- 9 Marks

Question

Akua is a shareholder of Annam Company Limited, a company not listed on the Ghana Stock Exchange (GSE) Market. Akua has the following transactions in Annam Company Limited:

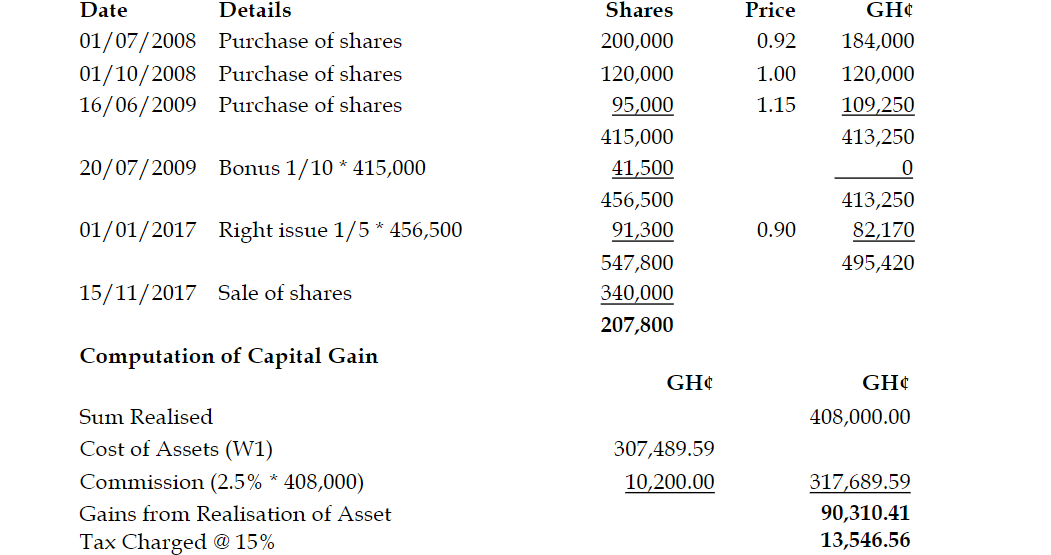

i) On 01/07/2008, Akua purchased 200,000 ordinary shares for GH¢184,000. She purchased another 120,000 shares on 01/10/2008 at a price of GH¢1.00 per share. Akua again purchased 95,000 shares on 16/06/2009 at a price of GH¢1.15 per share.

ii) On 20/07/2009, Akua received bonus shares of 1 for every 10 shares currently held by her.

iii) On 01/01/2017, Akua accepted a right offer of 1 for 5 shares held as at 31/12/2015 at a price of GH¢0.90 per share.

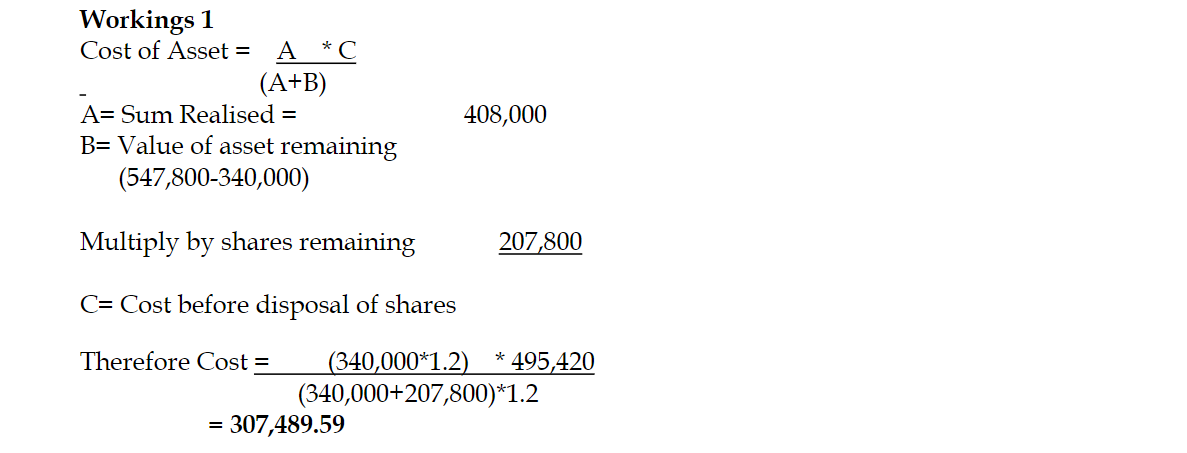

iv) On 15/11/2017, Akua sold 340,000 shares for GH¢408,000, paying a commission of 2.5% of the sale value to the brokerage firm that facilitated the sale. The proceeds received from the sale were GH¢0.10 per share lower than a similar share on the Ghana Stock Exchange Market.

Required:

Calculate the capital gain tax if any.

(9 marks)

Answer

Computation of capital gain tax

- Tags: Capital Gain, Shares, Tax Calculation

- Level: Level 3

- Topic: Tax Calculation

- Series: MAY 2018

- Uploader: Cheoli