- 10 Marks

Question

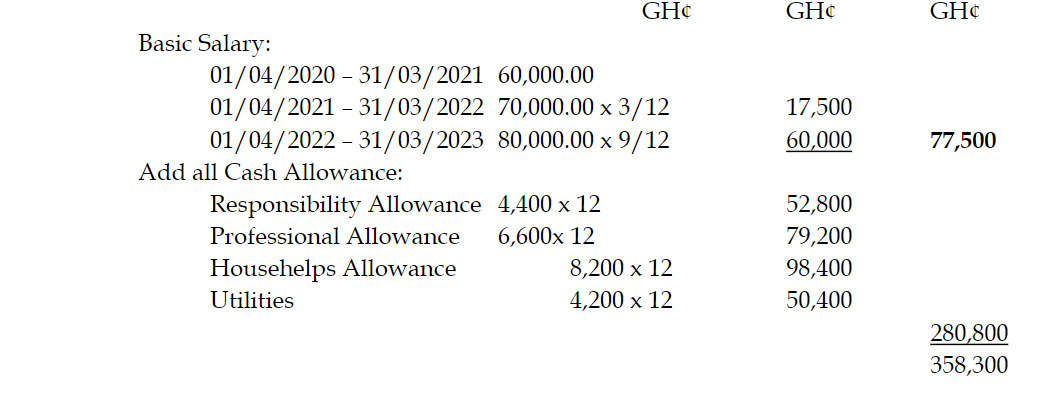

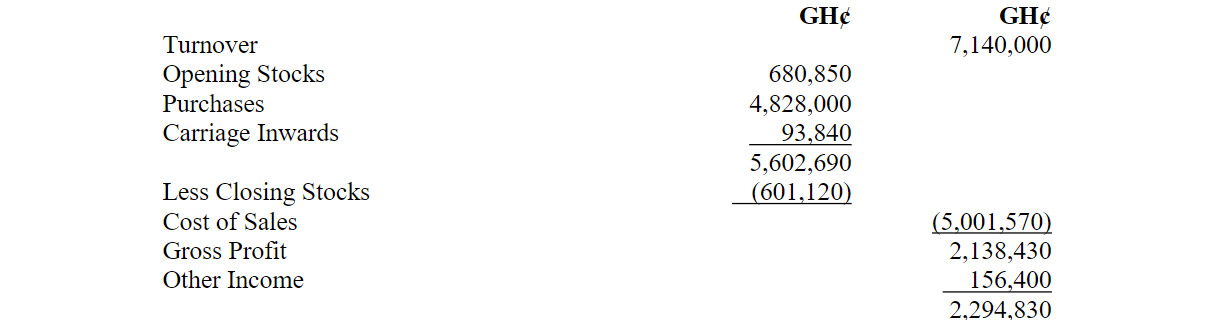

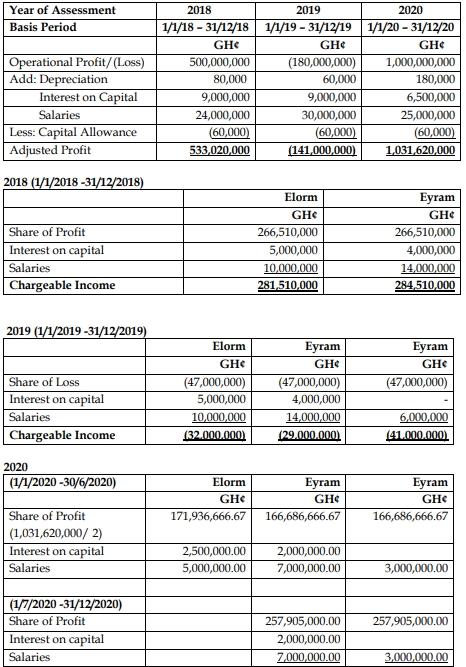

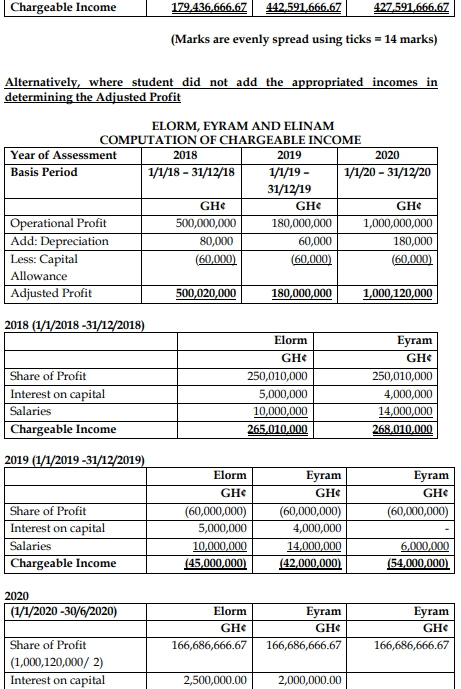

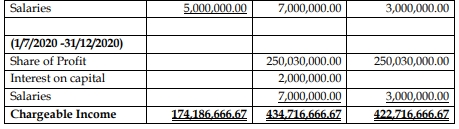

c) You have been offered an appointment by Bumu Manufacturing Company (BMC) as Tax Manager responsible for preparing and filing tax returns on behalf of the company. BMC files its returns with the Osu Medium Taxpayers Office of the Ghana Revenue Authority. The company’s Tax Identification Number is C0000261178. The company prepares accounts to 31 December each year.

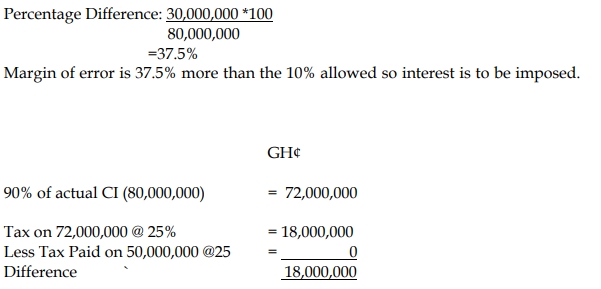

BMC estimated its chargeable income for the 2019 year of assessment as GH¢3,000,000. Subsequently, the company secured a Government contract and anticipates in the third (3rd) quarter that its chargeable income would be GH¢4,500,000.

Additional Information:

Tax paid on account:

1st quarter GH¢100,000

2nd quarter GH¢120,000

3rd quarter GH¢200,000

Required:

Compute the taxes payable for BMC for each quarter.

