- 20 Marks

FR – Mar 2023 – L2 – Q1 – Group Financial Statements and Consolidation

Prepare the consolidated statement of financial position for Panin Group as of 31 December 2021, considering various acquisitions and intercompany transactions.

Question

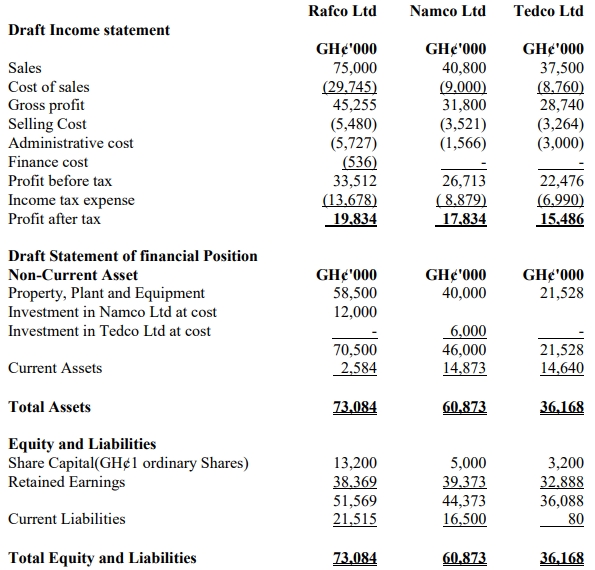

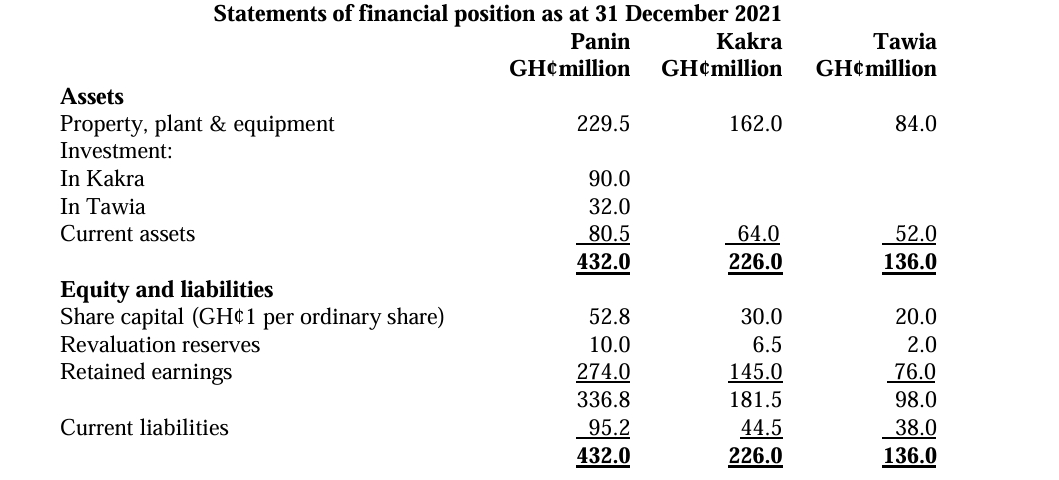

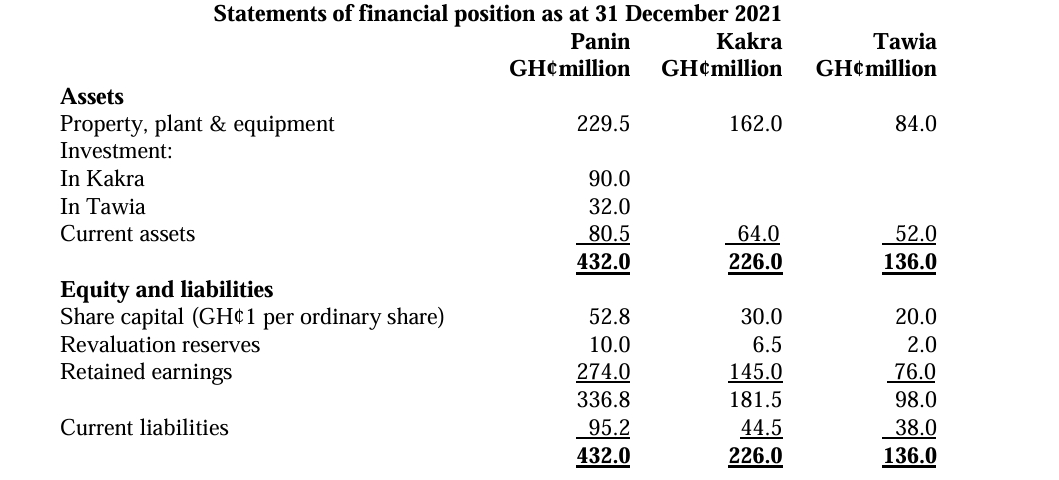

Below are the financial statements of Panin, Kakra, and Tawia.

Additional information:

- On 1 January 2021, Panin acquired 27 million equity shares in Kakra, transferring a parcel of land with a carrying value of GH¢90 million and fair value of GH¢96 million. The balances on Kakra’s retained earnings and revaluation reserves at this date were GH¢72 million and GH¢5.5 million respectively.

- On 1 January 2021, Kakra’s internally developed brand had a fair value of GH¢11 million. The brand has an indefinite useful life, but at year-end its value-in-use was assessed at GH¢8 million.

- On 1 July 2021, Panin also acquired 5 million equity shares in Tawia for GH¢32 million. Tawia earned post-acquisition profit of GH¢10 million after tax and revaluation gains of GH¢500,000.

- In 2021, Kakra made intercompany sales to Panin for GH¢7.8 million, with a profit of 25% on cost, and GH¢1.2 million of these goods were in Panin’s inventory as at 31 December 2021. Kakra also sold to Tawia, and all goods remained in Tawia’s inventory.

- Dividends payable were declared by Kakra and Tawia, but Panin has not yet taken credit for its share.

- On 1 January 2021, Panin sold machines to Kakra for GH¢8 million, with a carrying value of GH¢6 million, depreciating them at 20% per annum.

- Goodwill should be impaired by 10%.

- Non-controlling interest should be valued at their proportionate share of fair value of the subsidiary’s identifiable net assets.

Required:

Prepare a consolidated statement of financial position for Panin Group as at 31 December 2021.

Find Related Questions by Tags, levels, etc.

