- 20 Marks

Question

BIN Partnership is an existing partnership consisting of two partners, Bode and Igere, sharing profits and losses equally. On January 1, 2023, they decided to admit Ngor as a new partner into the partnership.

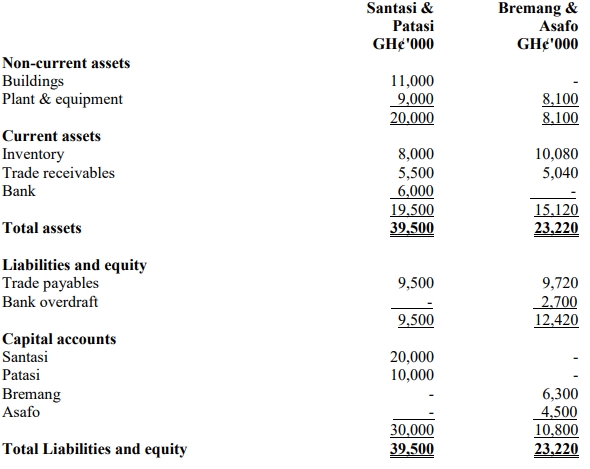

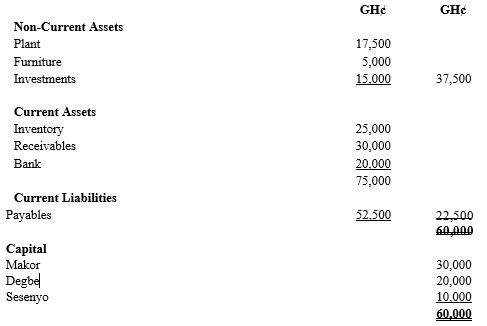

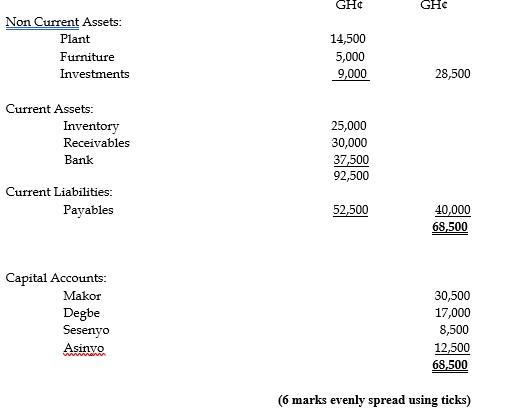

Additional Information: (i) The existing partnership’s statement of financial position before Ngor’s admission is as follows:

| Capital: | Property, plant, and equipment | ₦2,400,000 |

|---|---|---|

| Bode: ₦1,750,000 | Inventory | ₦700,000 |

| Igere: ₦1,750,000 | Accounts Receivable | ₦900,000 |

| Loan Notes: ₦1,000,000 | Cash | ₦800,000 |

| Accounts Payable: ₦300,000 | ||

| Total Liabilities: ₦4,800,000 | Total Assets: ₦4,800,000 |

(ii) Goodwill of the partnership is valued at ₦200,000.

(iii) Ngor invests ₦1,500,000 in cash and acquires a 30% share in the partnership’s profits and losses.

(iv) ₦600,000 from the cash contributed by Ngor will be used to reduce the existing partnership’s long-term liabilities.

(v) The partnership follows a policy of not recording goodwill on its financial statements.

Required: a. In the books of BIN partnership, prepare the following to give effect to the admission of Ngor:

- i. Goodwill account (2 Marks)

- ii. Partners’ capital accounts (4 Marks)

- iii. Statement of financial position after the admission of Ngor (10 Marks)

b. Discuss two methods of goodwill valuation in a partnership. (4 Marks)

(Total 20 Marks)

