- 20 Marks

Question

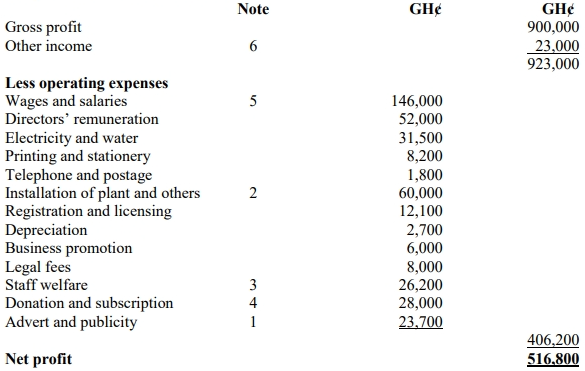

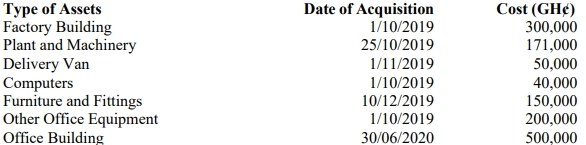

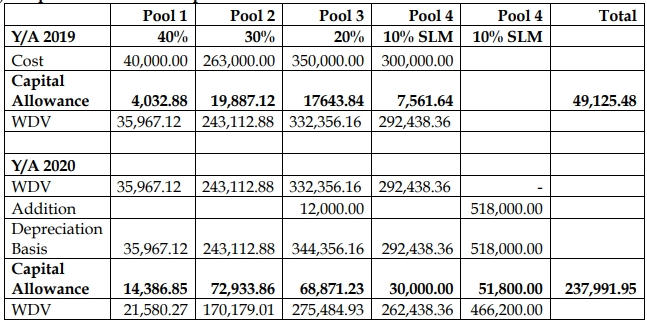

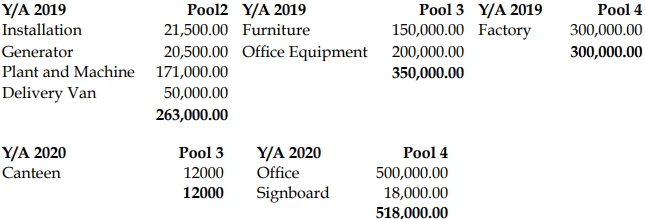

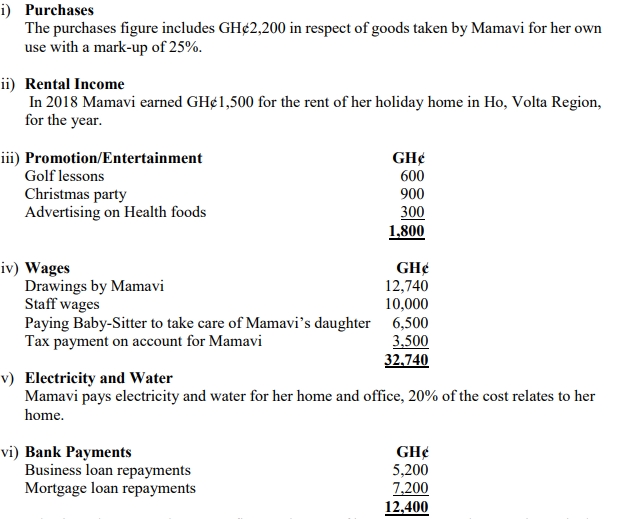

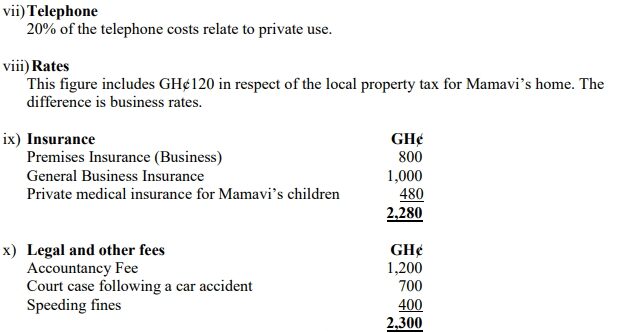

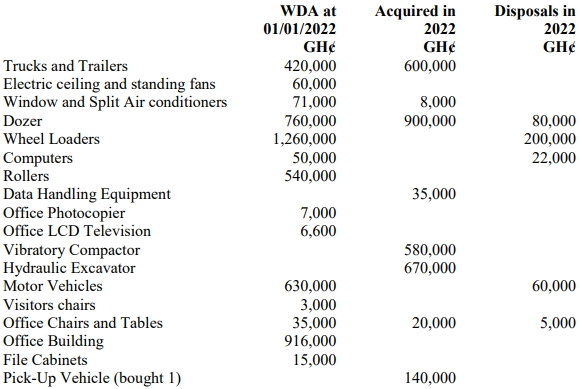

a) You are a Trainee Accountant, and your manager has asked you to correct a company tax

computation which has been prepared by the Managing Director of Prime Shea Ltd, a

manufacturing company located in Batanyili, a suburb of Tamale in the Northern Region.

The company commenced business on 1 January 2014. The company tax computation is

for the year ended 31 March 2020 and contains a significant number of errors:

Required:

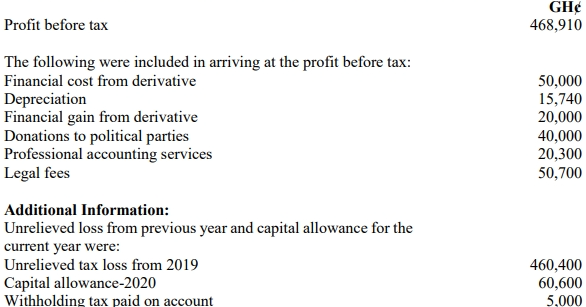

i) Determine the allowable financial cost for the year ended 31 December 2020. (4 marks)

ii) Prepare a revised tax computation to determine the chargeable income for the year ended

31 December 2020. (4 marks)

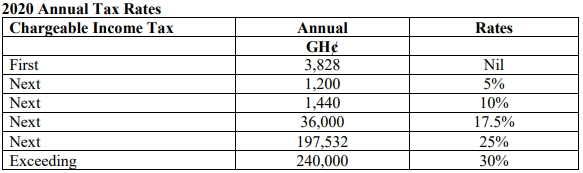

iii) Calculate the tax payable by Prime Shea Ltd under the Income Tax Act 2015 (Act 896) as

amended. (2 marks)

b) You are a final level CA student who has been helping Naagode Ltd on tax issues. Naagode Ltd has been doing business in the international space, importing and exporting products. You have been told that when you qualify, you would manage their Tax Department.

What has baffled the company lately is an audit outcome by the Ghana Revenue Authority. The audit was done in two-folds. One by the Post Clearance Audit Department of the Customs Division and the other by Tax Audit and Quality Assurance (TAQA) Department of Domestic Tax Revenue Division.

The audit findings are as follows:

Post Clearance Audit Department of the Custom Division:

Import Duties GH¢10,000,000

Value Added Tax (VAT) GH¢12,000,000

National Health Insurance Levy (NHIL) GH¢4,000,000

Ghana Education Trust Fund (GET/Fund) GH¢4,000,000

TAQA Department of Domestic Tax Revenue Division:

Corporate Tax GH¢230,000,000

VAT GH¢29,000,000

NHIL GH¢29,000,000

Withholding Tax (WHT) GH¢105,000,000

The management of Naagode Ltd has asked you to assess the chances of the Company if an objection to the assessment is raised as it considers the assessment quite excessive.

Required:

Recommend the process that the management should adopt to ensure success in its appeal.