(10 marks)

Answer

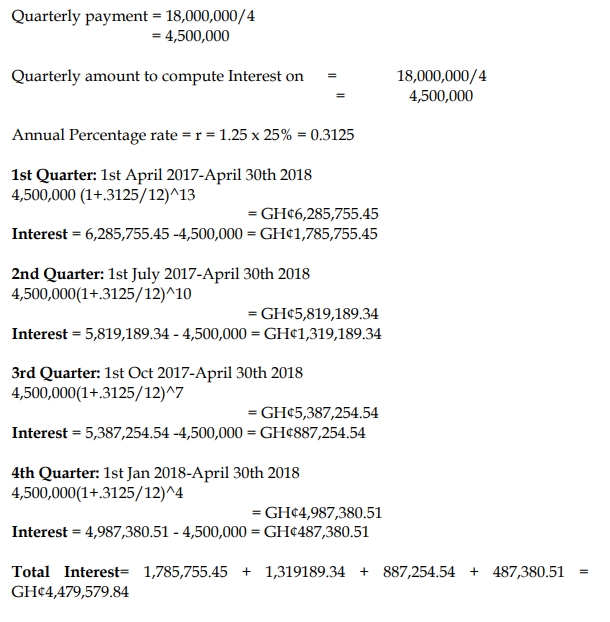

c) Taxes payable for BMC for each quarter

![]()

Where A = Tax payable (Annual tax payable),

B = All withholding up to the end of the

respective quarter + any other taxes paid in respect of that annual tax payable,

C = the number quarters remaining

1st Instalment

A = 25% X GH¢3,000,000 = GH¢750,000

B = 100,000

C = 4

Instalment payment = (750,000 – 100,000)/4 = GH¢162,500

2nd Instalment

A = GH¢750,000

B = 100,000 + 120,000 +162,500= 382,500

C = 3

Instalment payment = (750,000 – 382,599)/3 = GH¢122,500

3rd Instalment

A = 25% x GH¢4,500,000 = 1,125,000

B = 100,000 + 162,500 + 120,000 + 122,500 + 200,000 = 705,000

C = 2

Instalment payment = (1,125,000 – 705,000)/2 = GH¢210,000

4th Instalment

A = GH¢1,125,000

B = 705,000 + 210000 = 915,000

C = 1

Instalment payment = (1,125,000 – 915,000)/1 = GH¢210,000

(Marks are evenly spread = 10 marks)

- Topic: Corporate Tax Liabilities, Tax Administration

- Series: APR 2022

- Uploader: Cheoli