Report an error

You're reporting an error for "FR – Mar 2023 – L2 – Q1 – Group Financial Statements and Consolidation"

- 20 Marks

FR – Mar 2023 – L2 – Q1 – Group Financial Statements and Consolidation

Prepare the consolidated statement of financial position for Panin Group as of 31 December 2021, considering various acquisitions and intercompany transactions.

Question

Below are the financial statements of Panin, Kakra, and Tawia.

Additional information:

- On 1 January 2021, Panin acquired 27 million equity shares in Kakra, transferring a parcel of land with a carrying value of GH¢90 million and fair value of GH¢96 million. The balances on Kakra’s retained earnings and revaluation reserves at this date were GH¢72 million and GH¢5.5 million respectively.

- On 1 January 2021, Kakra’s internally developed brand had a fair value of GH¢11 million. The brand has an indefinite useful life, but at year-end its value-in-use was assessed at GH¢8 million.

- On 1 July 2021, Panin also acquired 5 million equity shares in Tawia for GH¢32 million. Tawia earned post-acquisition profit of GH¢10 million after tax and revaluation gains of GH¢500,000.

- In 2021, Kakra made intercompany sales to Panin for GH¢7.8 million, with a profit of 25% on cost, and GH¢1.2 million of these goods were in Panin’s inventory as at 31 December 2021. Kakra also sold to Tawia, and all goods remained in Tawia’s inventory.

- Dividends payable were declared by Kakra and Tawia, but Panin has not yet taken credit for its share.

- On 1 January 2021, Panin sold machines to Kakra for GH¢8 million, with a carrying value of GH¢6 million, depreciating them at 20% per annum.

- Goodwill should be impaired by 10%.

- Non-controlling interest should be valued at their proportionate share of fair value of the subsidiary’s identifiable net assets.

Required:

Prepare a consolidated statement of financial position for Panin Group as at 31 December 2021.

Find Related Questions by Tags, levels, etc.

Report an error