Answer

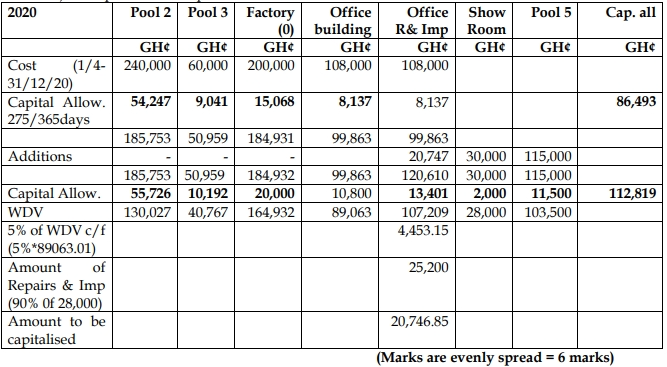

a) i

Allowable financial cost:

Financial gain + 50% of the adjusted chargeable income

= 20,000+ (50%*33,650)

=36,825

The amount of GH¢36,825 represents the allowable financial cost for the 2020 year

of assessment. The excess financial cost of GH¢13,175 (50,000 – 36,825) that is not

allowed as a deduction may be carried forward for the next five years of

assessment.

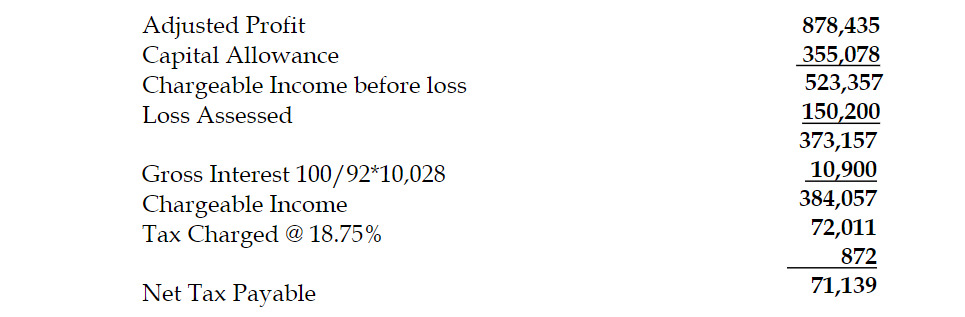

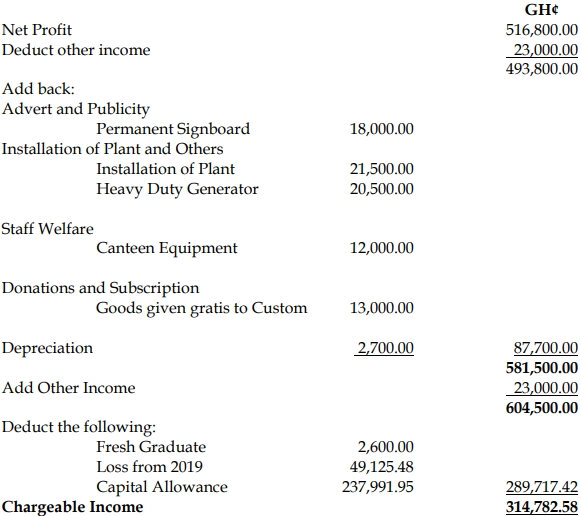

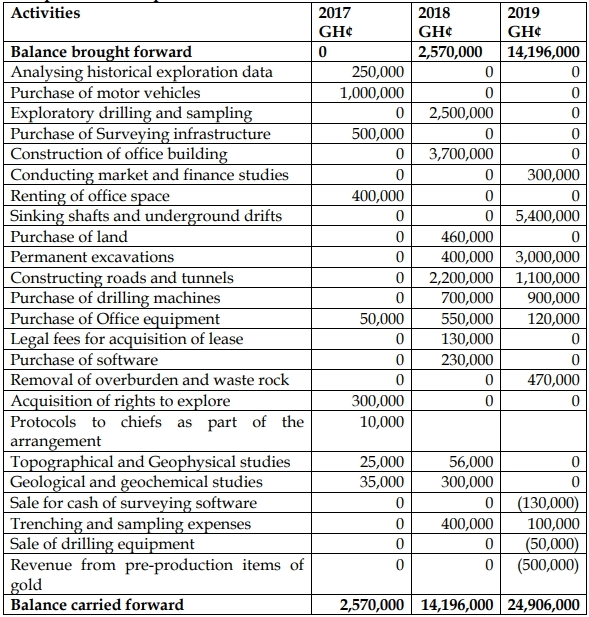

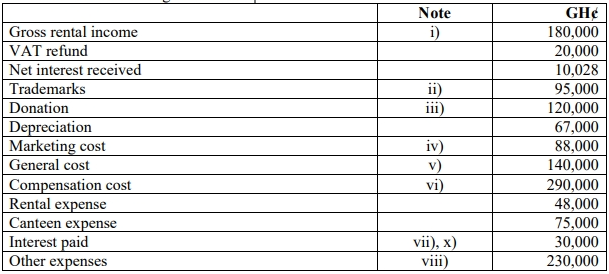

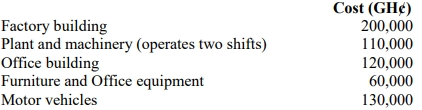

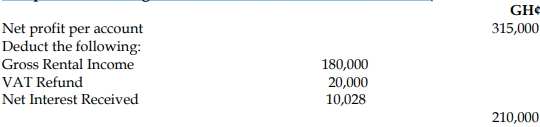

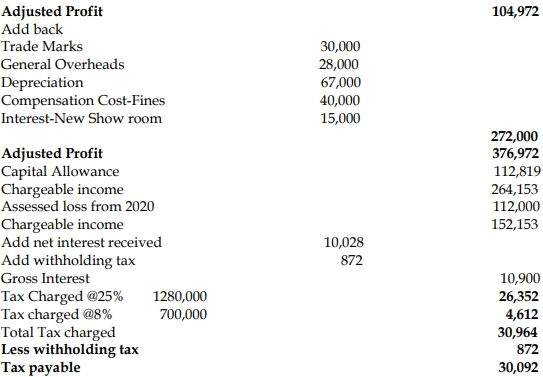

