- 10 Marks

Question

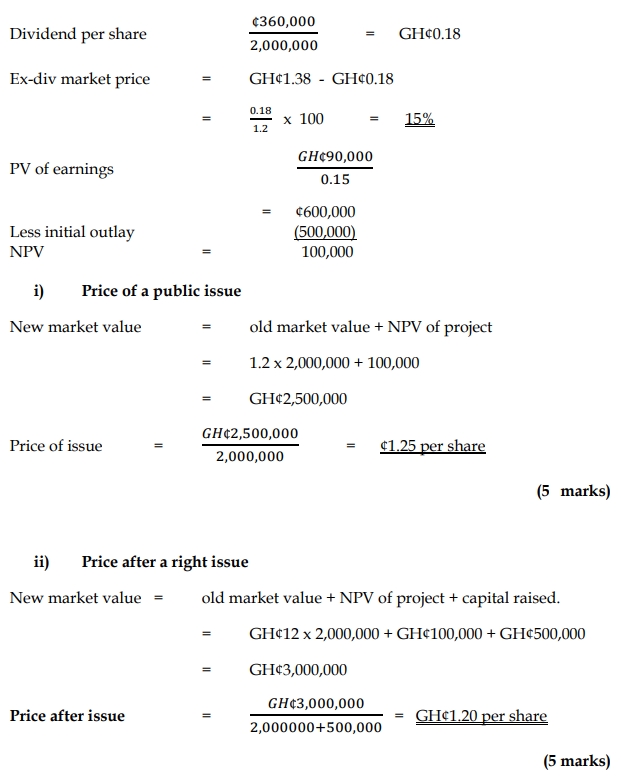

Mbo Ltd needs to raise GH¢500,000 to finance a large-scale project which would produce earnings of GH¢90,000 in perpetuity but is undecided as to the manner in which the money should be raised.

The company has an issued capital of 2 million equity shares of GH¢1 each with a current market price of GH¢1.38 cum div. The annual dividend (which has been constant for many years) of GH¢360,000 is about to be paid.

Two methods of raising capital are being considered, a public issue, and a right issue at GH¢1.

Required:

i) Calculate the price at which the public issue should be made. (5 marks)

ii) Calculate the price at which you would expect shares to be valued immediately after the rights issue. (5 marks)

Answer

- Tags: Capital raising, Financial management, Public Issue, Rights Issue, Share Price

- Level: Level 3

- Topic: Sources of finance and cost of capital

- Series: MAY 2018

- Uploader: Theophilus