags: Covid-19 Levy, CST, GETFund Levy, NHIL, Tax computation, VAT

- Level: Level 2

- Topic: Value-Added Tax (VAT), Customs, and Excise Duties

- Series: JULY 2023

- Uploader: Joseph