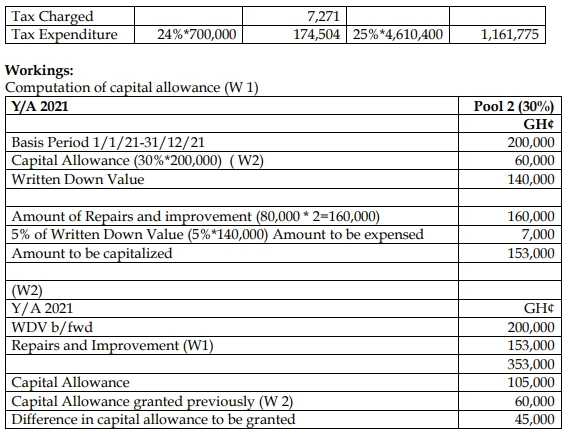

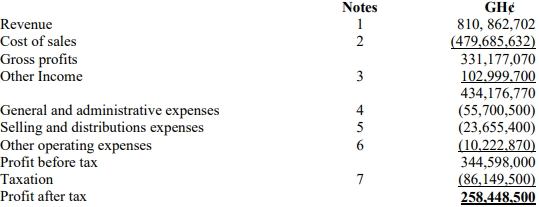

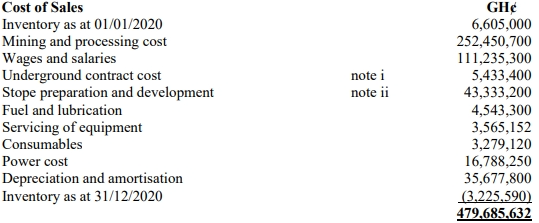

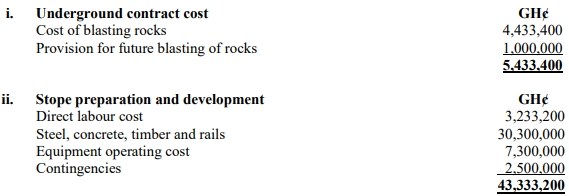

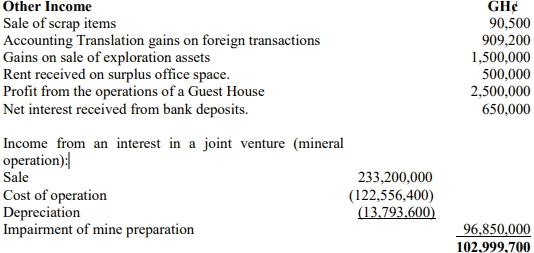

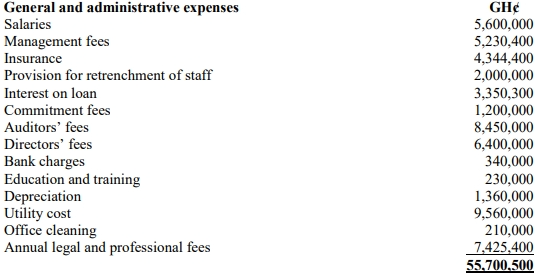

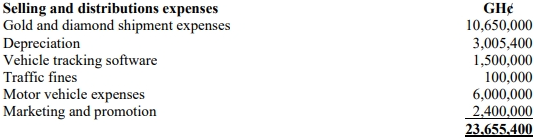

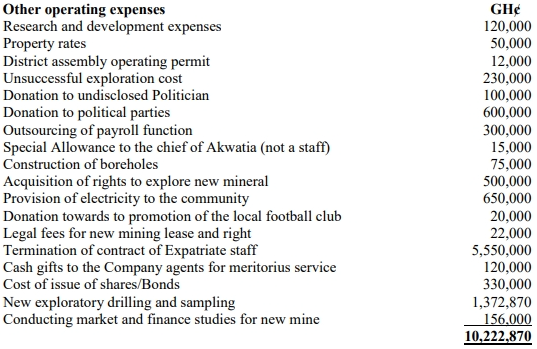

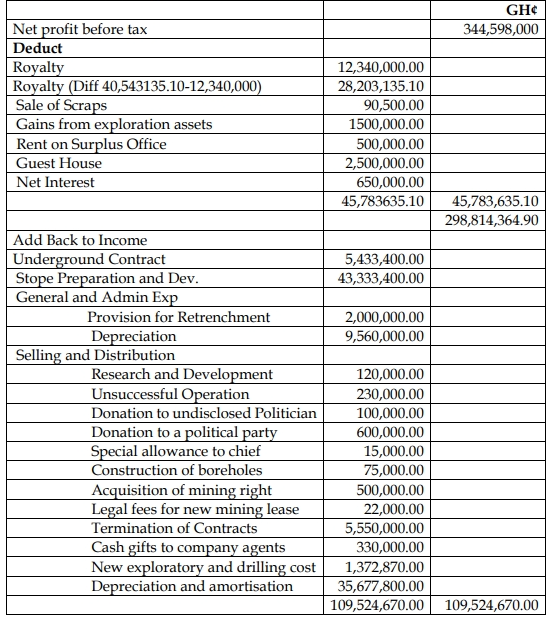

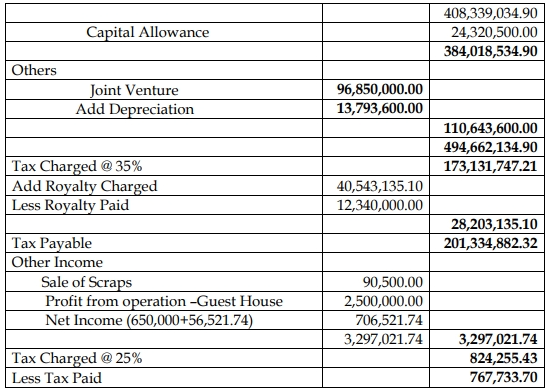

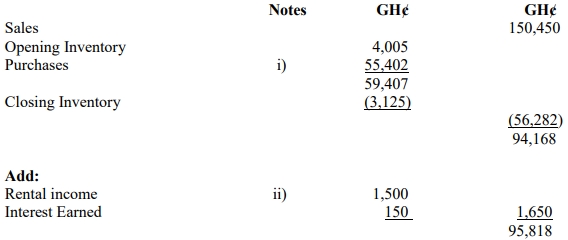

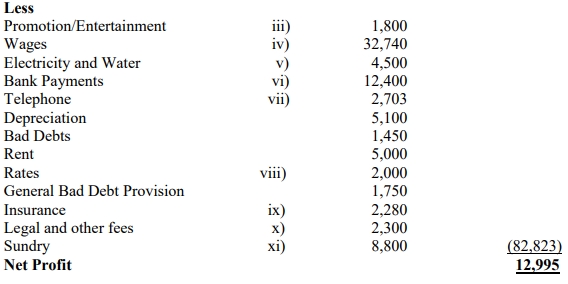

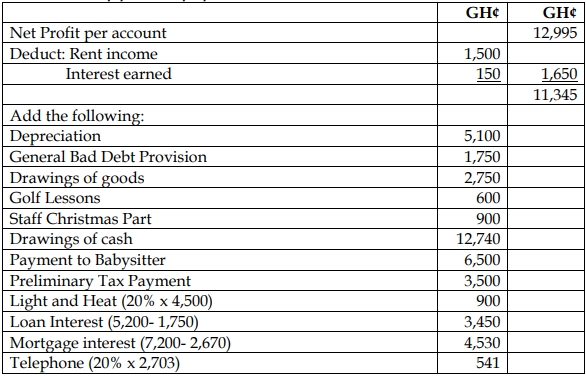

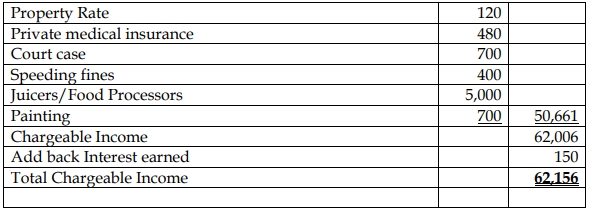

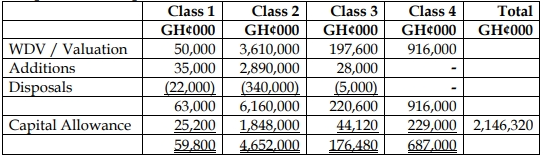

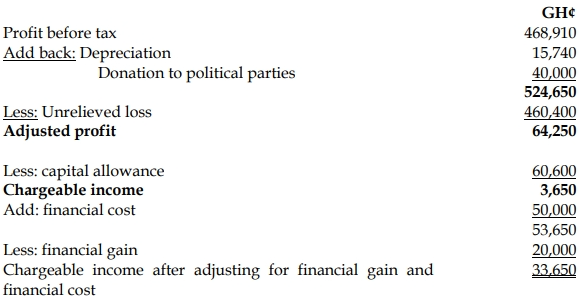

ii) Computation of Chargeable Income and tax payable by the company:

iii) Tax Payable Calculation:

