- 20 Marks

Question

a) You have been appointed as the Finance Manager of Jaja Ltd and the expectation of the board is for you to provide education and working solution to their foreign exchange losses problem which your predecessor had no clue.

How will you explain the following? i) Foreign Exchange Risk (2 marks)

ii) Transaction Risk (2 marks)

iii) Translation Risk (2 marks)

iv) Economic Risk (2 marks)

b) Kaluu Ltd is a listed company on the Ghana Stock Exchange Market and showed the following performance. The following information was made available to you:

- Current market price per share (as at 31/12/15): GH¢ 10

- Dividend per share 2015: GH¢ 1

- Expected growth rate of dividend: 20% per annum

- The average market returns: 27%

- The risk-free government rate: 24%

- The beta factor of Kaluu Ltd: 1.4

Required: i) What is the estimated cost of equity using the dividend growth model? (3 marks)

ii) What is the estimated cost of equity using the Capital Assets Pricing model? (3 marks)

c) i) Distinguish between repurchase agreement (repos) and reverse repos. (3 marks)

ii) A company enters into an agreement with a bank and it sells GH¢10 million government bonds with an obligation to buy back the security in 60 days. If the rate is 8.2%, what is the repurchase price of the bond? Assume 365 days in a year. (3 marks)

Answer

a) Explanation of Foreign Exchange Risks

i) Foreign Exchange Risk: This is the risk of changes in the foreign exchange rate or the value of a currency. The level of change or movement cannot be determined with certainty, exposing any counterparty with foreign currency transactions to market volatility. (2 marks)

ii) Transaction Risk: This refers to the gains or losses made on foreign exchange transactions due to changes in the exchange rate between the transaction date and the payment or settlement date if the exposure is unhedged. (2 marks)

iii) Translation Risk: This refers to the movement in values, either gains or losses, of the balance sheet due to the consolidation of assets and liabilities into a reporting currency from various currencies. (2 marks)

iv) Economic Risk: This refers to the long-term changes in the value of a foreign firm due to unexpected changes in exchange rate movements, affecting the firm’s market position and competitiveness. (2 marks)

b) Kaluu Ltd – Equity Cost Estimation

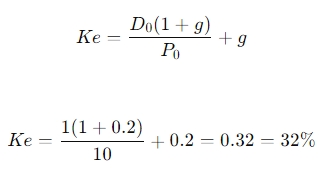

i) Cost of Equity using the Dividend Growth Model:

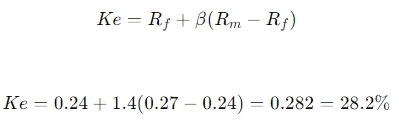

ii) Cost of Equity using the Capital Asset Pricing Model (CAPM):

c) Repos and Reverse Repos

i) Distinguishing Repos and Reverse Repos:

- Repo (Repurchase Agreement): A repo is an agreement where one party sells securities and agrees to repurchase them at a later date for a higher price. It is essentially a short-term borrowing.

- Reverse Repo: A reverse repo is the opposite; a party purchases securities and agrees to sell them back at a later date for a higher price, effectively lending money. (3 marks)

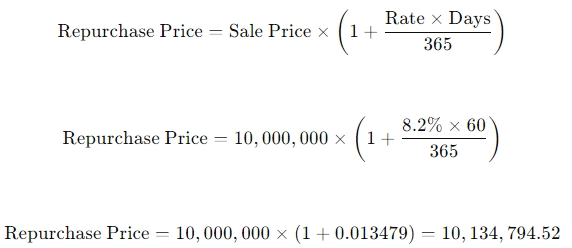

ii) Repurchase Price Calculation:

- Topic: Foreign exchange risk and currency risk management

- Series: NOV 2016

- Uploader: Joseph