- 20 Marks

Question

The Business Manager of Omaya Art Gallery has rented a hall to display the artworks of the artists of the gallery. She is considering organizing an exhibition of a number of rare painting masterpieces. In the past, only 70% of the paintings were sold in the first week. Moreover, if no painting is sold in the first five (5) days, the exhibition could be extended for another two (2) days but only 20% of the paintings would be sold.

The cost of the exhibition is GH¢500 per day. The manager estimated that in case she does not make any sales, she will have to pay GH¢15,000 to cover the costs of renting the exhibition hall for the same period.

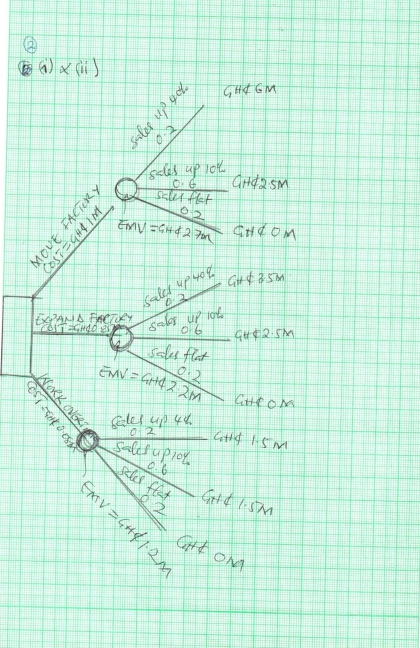

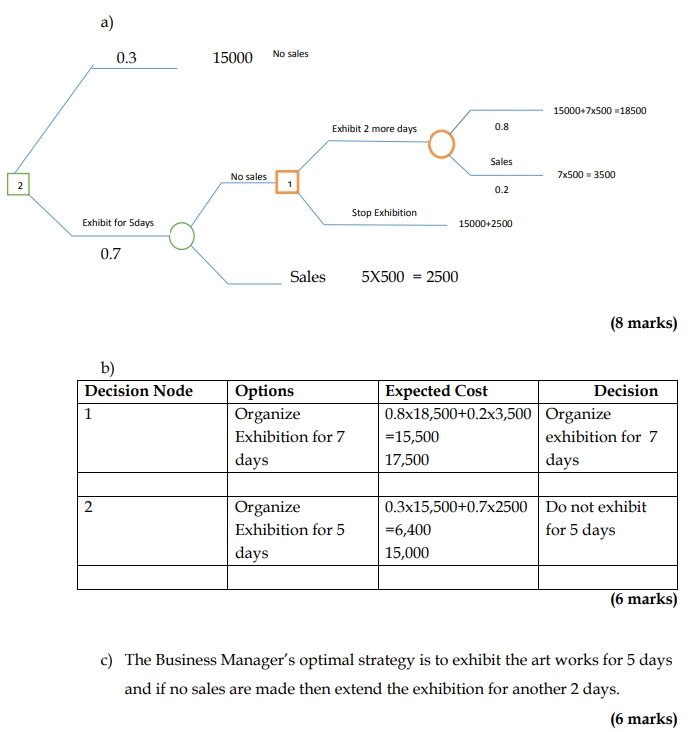

Required: a) Draw a decision tree representing the Business Manager’s decision-making process. (8 marks)

b) Calculate the expected monetary cost of each decision node. (6 marks)

c) Determine the Business Manager’s optimal strategy. (6 marks)

Answer

- Tags: Business decision, Cost Analysis, Decision tree, Expected Monetary Cost, Optimal Strategy

- Level: Level 1

- Topic: Probability

- Series: MAY 2019

- Uploader: Theophilus