- 16 Marks

Question

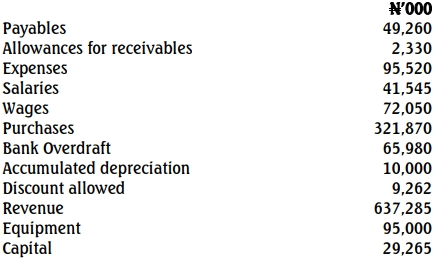

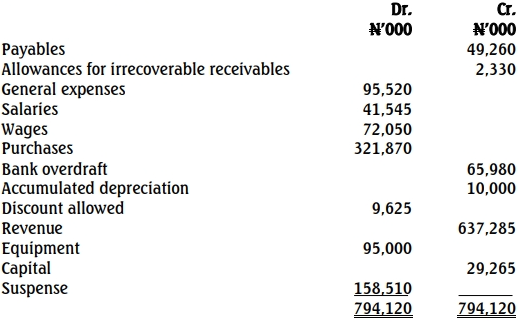

The following balances were extracted from the books of Arewa & Sons on December 31,

2015.

On investigation, you discovered the following:

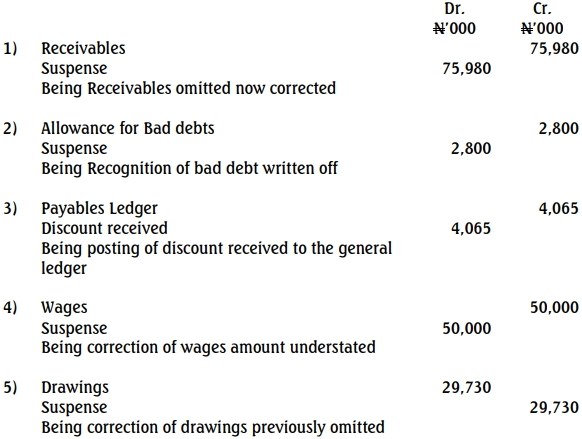

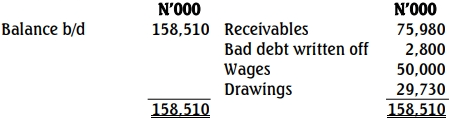

(i) Receivables amounting to N75,980,000 have been omitted.

(ii) Receivables amounting to N2,800,000 have been written off as bad debt, but no

postinghadbeenmadethus renderingtheentryasingleentry.

(iii) Discount received shown in the cashbook and totaling N4,065,000 had not been

posted to the general ledger.

(iv) The figure of wages shouldhavebeenN122,050,000.

(iv) DrawingsamountingtoN29,730,000 have been omitted.

You are required to

i. Prepare journal entries to correct the errors.

ii. Prepare the trial balance after effecting the corrections.

