- 20 Marks

Question

Agyeiwaa Grace (Agyeiwaa), aged 56, is a foreign languages teacher at Mountaintop School, a private boarding school in Koforidua. Agyeiwaa has been in the teaching profession for the past 30 years. On 1 January 2020, the school promoted Agyeiwaa to head the languages department, which is a management position. She could also be subcontracted to other schools, institutions, and foreign language associations to assist their teachers and candidates during her free time. Agyeiwaa also holds a contract with the Ministry of Foreign Affairs and Regional Integration as an interpreter on a consultancy services basis.

On 5 January 2020, Agyeiwaa entered into a consultancy agreement with the Ministry of Education to translate some local textbooks. The project is for three years ending on 31 December 2022. Payment is only effected on completion of the translation of the textbooks, and the agreed amount is GH¢30,000 per translated textbook.

Details of Agyeiwaa’s income for the year ended 31 December 2020 are as follows:

Employment income and benefits

i) Agyeiwaa receives a gross monthly salary of GH¢4,000 and an annual bonus of GH¢12,000, payable in December.

ii) Responsibility allowance of GH¢6,960 per annum.

iii) Agyeiwaa makes use of a fully furnished house in the school’s staff residential area. The school deducts a monthly rent of GH¢100 from Agyeiwaa’s salary.

iv) Upon Agyeiwaa’s appointment as the languages department head, the school provided her with a new motor vehicle with fuel for her official use.

v) Agyeiwaa contributes 2.5% of her monthly salary to a registered pension fund. The school contributes 2.5% to a provident fund on behalf of Agyeiwaa.

vi) The school deducts her statutory social security contributions at source.

vii) Agyeiwaa received a total of GH¢12,000 inconvenience allowances from the Mountaintop School during the year.

viii) The school deducts the following amounts monthly from Agyeiwaa’s salary upon her instruction and pays the appropriate amounts to the institutions concerned:

- Subscriptions to the Ghana National Association of Teachers: GH¢15

- Life insurance policy to Royal Life Insurance Services: GH¢50

Other non-employment income

i) Agyeiwaa successfully translated four textbooks under the terms of her contract with the Ministry of Education during 2020.

ii) Agyeiwaa’s bank account was credited with a total of GH¢15,000, representing rental income collected by an estate agent regarding residential property owned by Agyeiwaa in Kumasi.

iii) Agyeiwaa services amounted to a gross of GH¢30,000 for her subcontract work with other schools and foreign language associations. Agyeiwaa paid Mountaintop School 10% of this amount under the terms of a standing arrangement for the use of the school’s resources.

iv) The Ministry of Foreign Affairs and Regional Integration paid Agyeiwaa GH¢9,250 net for her services as an interpreter during the year.

Required:

a) Calculate Agyeiwaa’s taxable income for the 2020 year of assessment. (14 marks)

b) Explain FOUR (4) possible individual gains and profits from an employment for a year of assessment. (6 marks

Answer

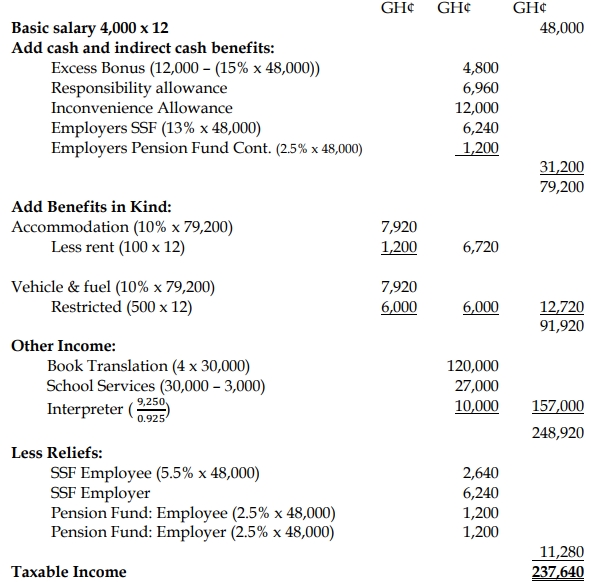

a) Agyeiwaa Grace

Computation of Taxable Income for the 2020 Year of Assessment

b) Possible Gains and Profits from Employment

The following are possible individual gains and profits from employment for a year of assessment:

- Salary, Wages, and Bonuses: Payments such as salary, wages, leave pay, and bonuses are considered part of employment gains.

- Allowances: Personal allowances like cost of living, subsistence, rent, entertainment, and travel allowances.

- Payments for Agreements to Conditions: Payments received for an individual’s agreement to employment conditions.

- Gifts and Benefits in Kind: Gifts or benefits received in respect of employment are taxable gains.

- Retirement Contributions: Contributions made to a retirement fund on behalf of the employee and retirement payments related to employment.

- Discharge of Expenses: Any payments that discharge expenses incurred by the individual or an associate of the individual.

- Topic: Income Tax Liabilities

- Series: NOV 2021

- Uploader: Theophilus