Answer

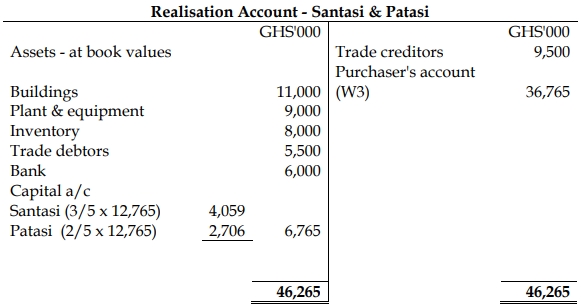

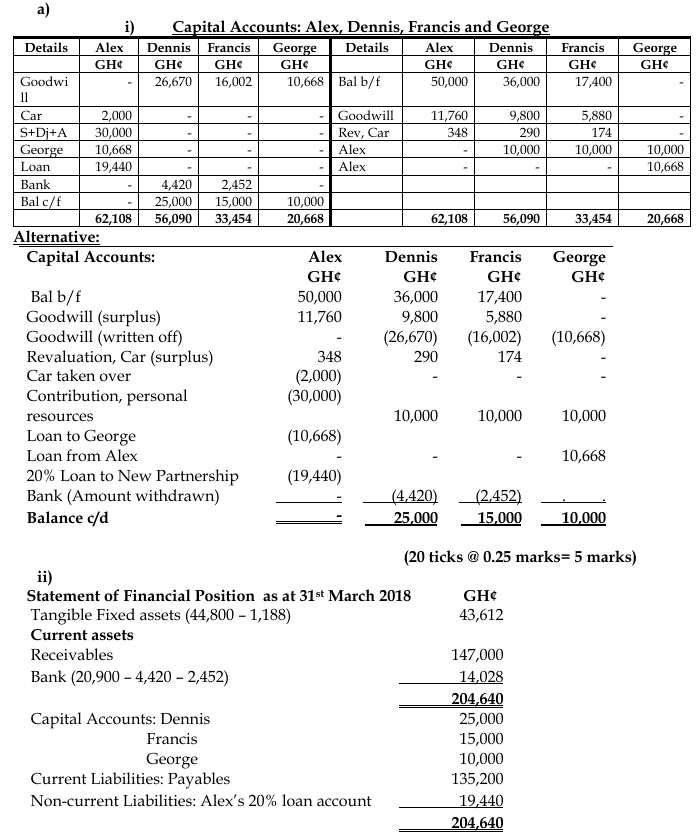

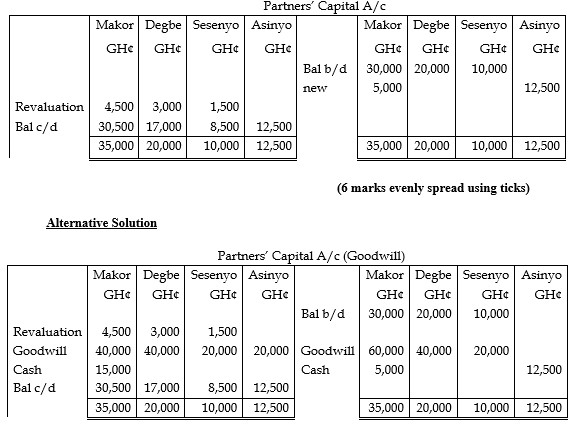

i. Goodwill Account:

| Particulars | Debit (₦) | Credit (₦) |

|---|---|---|

| Goodwill | 200,000 | |

| Capital – Bode | 100,000 | |

| Capital – Igere | 100,000 | |

| Total | 200,000 | 200,000 |

ii. Partners’ Capital Account:

| Particulars | Bode (₦) | Igere (₦) | Ngor (₦) |

|---|---|---|---|

| Goodwill | 100,000 | 100,000 | |

| Cash | 1,500,000 | ||

| Balance b/d | 1,750,000 | 1,750,000 | |

| Loan Repayment | (600,000) | ||

| Balance c/d | 1,780,000 | 1,780,000 | 1,440,000 |

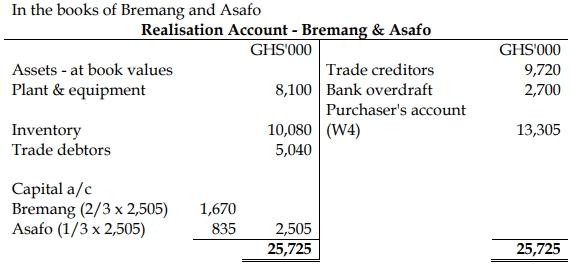

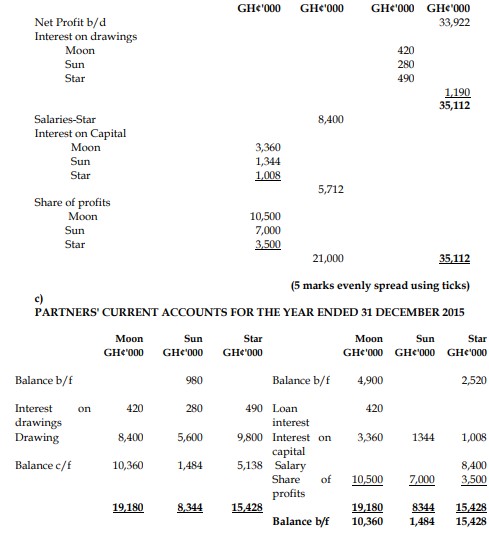

iii. Statement of Financial Position after Admission of Ngor:

| Assets | ₦ | Liabilities and Equity | ₦ |

|---|---|---|---|

| Property, plant, and equipment | 2,400,000 | Capital: Bode | 1,780,000 |

| Inventory | 700,000 | Capital: Igere | 1,780,000 |

| Accounts receivable | 900,000 | Capital: Ngor | 1,440,000 |

| Cash | 1,700,000 | Loan Notes | 400,000 |

| Accounts payable | 300,000 | ||

| Total Assets | 5,700,000 | Total Liabilities & Equity | 5,700,000 |

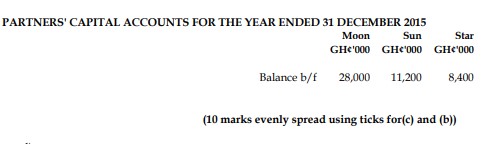

b. Methods of Goodwill Valuation in a Partnership:

i. Average Profit Method:

This method involves calculating the average profit of the firm over a specific number of years and multiplying it by a number of years’ purchase to determine the value of goodwill.

ii. Super Profit Method:

Goodwill is calculated by determining the firm’s super-profits, which is the excess of actual profits over normal profits, and then multiplying this by a number of years’ purchase.

- Tags: Capital Accounts, Financial Statements, Goodwill, Partnership

- Level: Level 1

- Uploader: Dotse