Answer

c

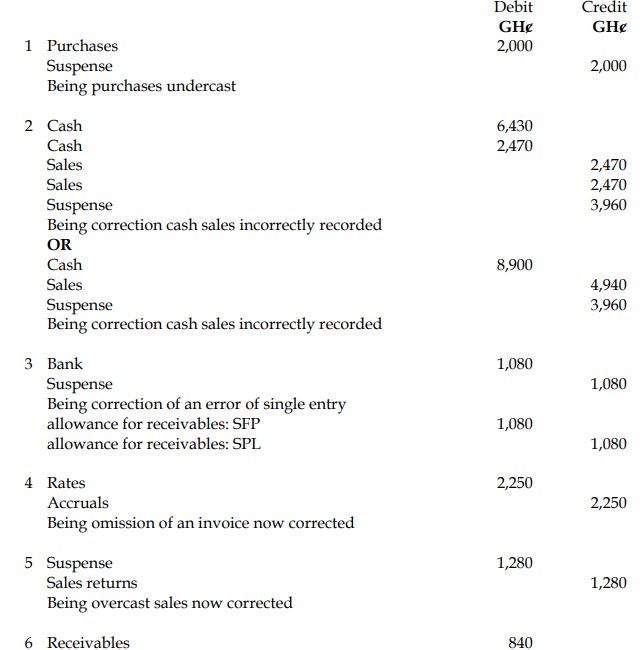

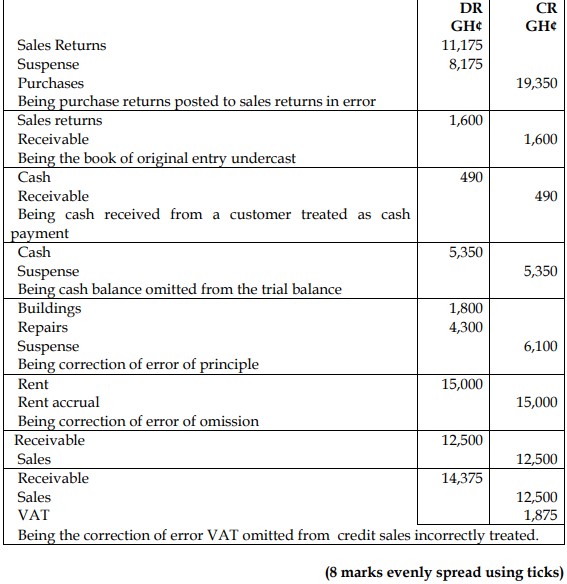

i) Journal Entries to correct the errors

c

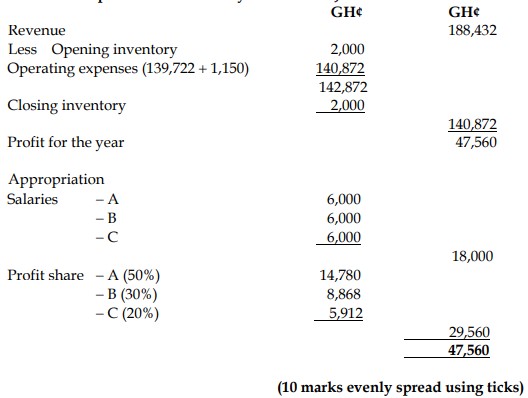

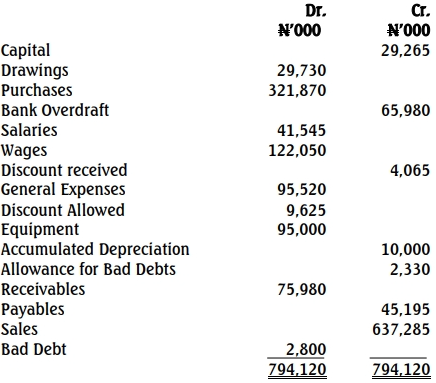

(ii) Adjusted Trial Balance – 31 December 2015

Tutorials

(i) Initial Trial Balance

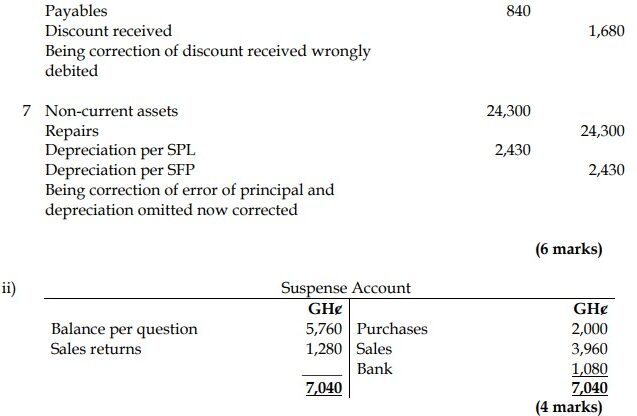

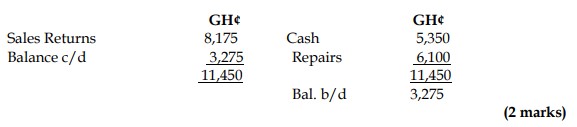

(ii) Suspense Account

- Tags: Correction of Errors, Financial Statements, Journal Entries

- Level: Level 1

- Topic: Correction of errors

- Series: MAY 2016

- Uploader: Joseph