As Prime Shea Ltd is a manufacturing business located in Batanyili, Tamale, it qualifies for a tax rebate of 50%, meaning its tax rate is 12.5%.

Therefore, tax payable = 12.5% * GH¢16,825 = GH¢2,103.13

b)

To object to the tax decision by the Ghana Revenue Authority (GRA), Naagode Ltd must follow these steps:

- Objection submission: Submit the objection in writing to the GRA within 30 days, stating the grounds for the objection.

- Payment of non-disputed taxes and partial payment: Naagode Ltd must pay all taxes not in dispute, plus 30% of the disputed tax amounts from the Domestic Tax Revenue Division (DTRD) assessment.

TAQA Department:

- Corporate Tax GH¢230,000,000

- VAT GH¢29,000,000

- NHIL GH¢29,000,000

- Withholding Tax GH¢105,000,000

Total: GH¢393,000,000

30% of GH¢393,000,000 = GH¢117,900,000

The company must pay GH¢117,900,000 plus any undisputed amounts before the objection is considered.

- Full payment of customs duties and taxes: Naagode Ltd must pay all taxes assessed by the Post Clearance Audit Department (GH¢30,000,000) in full.

Post Clearance Audit Department:

- Import Duties GH¢10,000,000

- VAT GH¢12,000,000

- NHIL GH¢4,000,000

- GET/Fund GH¢4,000,000

Total: GH¢30,000,000

The objection will not be entertained unless the payments are made. Management may appeal to the Commissioner-General for a waiver or suspension of the 30% payment, but the final decision rests with the Commissioner-General.

- Uploader: Joseph