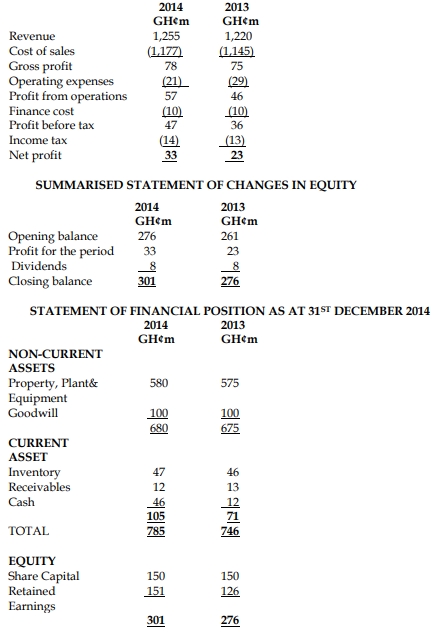

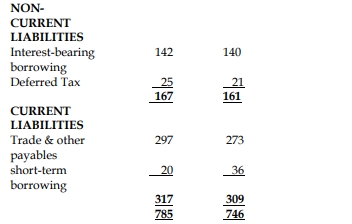

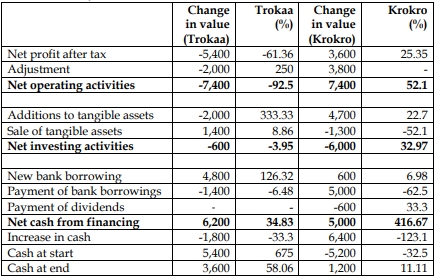

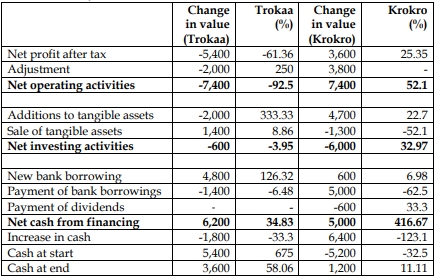

a) Horizontal Analysis

b) Report to the Investment Manager of Nkoso Funds

Report

To: Investment Manager, Nkoso Funds

From: Financial Consultant, Nkoso Funds

Date: xx/xx/xx

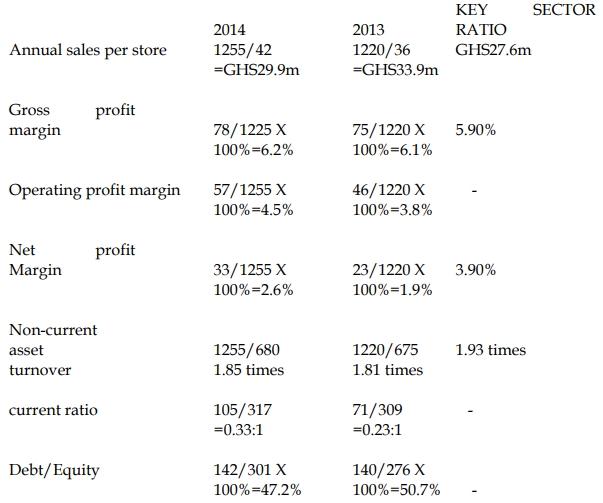

Subject: Relative cash flow analysis of Trokaa Plc and Krokro Plc

This report presents analysis of cash flow information of two companies: Trokaa Plc and Krokro Plc as part of a broad financial analysis carried out on these companies to decide which of them represents a better target to invest in. The analysis is undertaken under four different headings: cash flows from operating activities, cash flows from investing activities, cash flows from financing activities, and changes in cash and cash equivalents.

Cash flows from operating activities

From the cash flow statements, it is clear that both companies have remained profitable across the two years. However, while Trokaa Plc’s net profit has declined by 61.36% [(8800 – 3400)*100/8800] Krokro Plc’s profit has increased by 25.35% [(17800-14200)*100/14200]. This implies, albeit loosely, that Krokro’s profit figures are not only higher than those of Trokaa but also seem to be faring better over time.

The picture painted by the profit figures is same as what the net operating cash flows reveal. Both companies generated more cash than they spent on operations across both years. Trokaa’s net cash generated from operating activities decreased very significantly whereas Krokro matched the improved profitability with increased operating cash flows between the two periods.

A closer look at the numbers suggests that Trokaa’s poor cash management in 2023 did not result from only the reduced profitability but also from the increases in the negative adjustments. This most probably signifies a deterioration in net working capital management; more cash tied up in inventories and receivables. Another implication is that the poor current asset management has undone the impact of any addbacks of material non-cash expenses such as depreciation. In the case of Krokro, the nil adjustment indicates that 2022’s positive and negative adjustments may have cancelled each out. But in 2023 the adjustments represented an addition to profit to increase the operating cash flows. This may suggest a better working capital management and/or a simple addback of non-cash expenses.

Krokro Plc also appears to have had more quality profit than Trokaa Plc. In both years, Krokro Plc’s net operating cash flows exceeded the related net profits, indicating that the profit figures were not just an outcome of accounting gimmicks, but figures which are sufficiently backed by cash. On the contrary, Trokaa’s profits were higher than the related net operating cash flows in both years. For instance, in 2023, with operating cash flows sharply dropping, Trokaa’s profit was backed only 17.65% (600*100/3400) by operating cash flows for that year.

Cash flows from investing activities

Cash flows from investing activities are basically concerned with the acquisition and disposal of non-current assets and related items.

The cash flow statements reveal that Trokaa Plc has experienced net cash inflows from investing activities while Krokro Plc has recorded net cash outflows. This clearly indicates that Trokaa Plc is selling off and sizing down on its operations while Krokro Plc is investing long-term and expanding its activities.

Though the asset sales have generated material figures for Trokaa Plc across the two years, this action could raise going concern issue for the company unless there are plans to reinvest the proceeds in different ventures. Thus, these cash flows suggest that there are doubts about Trokaa’s future while Krokro Plc appears to be motivated by the good profit figures to be investing in new assets and creating even more positive outlook into the future.

The increased net investment activities by Krokro Plc however imply that free cash flows are negative in both years. The indication is that Krokro Plc did not fund the new acquisitions in both periods only with internally generated cash but also with funds from lenders as can be seen under financing activities. Conversely, Trokaa Plc’s increased divestment activities created positive free cash flows in both years.

Cash flows from financing activities

Cash flows from financing activities are concerned with activities which result in changes in an entity’s mix of equity and debt capital. These cash flows result from transactions between the entity on one hand and shareholders and lenders on the other.

Trokaa Plc reported net cash outflows from financing activities, albeit lower in 2023 than in 2022, across both years while Krokro Plc presented net cash outflows only in 2022. These figures show that Trokaa Plc spent the positive free cash flows (as discussed under investing) on capital holders while Krokro Plc rather had to raise additional monies (especially in 2023 when the net flows became positive) to finance its deficient free cash flows.

A closer look at the section breakdown shows that both entities obtained new funds from only lenders in both years. While at this point, it is apparently clear how the new borrowings by Krokro Plc were applied as discussed under investment activities, it is not for Trokaa Plc. However, the immediate next line shows that huge debt repayments were made by Trokaa Plc, compared to Krokro Plc. The proceeds from asset sales did not find their way into idle accounts or short-term investments for later use but were utilized to repay loans. This thus offers a confirmation that the company does not intend to invest in new projects or replace ones sold.

But then as a lot of repayments are occurring at Trokaa, its gearing position is expected to improve while future interest payments can be projected to fall. Krokro Plc’s loan build-ups in both years would worsen its gearing ratio and cause future interest payments to rise. However, it seems this does not create much concern as its strong profitability and operating cash flows should be able to allay any fears that lenders might harbour.

A more worrying picture painted by the 2023 figures of Trokaa is how the company has used the new loan. Instead of investing the loan proceeds in new assets, it appears Trokaa has used a good chunk to augment the asset sales to redeem the existing debts. This situation can easily push the company into debt distress as falling profitability coupled with failure to find and invest in new viable projects may impair the firm’s debt servicing capacity despite the improving gearing and lower future interest costs.

Only Krokro Plc paid dividends to shareholders in both years, with the 2023’s payment being one-third higher. Krokro Plc’s decisions to pay dividends and increase amount this year look very apt as the amounts in both years are sufficiently below the net cash generated from operating activities. The implication is that these payments can be sustained going forward. But the failure of Trokaa Plc to return anything to shareholders just adduces additional evidence of the apparent cash flow problems that its earlier numbers seem to be revealing.

Changes in cash and cash equivalents

Trokaa’s net cash changes have remained positive across the two periods even though the net cash increase of GH¢3.6 million in 2023 falls below what occurred in 2022 by 33 1/3 % [(5400 – 3600) * 100/5400].

These positive changes have been driven by cash generated from net asset disposals and net operating cash inflows, with the larger contributor being the former. Net cash from financing activities has been negative in both periods. But the reduction in net cash increment appears to have occurred largely because of the significant dip in net cash from operations (from GH¢8 million to GH¢0.6 million). This drop, combined with the small decrease in net investing inflows, was too huge to be compensated for by the significant decrease in the net cash used on financing activities.

The fact that Trokaa’s positive net cash changes are disproportionately dependent on proceeds from asset sales does not leave an all-that-good picture. In fact, without these inflows, the company would have net decreases in cash and cash equivalents. Meanwhile these flows are not sustainable as the firm cannot continue disposing of its assets to raise new funds. Else, it would be out of business.

It appears that Krokro’s cash flows situation gives a more encouraging picture than Trokaa’s. Krokro’s net cash changes improved from being a net negative figure last year to becoming a positive one this year. This improvement in net cash changes translates into an increment of GH¢6.4 million (GH¢1.2 million + GH¢5.2 m) from 2022 to 2023.

This improved performance was due to the significant rise in the net cash generated from both operating and financing activities. These huge increases led to the improvement we see because they exceeded how much more cash was required for the additional cash investments in 2023. Krokro’s turnaround appears even more impressive given that the firm generated much of the improvement from its own operating activities.

Overall, the cash flow data of the two companies suggest that not only has Krokro Plc been more profitable (in absolute terms, at least) across and over the two years but it has also handled and managed its cash flows better than Trokaa Plc. Krokro Plc has generated more cash from its own operations, is expanding its activities by buying new assets, is committed to sustainable dividend payments and is leveraging its strong potential to use a cheaper source of finance – debts – to fund its investments. I therefore recommend that we consider Krokro Plc for the share investment.